J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

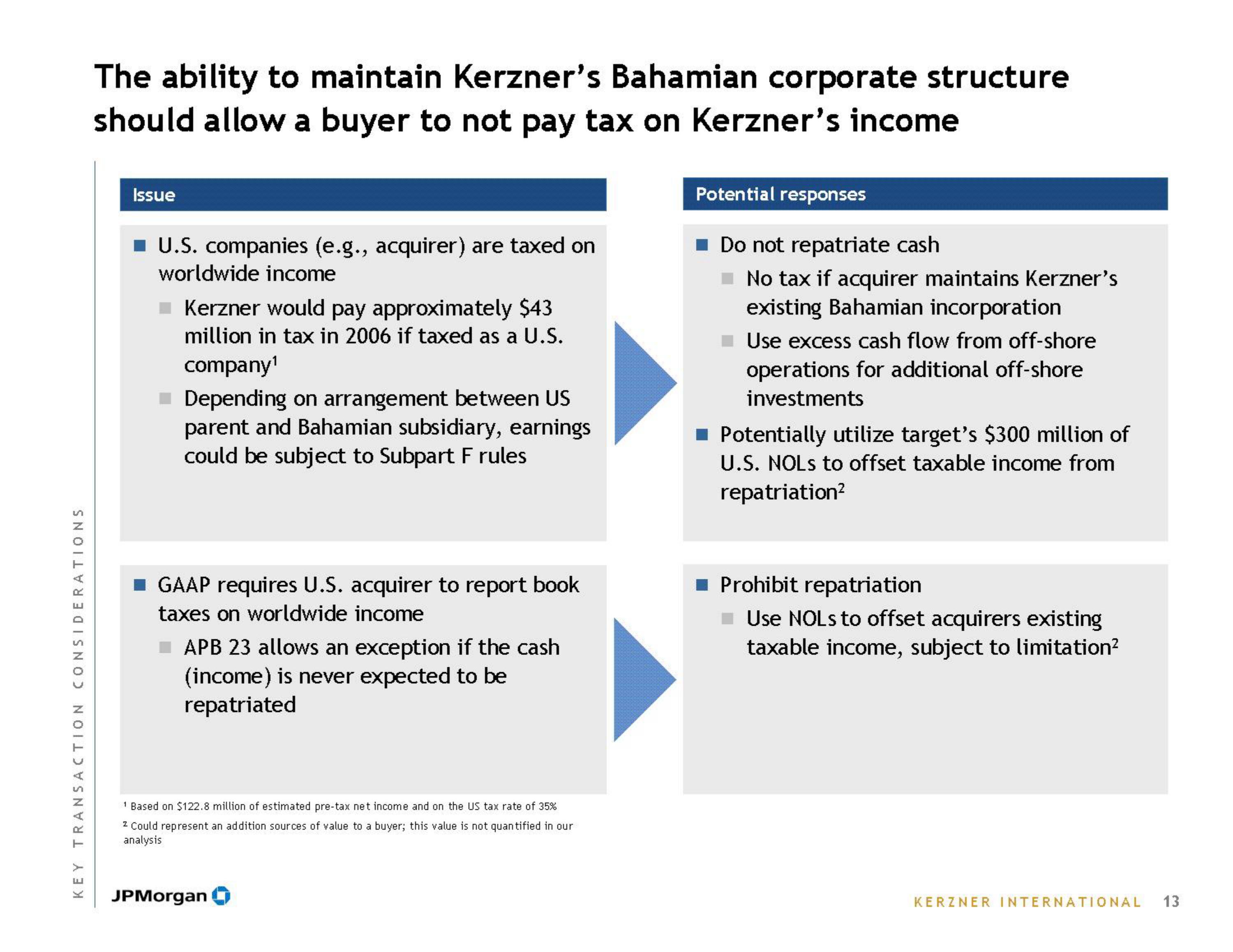

The ability to maintain Kerzner's Bahamian corporate structure

should allow a buyer to not pay tax on Kerzner's income

Issue

■ U.S. companies (e.g., acquirer) are taxed on

worldwide income

Kerzner would pay approximately $43

million in tax in 2006 if taxed as a U.S.

company¹

Depending on arrangement between US

parent and Bahamian subsidiary, earnings

could be subject to Subpart F rules

GAAP requires U.S. acquirer to report book

taxes on worldwide income

APB 23 allows an exception if the cash

(income) is never expected to be

repatriated

1 Based on $122.8 million of estimated pre-tax net income and on the US tax rate of 35%

2 Could represent an addition sources of value to a buyer; this value is not quantified in our

analysis

JPMorgan

Potential responses

■ Do not repatriate cash

No tax if acquirer maintains Kerzner's

existing Bahamian incorporation

Use excess cash flow from off-shore

operations for additional off-shore

investments

Potentially utilize target's $300 million of

U.S. NOLS to offset taxable income from

repatriation²

■ Prohibit repatriation

Use NOLS to offset acquirers existing

taxable income, subject to limitation²

KERZNER INTERNATIONAL 13View entire presentation