Blend Results Presentation Deck

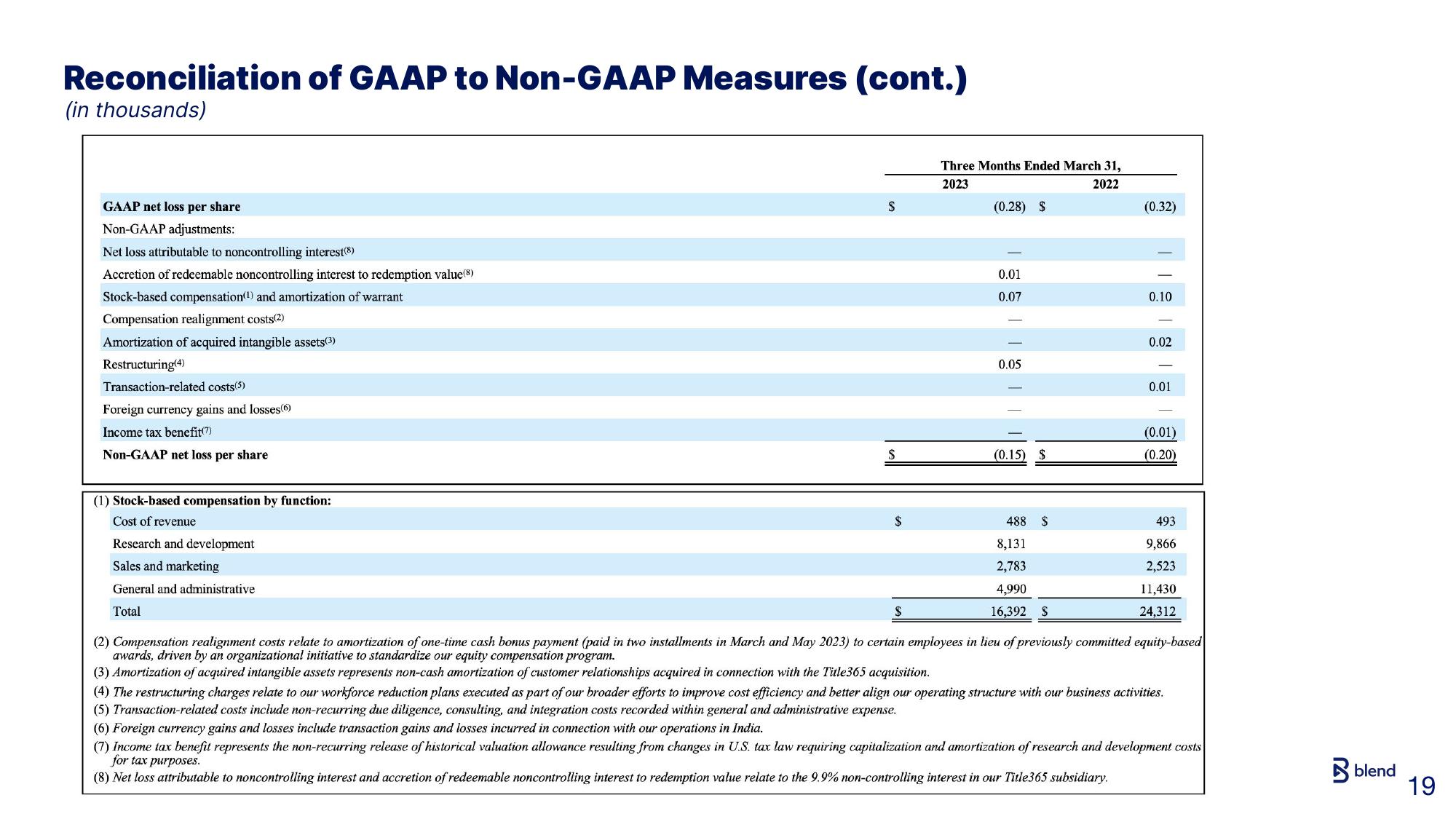

Reconciliation of GAAP to Non-GAAP Measures (cont.)

(in thousands)

GAAP net loss per share

Non-GAAP adjustments:

Net loss attributable to noncontrolling interest(8)

Accretion of redeemable noncontrolling interest to redemption value (8)

Stock-based compensation(¹) and amortization of warrant

Compensation realignment costs(2)

Amortization of acquired intangible assets(3)

Restructuring(4)

Transaction-related costs(5)

Foreign currency gains and losses(6)

Income tax benefit(7)

Non-GAAP net loss per share

(1) Stock-based compensation by function:

Cost of revenue

Research and development

Sales and marketing

General and administrative

Total

$

$

Three Months Ended March 31,

2023

2022

(0.28) S

0.01

0.07

0.05

(0.15) $

488 $

8,131

2,783

4,990

16,392 S

(0.32)

0.10

0.02

0.01

(0.01)

(0.20)

493

9,866

2,523

11,430

24,312

$

(2) Compensation realignment costs relate to amortization of one-time cash bonus payment (paid in two installments in March and May 2023) to certain employees in lieu of previously committed equity-based

awards, driven by an organizational initiative to standardize our equity compensation program.

(3) Amortization of acquired intangible assets represents non-cash amortization of customer relationships acquired in connection with the Title365 acquisition.

(4) The restructuring charges relate to our workforce reduction plans executed as part of our broader efforts to improve cost efficiency and better align our operating structure with our business activities.

(5) Transaction-related costs include non-recurring due diligence, consulting, and integration costs recorded within general and administrative expense.

(6) Foreign currency gains and losses include transaction gains and losses incurred in connection with our operations in India.

(7) Income tax benefit represents the non-recurring release of historical valuation allowance resulting from changes in U.S. tax law requiring capitalization and amortization of research and development costs

for tax purposes.

(8) Net loss attributable to noncontrolling interest and accretion of redeemable noncontrolling interest to redemption value relate to the 9.9% non-controlling interest in our Title365 subsidiary.

blend

19View entire presentation