Schroders Investor Day Presentation Deck

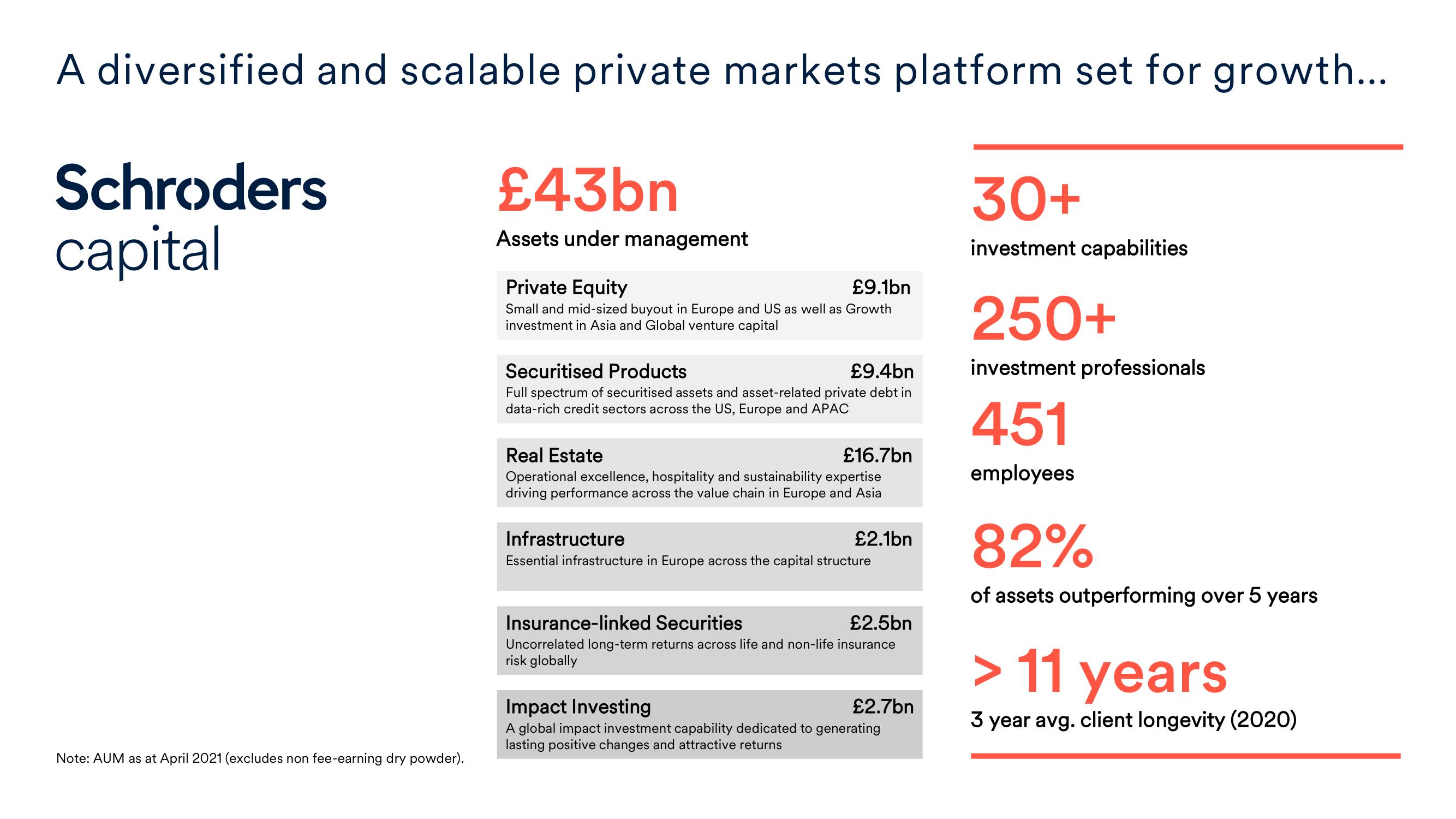

A diversified and scalable private markets platform set for growth...

Schroders

capital

Note: AUM as at April 2021 (excludes non fee-earning dry powder).

£43bn

Assets under management

Private Equity

£9.1bn

Small and mid-sized buyout in Europe and US as well as Growth

investment in Asia and Global venture capital

Securitised Products

£9.4bn

Full spectrum of securitised assets and asset-related private debt in

data-rich credit sectors across the US, Europe and APAC

Real Estate

£16.7bn

Operational excellence, hospitality and sustainability expertise

driving performance across the value chain in Europe and Asia

Infrastructure

£2.1bn

Essential infrastructure in Europe across the capital structure

Insurance-linked Securities

£2.5bn

Uncorrelated long-term returns across life and non-life insurance

risk globally

Impact Investing

A global impact investment capability dedicated to generating

lasting positive changes and attractive returns

£2.7bn

30+

investment capabilities

250+

investment professionals

451

employees

82%

of assets outperforming over 5 years

> 11 years

3 year avg. client longevity (2020)View entire presentation