FlexJet SPAC Presentation Deck

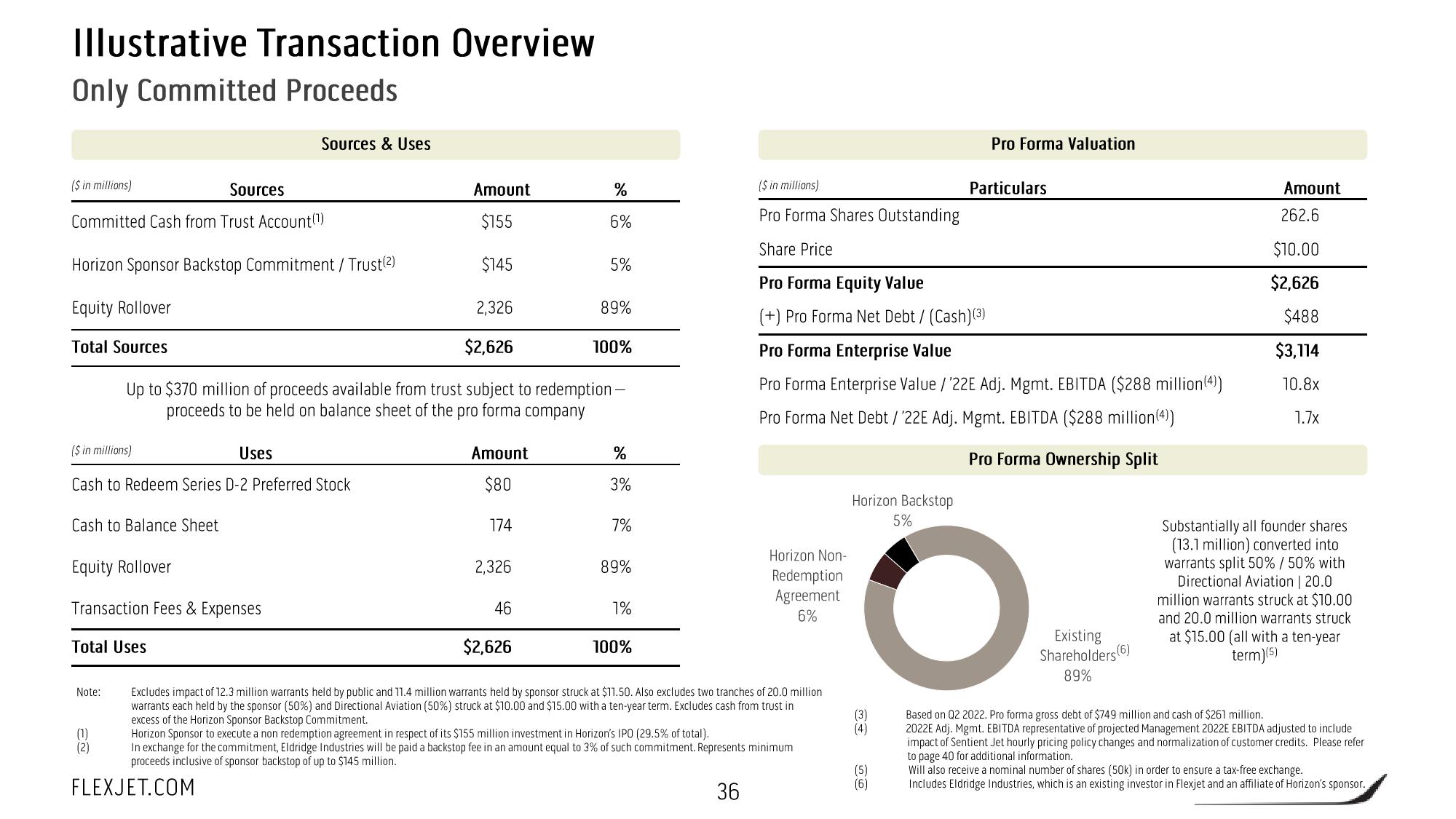

Illustrative Transaction Overview

Only Committed Proceeds

($ in millions)

Sources

Committed Cash from Trust Account(¹)

Horizon Sponsor Backstop Commitment / Trust(²)

Equity Rollover

Total Sources

($ in millions)

Cash to Redeem Series D-2 Preferred Stock

Cash to Balance Sheet

Equity Rollover

Transaction Fees & Expenses

Total Uses

Note:

Sources & Uses

(2)

Uses

Amount

$155

$145

$2,626

Up to $370 million of proceeds available from trust subject to redemption -

proceeds to be held on balance sheet of the pro forma company

2,326

Amount

$80

174

2,326

46

%

6%

$2,626

5%

89%

100%

%

3%

7%

89%

1%

100%

($ in millions)

Pro Forma Shares Outstanding

Share Price

Pro Forma Equity Value

(+) Pro Forma Net Debt / (Cash)(3)

Horizon Non-

Redemption

Agreement

6%

Pro Forma Enterprise Value

Pro Forma Enterprise Value /'22E Adj. Mgmt. EBITDA ($288 million(4))

Pro Forma Net Debt /'22E Adj. Mgmt. EBITDA ($288 million(4))

Pro Forma Ownership Split

Excludes impact of 12.3 million warrants held by public and 11.4 million warrants held by sponsor struck at $11.50. Also excludes two tranches of 20.0 million

warrants each held by the sponsor (50%) and Directional Aviation (50%) struck at $10.00 and $15.00 with a ten-year term. Excludes cash from trust in

excess of the Horizon Sponsor Backstop Commitment.

Horizon Sponsor to execute a non redemption agreement in respect of its $155 million investment in Horizon's IPO (29.5% of total).

In exchange for the commitment, Eldridge Industries will be paid a backstop fee in an amount equal to 3% of such commitment. Represents minimum

proceeds inclusive of sponsor backstop of up to $145 million.

FLEXJET.COM

36

Horizon Backstop

5%

(3)

(4)

Pro Forma Valuation

(5)

(6)

Particulars

Existing

Shareholders (6)

89%

Amount

262.6

$10.00

$2,626

$488

$3,114

10.8x

1.7x

Substantially all founder shares

(13.1 million) converted into

warrants split 50% / 50% with

Directional Aviation | 20.0

million warrants struck at $10.00

and 20.0 million warrants struck

at 5.00 (all with a ten-year

term) (5)

Based on Q2 2022. Pro forma gross debt of $749 million and cash of $261 million.

2022E Adj. Mgmt. EBITDA representative of projected Management 2022E EBITDA adjusted to include

impact of Sentient Jet hourly pricing policy changes and normalization of customer credits. Please refer

to page 40 for additional information.

Will also receive a nominal number of shares (50k) in order to ensure a tax-free exchange.

Includes Eldridge Industries, which is an existing investor in Flexjet and an affiliate of Horizon's sponsor.View entire presentation