Adtheorent SPAC Presentation Deck

MONROE

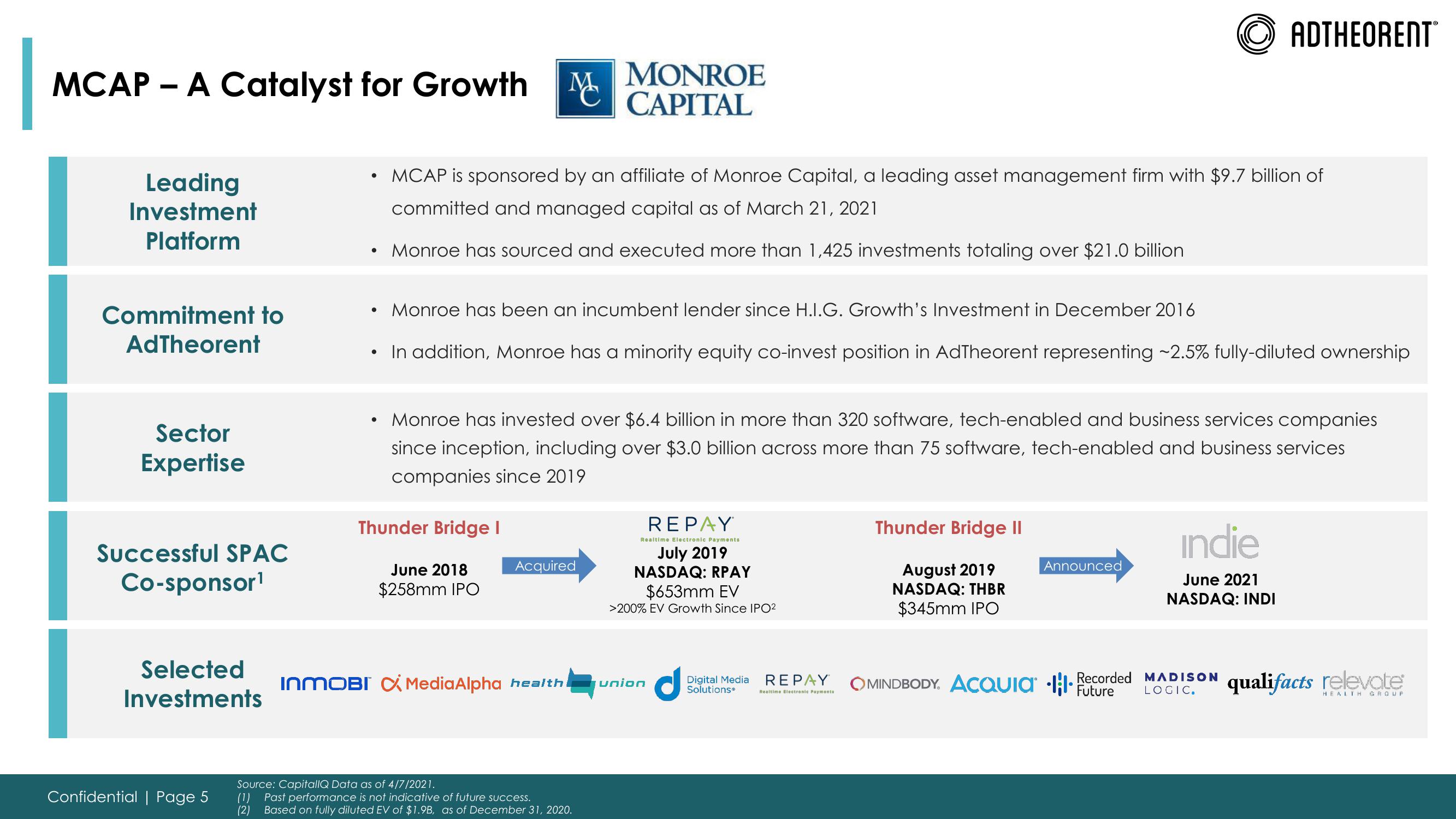

MCAP - A Catalyst for Growth M CAPITAL

Leading

Investment

Platform

Commitment to

AdTheorent

Sector

Expertise

Successful SPAC

Co-sponsor¹

Selected

Investments

Confidential | Page 5

●

MCAP is sponsored by an affiliate of Monroe Capital, a leading asset management firm with $9.7 billion of

committed and managed capital as of March 21, 2021

• Monroe has sourced and executed more than 1,425 investments totaling over $21.0 billion

●

Monroe has been an incumbent lender since H.I.G. Growth's Investment in December 2016

In addition, Monroe has a minority equity co-invest position in AdTheorent representing ~2.5% fully-diluted ownership

Monroe has invested over $6.4 billion in more than 320 software, tech-enabled and business services companies

since inception, including over $3.0 billion across more than 75 software, tech-enabled and business services

companies since 2019

Thunder Bridge I

June 2018

$258mm IPO

Acquired

INMOBI MediaAlpha health

Source: CapitallQ Data as of 4/7/2021.

(1) Past performance is not indicative of future success.

(2) Based on fully diluted EV of $1.9B, as of December 31, 2020.

REPAY

Realtime Electronic Payments

July 2019

NASDAQ: RPAY

$653mm EV

>200% EV Growth Since IPO²

union

d

Digital Media

Solutions

REPAY

Realtime Electronic Payments

ADTHEORENT

Thunder Bridge II

August 2019

NASDAQ: THBR

$345mm IPO

Announced

indie

June 2021

NASDAQ: INDI

ⒸMINDBODY. ACQUIa Recorded MADISON qualifacts relevate

Future LOGIC.

HEALTH GROUPView entire presentation