Credit Suisse Results Presentation Deck

Notes

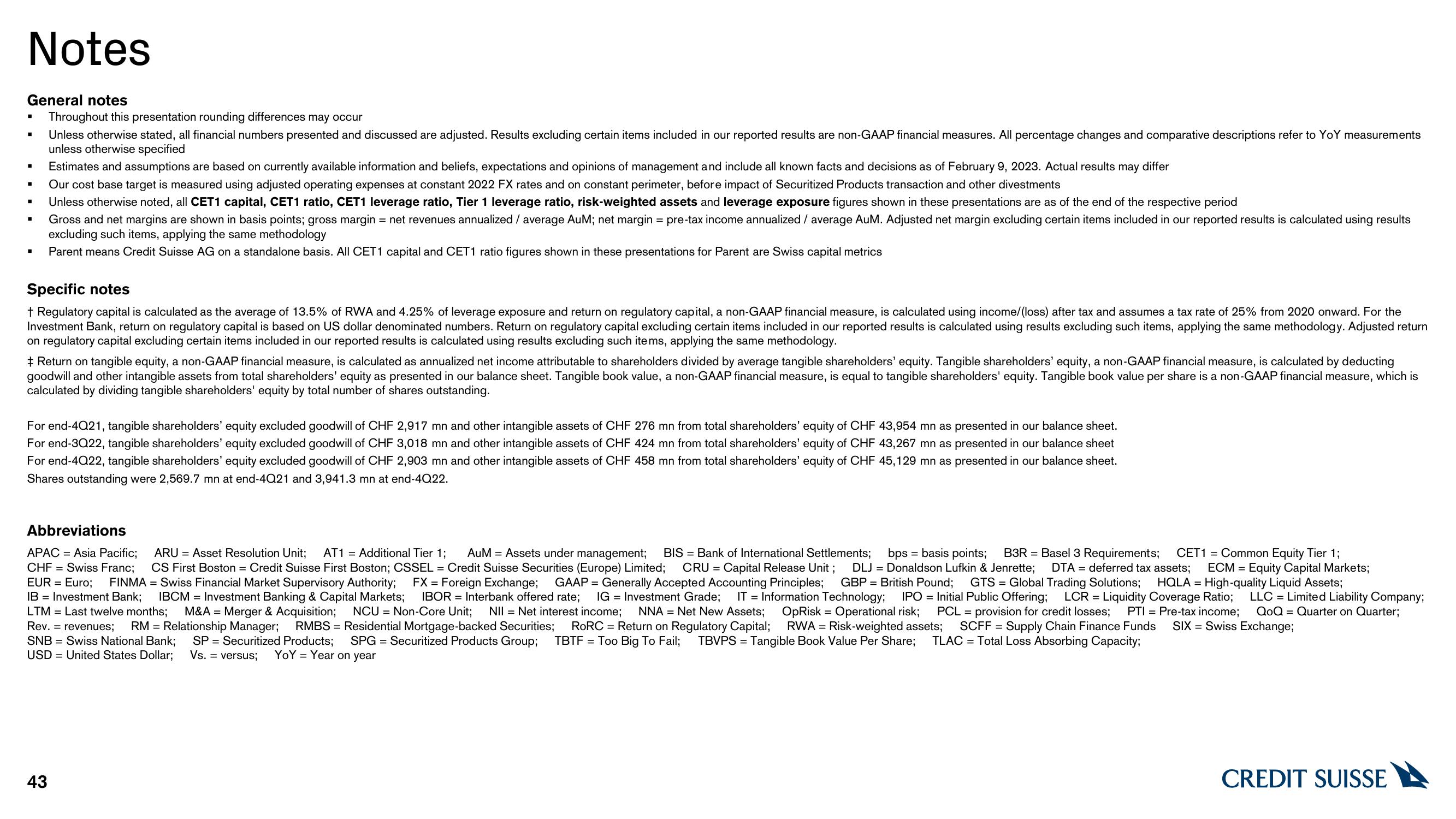

General notes

Throughout this presentation rounding differences may occur

Unless otherwise stated, all financial numbers presented and discussed are adjusted. Results excluding certain items included in our reported results are non-GAAP financial measures. All percentage changes and comparative descriptions refer to YoY measurements

unless otherwise specified

Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of February 9, 2023. Actual results may differ

Our cost base target is measured using adjusted operating expenses at constant 2022 FX rates and on constant perimeter, before impact of Securitized Products transaction and other divestments

Unless otherwise noted, all CET1 capital, CET1 ratio, CET1 leverage ratio, Tier 1 leverage ratio, risk-weighted assets and leverage exposure figures shown in these presentations are as of the end of the respective period

Gross and net margins are shown in basis points; gross margin = net revenues annualized / average AuM; net margin = pre-tax income annualized / average AuM. Adjusted net margin excluding certain items included in our reported results is calculated using results

excluding such items, applying the same methodology

Parent mea

s Credit Suisse AG on a standalone basis. All CET1 capital and CET1 ratio figures shown in these presentations for Parent are Swiss capital metrics

■

■

■

■

Specific notes

+ Regulatory capital is calculated as the average of 13.5% of RWA and 4.25% of leverage exposure and return on regulatory capital, a non-GAAP financial measure, is calculated using income/(loss) after tax and assumes a tax rate of 25% from 2020 onward. For the

Investment Bank, return on regulatory capital is based on US dollar denominated numbers. Return on regulatory capital excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology. Adjusted return

on regulatory capital excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology.

+ Return on tangible equity, a non-GAAP financial measure, is calculated as annualized net income attributable to shareholders divided by average tangible shareholders' equity. Tangible shareholders' equity, a non-GAAP financial measure, is calculated by deducting

goodwill and other intangible assets from total shareholders' equity as presented in our balance sheet. Tangible book value, a non-GAAP financial measure, is equal to tangible shareholders' equity. Tangible book value per share is a non-GAAP financial measure, which is

calculated by dividing tangible shareholders' equity by total number of shares outstanding.

For end-4Q21, tangible shareholders' equity excluded goodwill of CHF 2,917 mn and other intangible assets of CHF 276 mn from total shareholders' equity of CHF 43,954 mn as presented in our balance sheet.

For end-3Q22, tangible shareholders' equity excluded goodwill of CHF 3,018 mn and other intangible assets of CHF 424 mn from total shareholders' equity of CHF 43,267 mn as presented in our balance sheet

For end-4Q22, tangible shareholders' equity excluded goodwill of CHF 2,903 mn and other intangible assets of CHF 458 mn from total shareholders' equity of CHF 45,129 mn as presented in our balance sheet.

Shares outstanding were 2,569.7 mn at end-4Q21 and 3,941.3 mn at end-4Q22.

Abbreviations

APAC = Asia Pacific;

CHF Swiss Franc;

CET1 = Common Equity Tier 1;

assets; ECM = Equity Capital Markets;

ARU = Asset Resolution Unit; AT1 = Additional Tier 1; AuM = Assets under management; BIS Bank of International Settlements; bps = basis points; B3R = Basel 3 Requirements;

CS First Boston = Credit Suisse First Boston; CSSEL = Credit Suisse Securities (Europe) Limited; CRU = Capital Release Unit ; DLJ= Donaldson Lufkin & Jenrette; DTA = deferred tax

EUR = Euro; FINMA = Swiss Financial Market Supervisory Authority; FX = Foreign Exchange; GAAP = Generally Accepted Accounting Principles; GBP British Pound; GTS Global Trading Solutions; HQLA = High-quality Liquid Assets;

IT = Information Technology; IPO = Initial Public Offering; LCR Liquidity Coverage Ratio; LLC Limited Liability Company;

PCL = provision for credit losses; PTI = Pre-tax income; QoQ Quarter on Quarter;

SCFF = Supply Chain Finance Funds SIX Swiss Exchange;

TLAC = Total Loss Absorbing Capacity;

IB Investment Bank; IBCM = Investment Banking & Capital Markets; IBOR Interbank offered rate; IG Investment Grade;

LTM Last twelve months; M&A = Merger & Acquisition; NCU Non-Core Unit; NII Net interest income; NNA = Net New Assets; OpRisk = Operational risk;

Rev. revenues; RM = Relationship Manager; RMBS = Residential Mortgage-backed Securities; RoRC = Return on Regulatory Capital; RWA = Risk-weighted assets;

SNB Swiss National Bank; SP Securitized Products; SPG = Securitized Products Group; TBTF = Too Big To Fail; TBVPS = Tangible Book Value Per Share;

USD United States Dollar; Vs. versus; YOY Year on year

43

CREDIT SUISSEView entire presentation