Nexters Results Presentation Deck

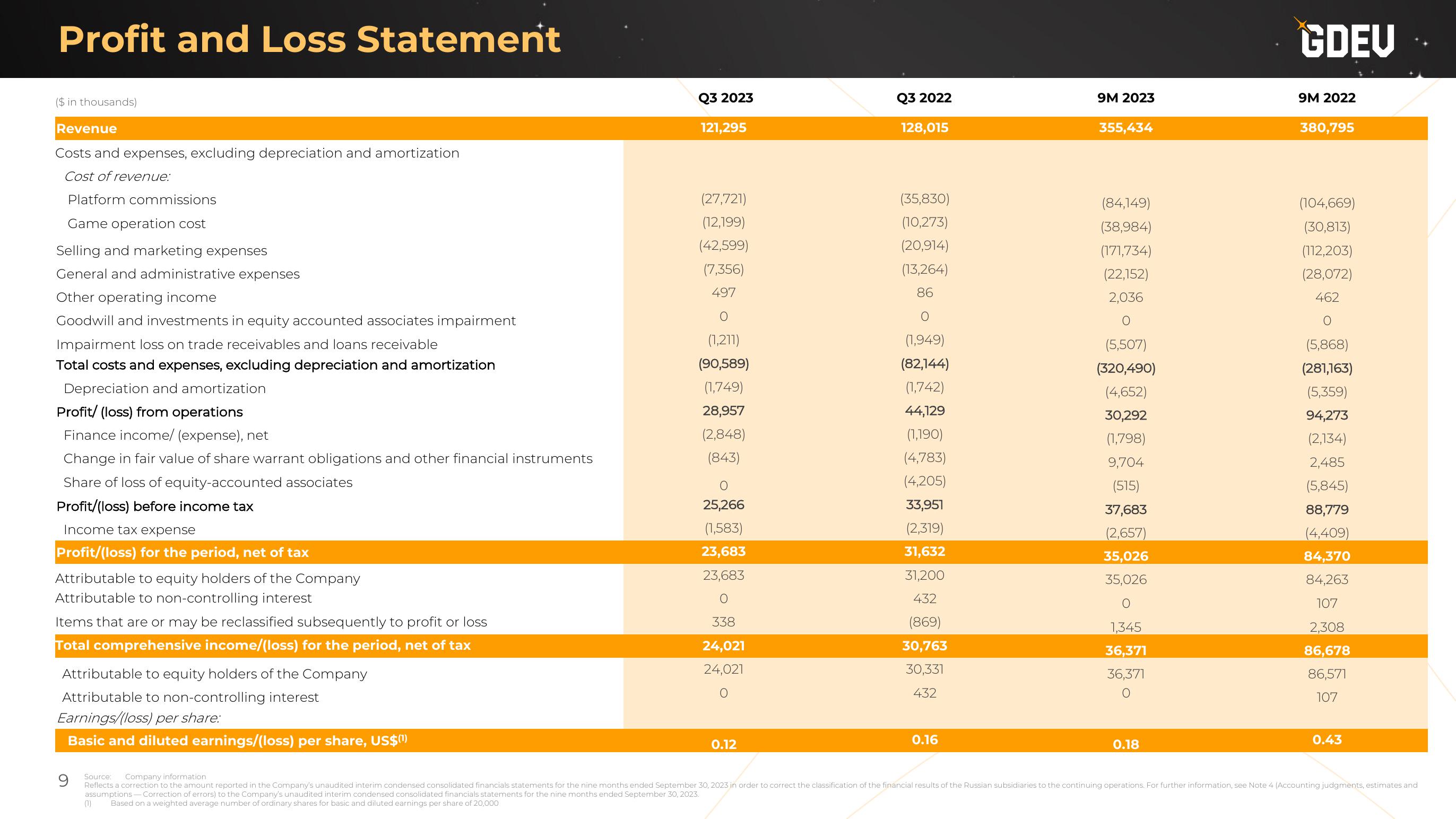

Profit and Loss Statement

($ in thousands)

Revenue

Costs and expenses, excluding depreciation and amortization

Cost of revenue:

Platform commissions

Game operation cost

Selling and marketing expenses

General and administrative expenses

Other operating income

Goodwill and investments in equity accounted associates impairment

Impairment loss on trade receivables and loans receivable

Total costs and expenses, excluding depreciation and amortization

Depreciation and amortization

Profit/ (loss) from operations

Finance income/ (expense), net

Change in fair value of share warrant obligations and other financial instruments

Share of loss of equity-accounted associates

Profit/(loss) before income tax

Income tax expense

Profit/(loss) for the period, net of tax

Attributable to equity holders of the Company

Attributable to non-controlling interest

Items that are or may be reclassified subsequently to profit or loss

Total comprehensive income/(loss) for the period, net of tax

Attributable to equity holders of the Company

Attributable to non-controlling interest

Earnings/(loss) per share:

Basic and diluted earnings/(loss) per share, US$(¹)

Q3 2023

121,295

(1)

(27,721)

(12,199)

(42,599)

(7,356)

497

O

(1,211)

(90,589)

(1,749)

28,957

(2,848)

(843)

O

25,266

(1,583)

23,683

23,683

338

24,021

24,021

O

0.12

Q3 2022

128,015

(35,830)

(10,273)

(20,914)

(13,264)

86

O

(1,949)

(82,144)

(1,742)

44,129

(1,190)

(4,783)

(4,205)

33,951

(2,319)

31,632

31,200

432

(869)

30,763

30,331

432

0.16

9M 2023

355,434

(84,149)

(38,984)

(171,734)

(22,152)

2,036

O

(5,507)

(320,490)

(4,652)

30,292

(1,798)

9,704

(515)

37,683

(2,657)

35,026

35,026

O

1,345

36,371

36,371

O

0.18

GDEU

9M 2022

380,795

(104,669)

(30,813)

(112,203)

(28,072)

462

O

(5,868)

(281,163)

(5,359)

94,273

(2,134)

2,485

(5,845)

88,779

(4,409)

84,370

84,263

107

2,308

86,678

86,571

107

0.43

9

Source: Company information.

Reflects a correction to the amount reported in the Company's unaudited interim condensed consolidated financials statements for the nine months ended September 30, 2023 in order to correct the classification of the financial results of the Russian subsidiaries to the continuing operations. For further information, see Note 4 (Accounting judgments, estimates and

assumptions Correction of errors) to the Company's unaudited interim condensed consolidated financials statements for the nine months ended September 30, 2023.

Based on a weighted average number of ordinary shares for basic and diluted earnings per share of 20,000View entire presentation