Imperial Brands Investor Day Presentation Deck

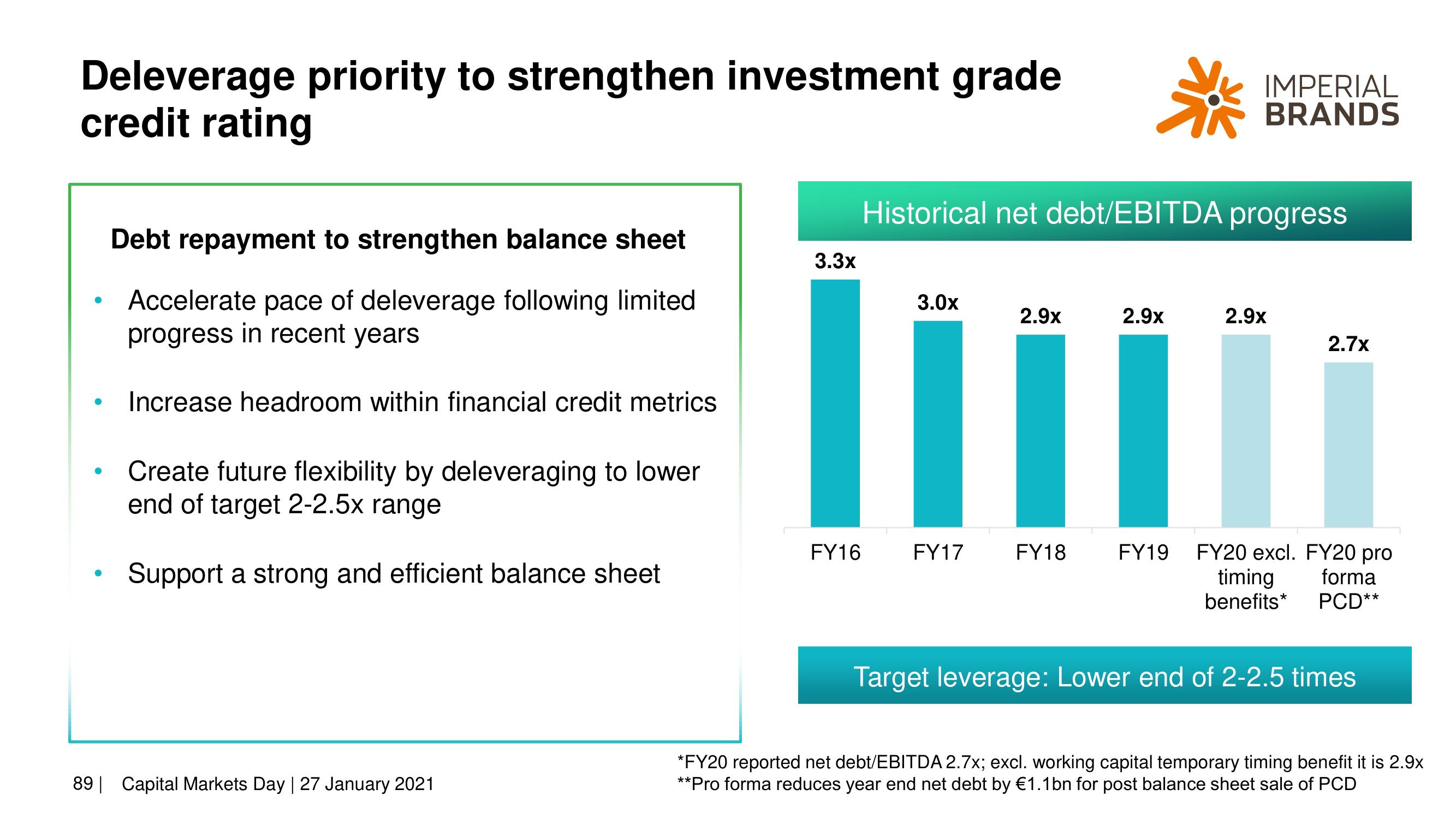

Deleverage priority to strengthen investment grade

credit rating

●

●

Debt repayment to strengthen balance sheet

Accelerate pace of deleverage following limited

progress in recent years.

Increase headroom within financial credit metrics

Create future flexibility by deleveraging to lower

end of target 2-2.5x range

Support a strong and efficient balance sheet

89 Capital Markets Day | 27 January 2021

3.3x

FY16

Historical net debt/EBITDA progress

3.0x

IMPERIAL

BRANDS

2.9x

2.9x

liii

FY17

FY18

2.9x

2.7x

FY19 FY20 excl. FY20 pro

timing

forma

benefits*

PCD**

Target leverage: Lower end of 2-2.5 times

*FY20 reported net debt/EBITDA 2.7x; excl. working capital temporary timing benefit it is 2.9x

**Pro forma reduces year end net debt by €1.1 bn for post balance sheet sale of PCDView entire presentation