The Urgent Need for Change and The Superior Path Forward

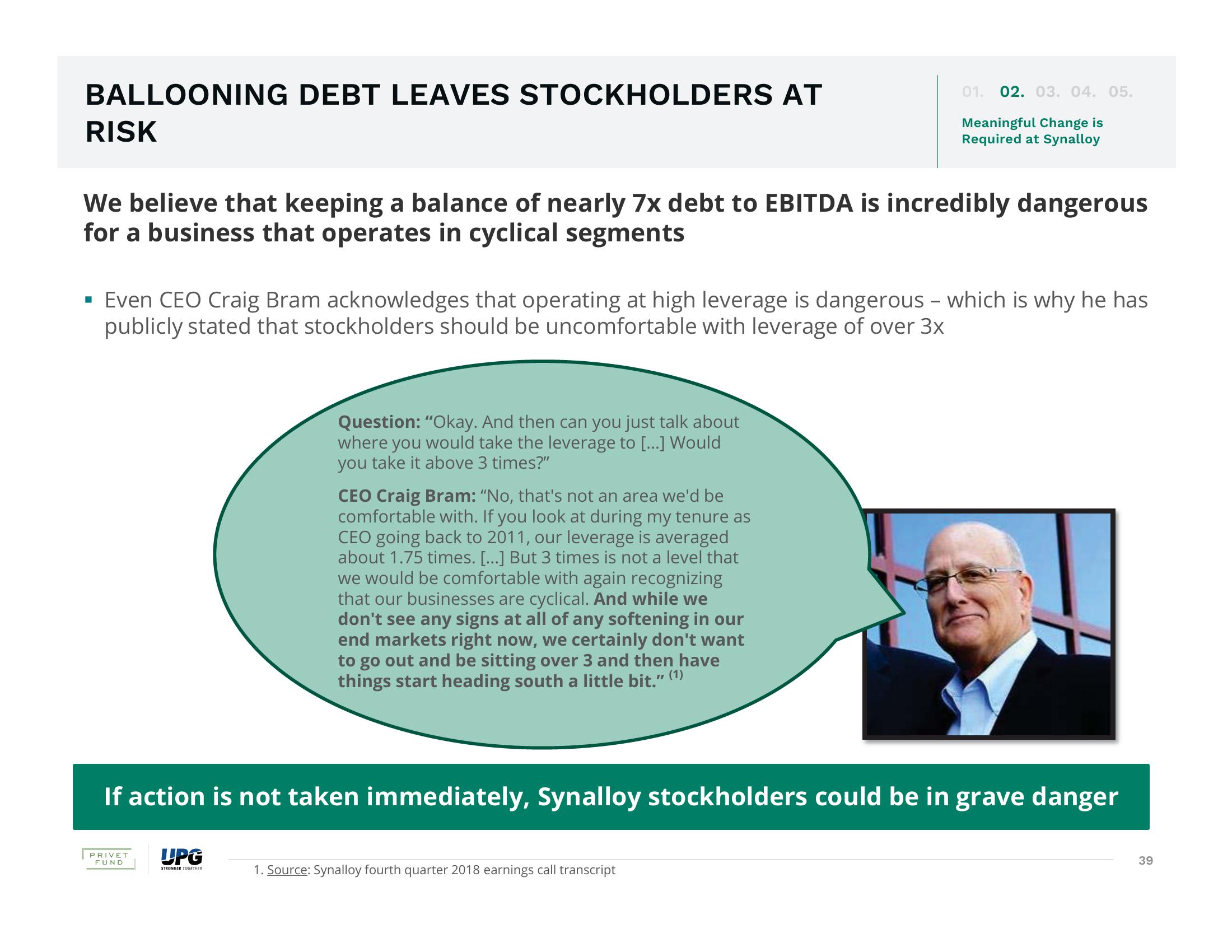

BALLOONING DEBT LEAVES STOCKHOLDERS AT

RISK

We believe that keeping a balance of nearly 7x debt to EBITDA is incredibly dangerous

for a business that operates in cyclical segments

▪ Even CEO Craig Bram acknowledges that operating at high leverage is dangerous - which is why he has

publicly stated that stockholders should be uncomfortable with leverage of over 3x

PRIVET

FUND

Question: "Okay. And then can you just talk about

where you would take the leverage to [...] Would

you take it above 3 times?"

UPG

STRONGER TOGETHER

01. 02. 03. 04. 05.

CEO Craig Bram: "No, that's not an area we'd be

comfortable with. If you look at during my tenure as

CEO going back to 2011, our leverage is averaged

about 1.75 times. [...] But 3 times is not a level that

we would be comfortable with again recognizing

that our businesses are cyclical. And while we

don't see any signs at all of any softening in our

end markets right now, we certainly don't want

to go out and be sitting over 3 and then have

things start heading south a little bit."

" (1)

Meaningful Change is

Required at Synalloy

If action is not taken immediately, Synalloy stockholders could be in grave danger

1. Source: Synalloy fourth quarter 2018 earnings call transcript

39View entire presentation