Better SPAC Presentation Deck

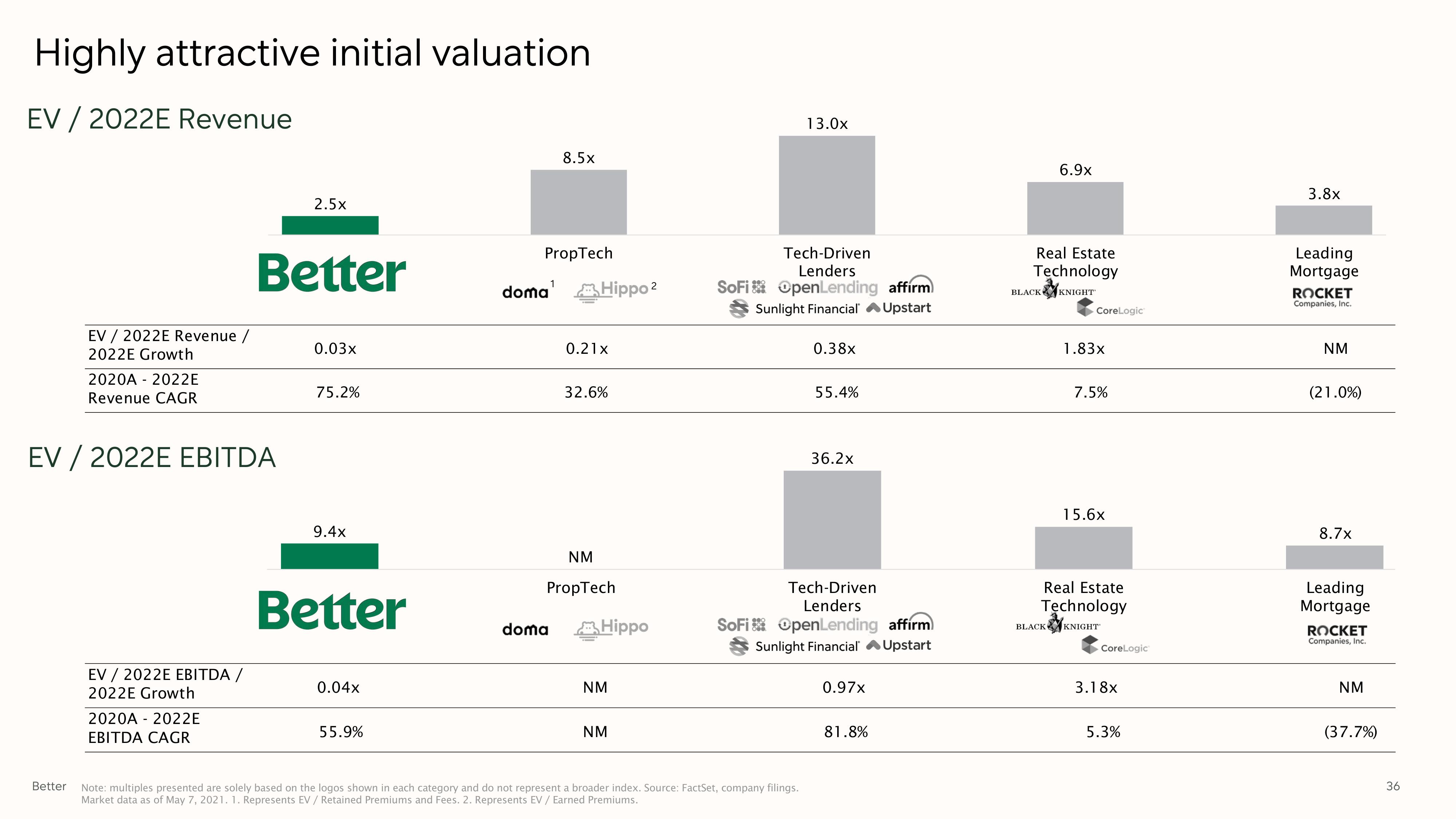

Highly attractive initial valuation

EV / 2022E Revenue

EV / 2022E Revenue /

2022E Growth

Better

2020A 2022E

Revenue CAGR

EV / 2022E EBITDA

EV / 2022E EBITDA /

2022E Growth

2020A 2022E

EBITDA CAGR

2.5x

Better

0.03x

75.2%

9.4x

Better

0.04x

55.9%

8.5x

PropTech

doma¹ Hippo ²

doma

0.21x

32.6%

NM

PropTech

Hippo

NM

NM

13.0x

Tech-Driven

Lenders

SoFi OpenLending affirm

Sunlight Financial Upstart

0.38x

Note: multiples presented are solely based on the logos shown in each category and do not represent a broader index. Source: FactSet, company filings.

Market data as of May 7, 2021. 1. Represents EV / Retained Premiums and Fees. 2. Represents EV / Earned Premiums.

55.4%

36.2x

Tech-Driven

Lenders

SoFi OpenLending affirm

Sunlight Financial Upstart

0.97x

81.8%

6.9x

Real Estate

Technology

BLACK KNIGHT

CoreLogic

1.83x

7.5%

15.6x

Real Estate

Technology

BLACK KNIGHT

CoreLogic

3.18x

5.3%

3.8x

Leading

Mortgage

ROCKET

Companies, Inc.

NM

(21.0%)

8.7x

Leading

Mortgage

ROCKET

Companies, Inc.

NM

(37.7%)

36View entire presentation