Metals Acquisition Corp SPAC Presentation Deck

A

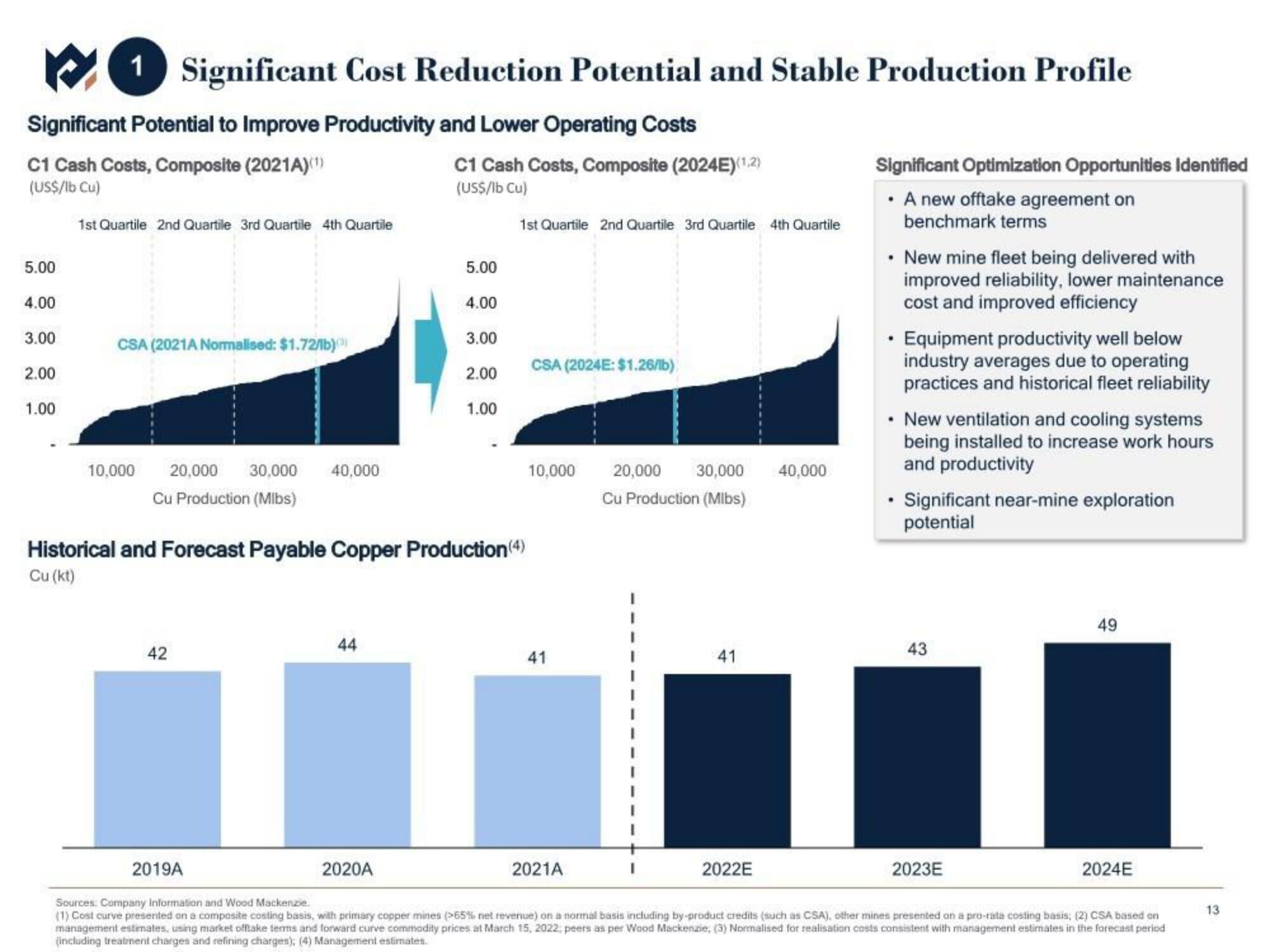

1 Significant Cost Reduction Potential and Stable Production Profile

Significant Potential to Improve Productivity and Lower Operating Costs

C1 Cash Costs, Composite (2021A)(¹)

(US$/lb Cu)

5.00

4.00

3.00

2.00

1.00

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

CSA (2021A Normalised: $1.72/lb)()

10,000 20,000 30,000 40,000

Cu Production (Mlbs)

42

44

C1 Cash Costs, Composite (2024E)(1.2)

(US$/lb Cu)

2020A

5.00

4.00

3.00

2.00

1.00

Historical and Forecast Payable Copper Production (4)

Cu (kt)

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

CSA (2024E: $1.26/lb)

10,000

41

2021A

20,000

30,000

Cu Production (Mlbs)

41

2022E

40,000

Significant Optimization Opportunities Identified

• A new offtake agreement on

benchmark terms

• New mine fleet being delivered with

improved reliability, lower maintenance

cost and improved efficiency

• Equipment productivity well below

industry averages due to operating

practices and historical fleet reliability

• New ventilation and cooling systems

being installed to increase work hours

and productivity

• Significant near-mine exploration

potential

2019A

Sources: Company Information and Wood Mackenzie.

(1) Cost curve presented on a composite costing basis, with primary copper mines (>65% net revenue) on a normal basis including by-product credits (such as CSA), other mines presented on a pro-rata costing basis; (2) CSA based on

management estimates, using market offtake terms and forward curve commodity prices at March 15, 2022, peers as per Wood Mackenzie; (3) Normalised for realisation costs consistent with management estimates in the forecast period

(including treatment charges and refining charges); (4) Management estimates.

43

2023E

49

2024E

13View entire presentation