WeWork Investor Day Presentation Deck

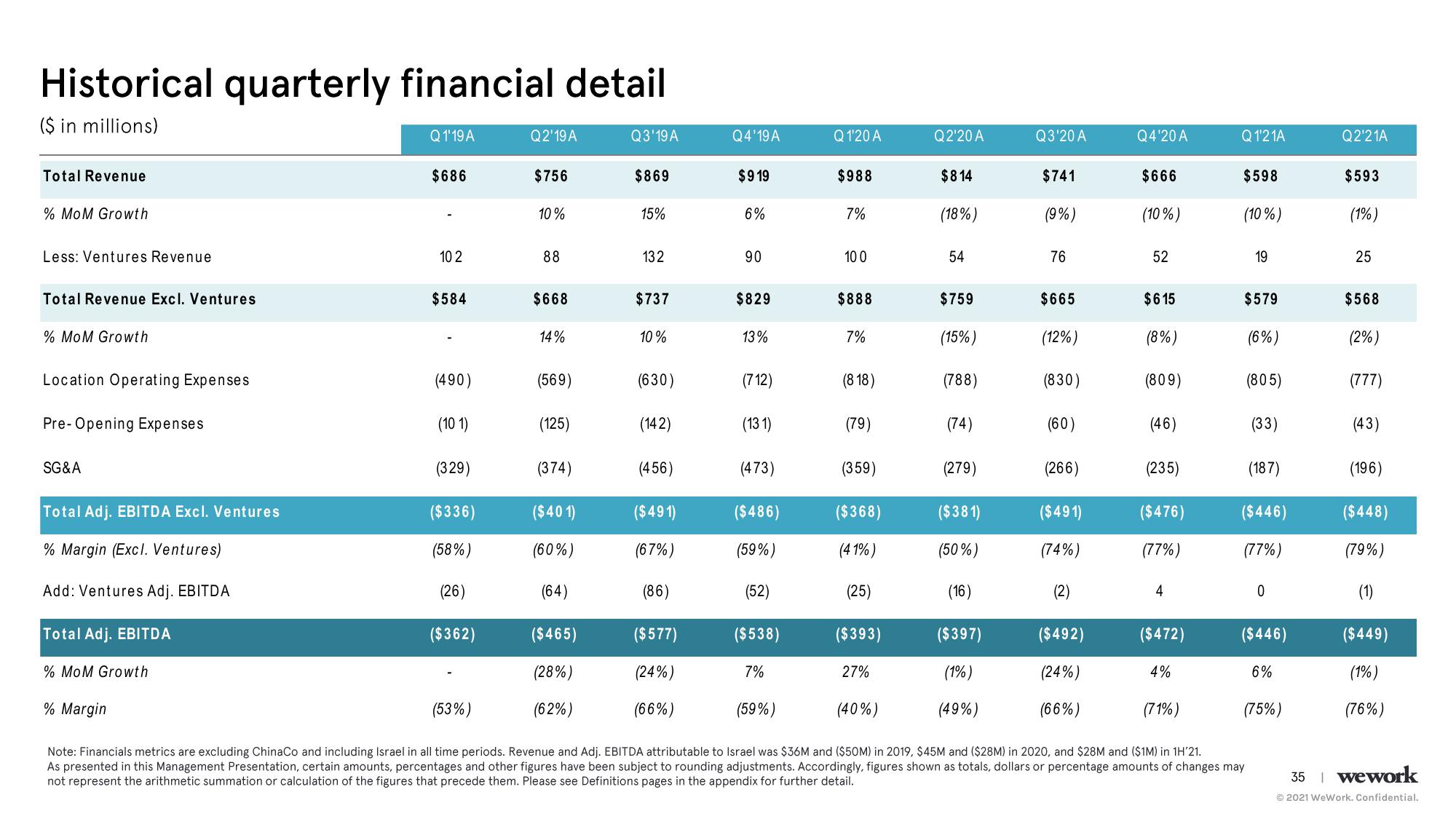

Historical quarterly financial detail

($ in millions)

Total Revenue

% MoM Growth

Less: Ventures Revenue

Total Revenue Excl. Ventures

% MoM Growth

Location Operating Expenses

Pre-Opening Expenses

SG&A

Total Adj. EBITDA Excl. Ventures

% Margin (Excl. Ventures)

Add: Ventures Adj. EBITDA

Total Adj. EBITDA

% MoM Growth

% Margin

Q1'19 A

$686

10 2

$584

(490)

(101)

(329)

($336)

(58%)

(26)

($362)

(53%)

Q2'19 A

$756

10%

88

$668

14%

(569)

(125)

(374)

($401)

(60%)

(64)

($465)

(28%)

(62%)

Q3'19 A

$869

15%

132

$737

10%

(630)

(142)

(456)

($491)

(67%)

(86)

($577)

(24%)

(66%)

Q4'19 A

$919

6%

90

$829

13%

(712)

(131)

(473)

($486)

(59%)

(52)

($538)

7%

(59%)

Q1'20 A

$988

7%

10 0

$888

(818)

(79)

(359)

($368)

(41%)

(25)

($393)

27%

Q2'20 A

$814

(18%)

54

$759

(15%)

(788)

(74)

(279)

($381)

(50%)

(16)

($397)

(1%)

(49%)

Q3'20 A

$741

(9%)

76

$665

(12%)

(830)

(60)

(266)

($491)

(74%)

(2)

($492)

(24%)

(66%)

Q4'20 A

$666

(10%)

52

$615

(8%)

(809)

(46)

(235)

($476)

(77%)

4

($472)

4%

(71%)

Q1'21A

$598

(10%)

19

$579

(6%)

(805)

(33)

(187)

($446)

(77%)

(40%)

Note: Financials metrics are excluding ChinaCo and including Israel in all time periods. Revenue and Adj. EBITDA attributable to Israel was $36M and ($50M) in 2019, $45M and ($28M) in 2020, and $28M and ($1M) in 1H'21.

As presented in this Management Presentation, certain amounts, percentages and other figures have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars or percentage amounts of changes may

not represent the arithmetic summation or calculation of the figures that precede them. Please see Definitions pages in the appendix for further detail.

0

($446)

6%

(75%)

Q2'21A

$593

(1%)

25

$568

(2%)

(777)

(43)

(196)

($448)

(79%)

(1)

($449)

(1%)

(76%)

35 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation