Nano Dimension Mergers and Acquisitions Presentation Deck

●

●

●

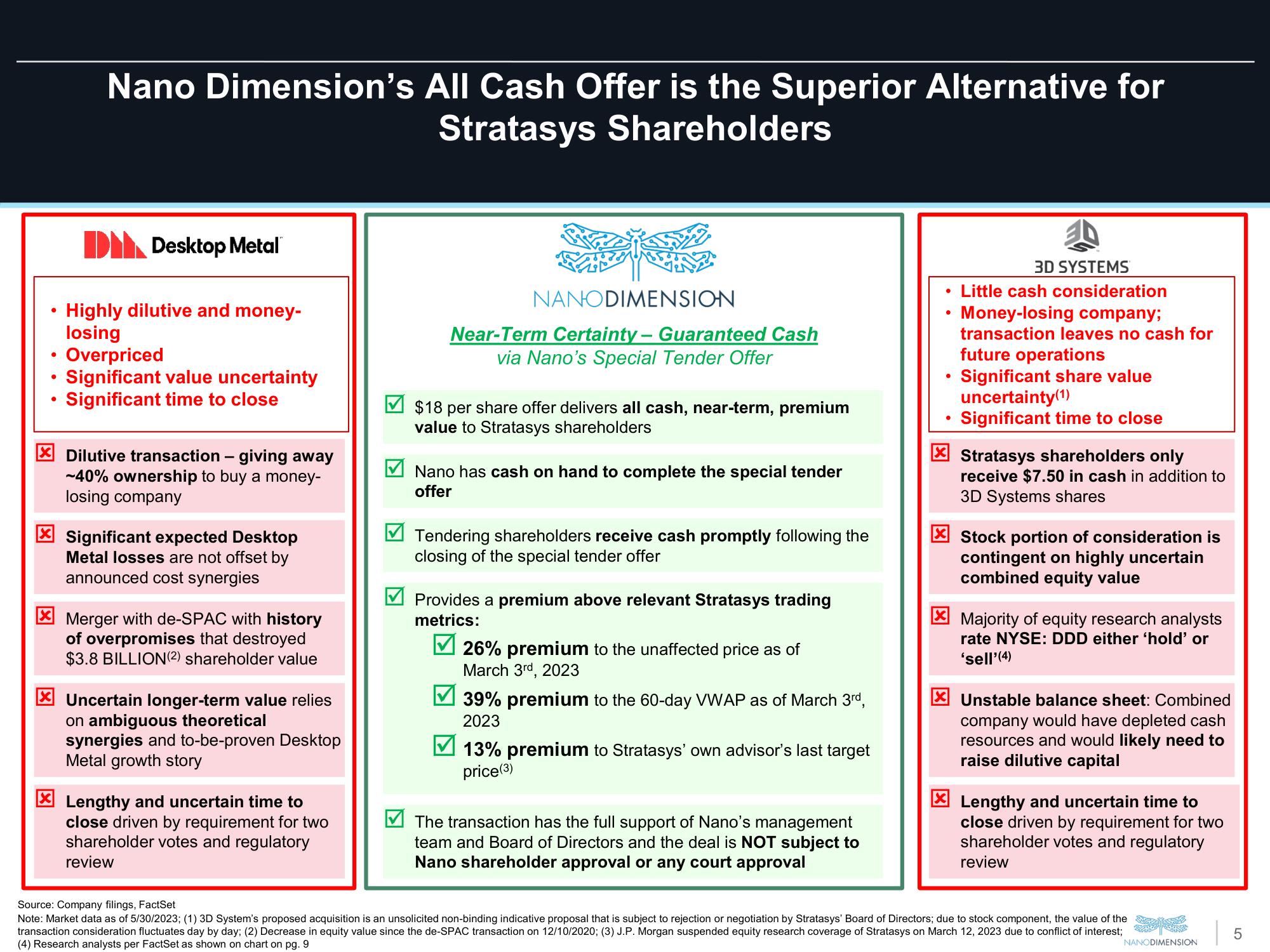

Nano Dimension's All Cash Offer is the Superior Alternative for

Stratasys Shareholders

DI Desktop Metal™

Highly dilutive and money-

losing

Overpriced

Significant value uncertainty

Significant time to close

Dilutive transaction - giving away

-40% ownership to buy a money-

losing company

Significant expected Desktop

Metal losses are not offset by

announced cost synergies

Merger with de-SPAC with history

of overpromises that destroyed

$3.8 BILLION (2) shareholder value

Uncertain longer-term value relies

on ambiguous theoretical

synergies and to-be-proven Desktop

Metal growth story

X Lengthy and uncertain time to

close driven by requirement for two

shareholder votes and regulatory

review

NANODIMENSION

Near-Term Certainty-Guaranteed Cash

via Nano's Special Tender Offer

$18 per share offer delivers all cash, near-term, premium

value to Stratasys shareholders

Nano has cash on hand to complete the special tender

offer

Tendering shareholders receive cash promptly following the

closing of the special tender offer

Provides a premium above relevant Stratasys trading

metrics:

26% premium to the unaffected price as of

March 3rd, 2023

39% premium to the 60-day VWAP as of March 3rd,

2023

13% premium to Stratasys' own advisor's last target

price (3)

The transaction has the full support of Nano's management

team and Board of Directors and the deal is NOT subject to

Nano shareholder approval or any court approval

●

●

3D SYSTEMS

Little cash consideration

Money-losing company;

transaction leaves no cash for

future operations

Significant share value

uncertainty(1)

Significant time to close

Stratasys shareholders only

receive $7.50 in cash in addition to

3D Systems shares

X Stock portion of consideration is

contingent on highly uncertain

combined equity value

Majority of equity research analysts

rate NYSE: DDD either 'hold' or

'sell'(4)

Unstable balance sheet: Combined

company would have depleted cash

resources and would likely need to

raise dilutive capital

Lengthy and uncertain time to

close driven by requirement for two

shareholder votes and regulatory

review

Source: Company filings, FactSet

Note: Market data as of 5/30/2023; (1) 3D System's proposed acquisition is an unsolicited non-binding indicative proposal that is subject to rejection or negotiation by Stratasys' Board of Directors; due to stock component, the value of the

transaction consideration fluctuates day by day; (2) Decrease in equity value since the de-SPAC transaction on 12/10/2020; (3) J.P. Morgan suspended equity research coverage of Stratasys on March 12, 2023 due to conflict of interest;

(4) Research analysts per FactSet as shown on chart on pg. 9

NANODIMENSION

5View entire presentation