Proterra SPAC Presentation Deck

TRANSACTION SUMMARY

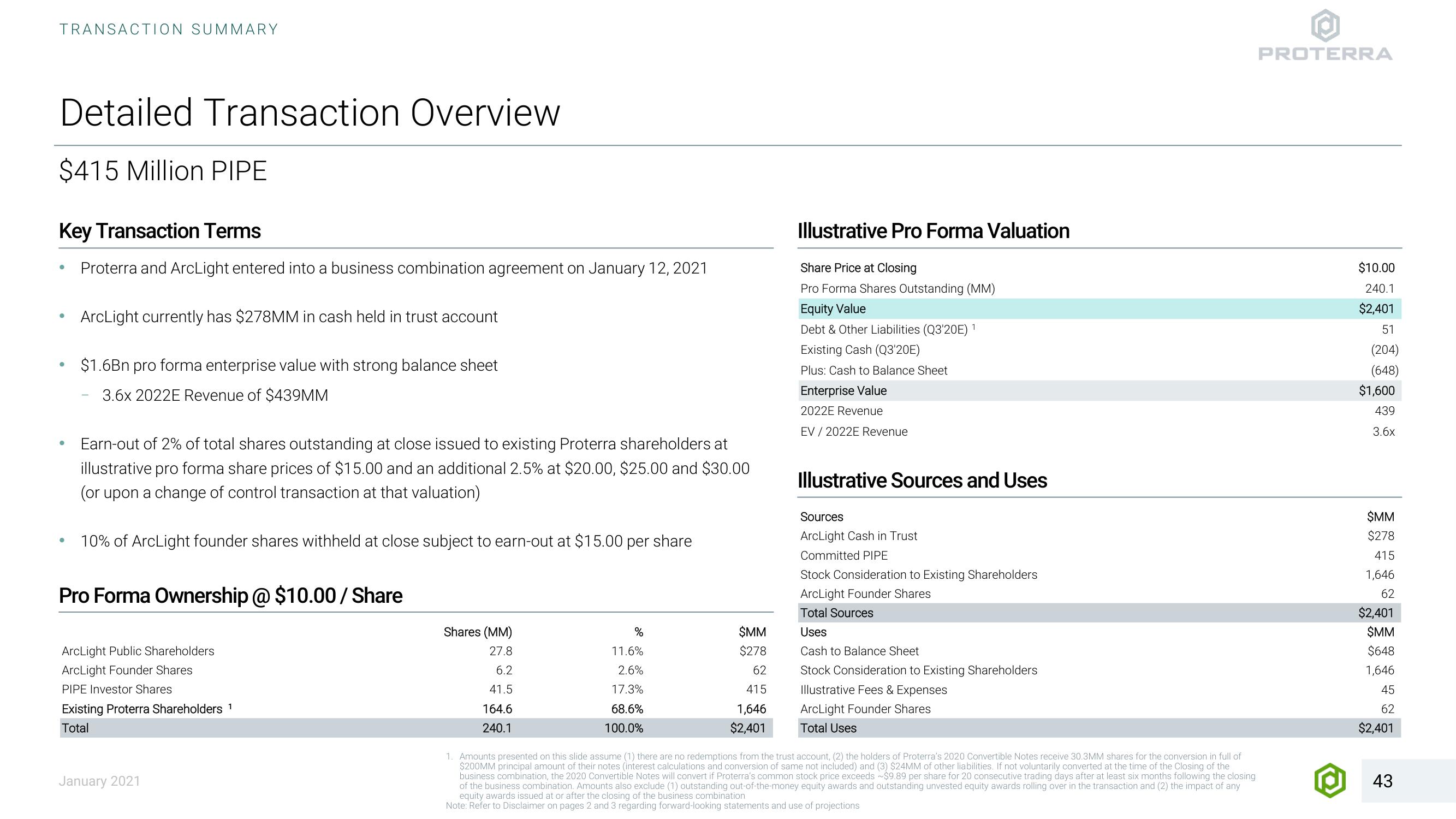

Detailed Transaction Overview

$415 Million PIPE

Key Transaction Terms

Proterra and ArcLight entered into a business combination agreement on January 12, 2021

●

●

ArcLight currently has $278MM in cash held in trust account

$1.6Bn pro forma enterprise value with strong balance sheet

3.6x 2022E Revenue of $439MM

Earn-out of 2% of total shares outstanding at close issued to existing Proterra shareholders at

illustrative pro forma share prices of $15.00 and an additional 2.5% at $20.00, $25.00 and $30.00

(or upon a change of control transaction at that valuation)

10% of ArcLight founder shares withheld at close subject to earn-out at $15.00 per share

Pro Forma Ownership @ $10.00/Share

ArcLight Public Shareholders

ArcLight Founder Shares

PIPE Investor Shares

Existing Proterra Shareholders 1

Total

January 2021

Shares (MM)

27.8

6.2

41.5

164.6

240.1

%

11.6%

2.6%

17.3%

68.6%

100.0%

$MM

$278

62

415

1,646

$2,401

Illustrative Pro Forma Valuation

Share Price at Closing

Pro Forma Shares Outstanding (MM)

Equity Value

Debt & Other Liabilities (Q3'20E) ¹

Existing Cash (Q3'20E)

Plus: Cash to Balance Sheet

Enterprise Value

2022E Revenue

EV / 2022E Revenue

Illustrative Sources and Uses

Sources

ArcLight Cash in Trust

Committed PIPE

Stock Consideration to Existing Shareholders

ArcLight Founder Shares

Total Sources

Uses

Cash to Balance Sheet

Stock Consideration to Existing Shareholders

Illustrative Fees & Expenses

ArcLight Founder Shares

Total Uses

1. Amounts presented on this slide assume (1) there are no redemptions from the trust account, (2) the holders of Proterra's 2020 Convertible Notes receive 30.3MM shares for the conversion in full of

$200MM principal amount of their notes (interest calculations and conversion of same not included) and (3) $24MM of other liabilities. If not voluntarily converted at the time of the Closing of the

business combination, the 2020 Convertible Notes will convert if Proterra's common stock price exceeds $9.89 per share for 20 consecutive trading days after at least six months following the closing

of the business combination. Amounts also exclude (1) outstanding out-of-the-money equity awards and outstanding unvested equity awards rolling over in the transaction and (2) the impact of any

equity awards issued at or after the closing of the business combination

Note: Refer to Disclaimer on pages 2 and 3 regarding forward-looking statements and use of projections

PROTERRA

$10.00

240.1

$2,401

51

(204)

(648)

$1,600

439

3.6x

$MM

$278

415

1,646

62

$2,401

$MM

$648

1,646

45

62

$2,401

43View entire presentation