Synchrony Financial Results Presentation Deck

Net Interest Income

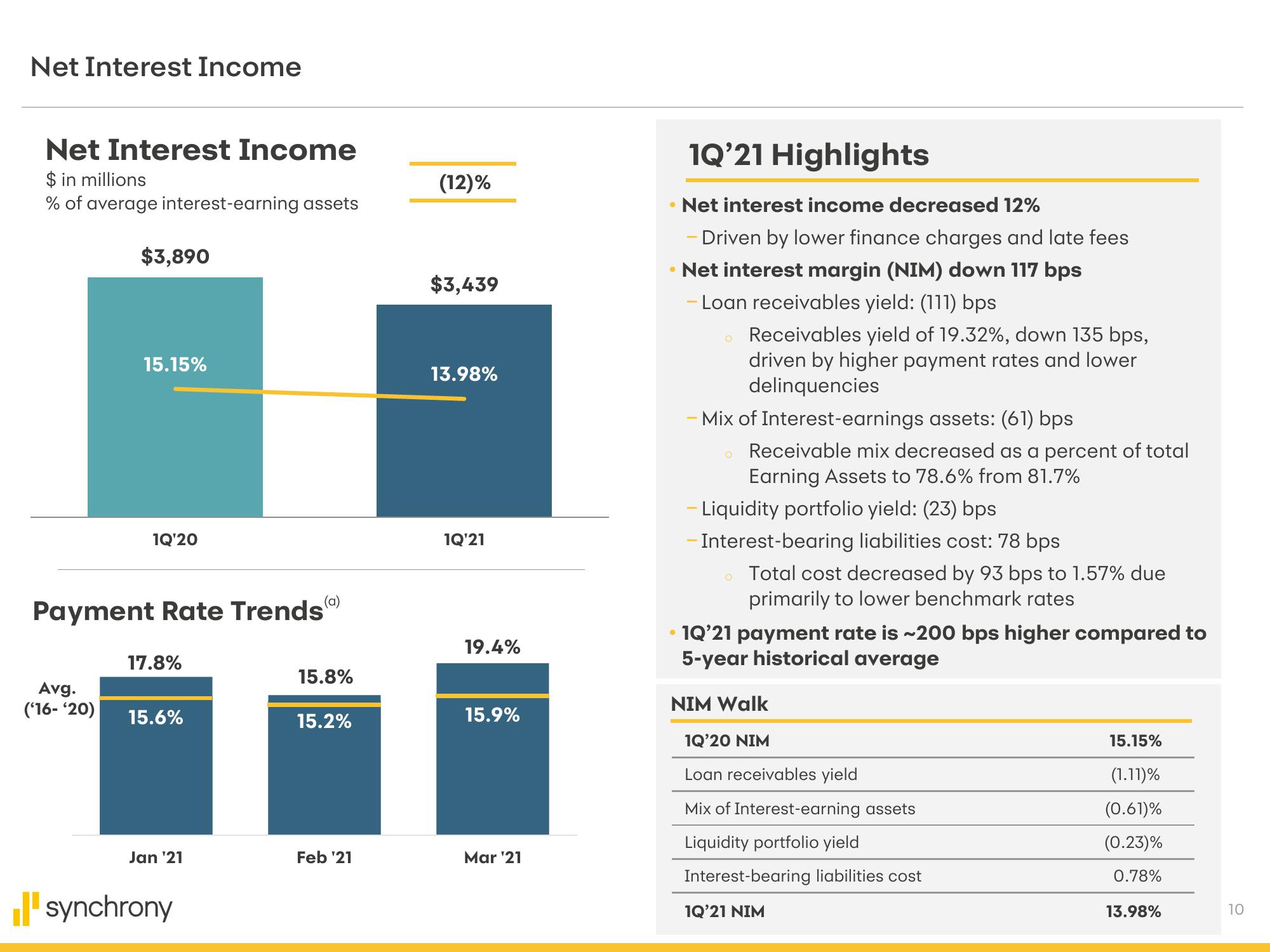

Net Interest Income

$ in millions

% of average interest-earning assets

$3,890

Avg.

('16-'20)

15.15%

1Q'20

Payment Rate Trends

17.8%

15.6%

Jan '21

synchrony

15.8%

15.2%

Feb '21

(12)%

$3,439

13.98%

1Q'21

19.4%

15.9%

Mar ¹21

O

●

1Q'21 Highlights

Net interest income decreased 12%

- Driven by lower finance charges and late fees

Net interest margin (NIM) down 117 bps

Loan receivables yield: (111) bps

o Receivables yield of 19.32%, down 135 bps,

driven by higher payment rates and lower

delinquencies

Mix of Interest-earnings assets: (61) bps

Receivable mix decreased as a percent of total

Earning Assets to 78.6% from 81.7%

- Liquidity portfolio yield: (23) bps

- Interest-bearing liabilities cost: 78 bps

。 Total cost decreased by 93 bps to 1.57% due

primarily to lower benchmark rates

●

• 1Q'21 payment rate is ~200 bps higher compared to

5-year historical average

NIM Walk

1Q'20 NIM

Loan receivables yield

Mix of Interest-earning assets

Liquidity portfolio yield

Interest-bearing liabilities cost

1Q'21 NIM

15.15%

(1.11)%

(0.61)%

(0.23)%

0.78%

13.98%

10View entire presentation