Netstreit Investor Presentation Deck

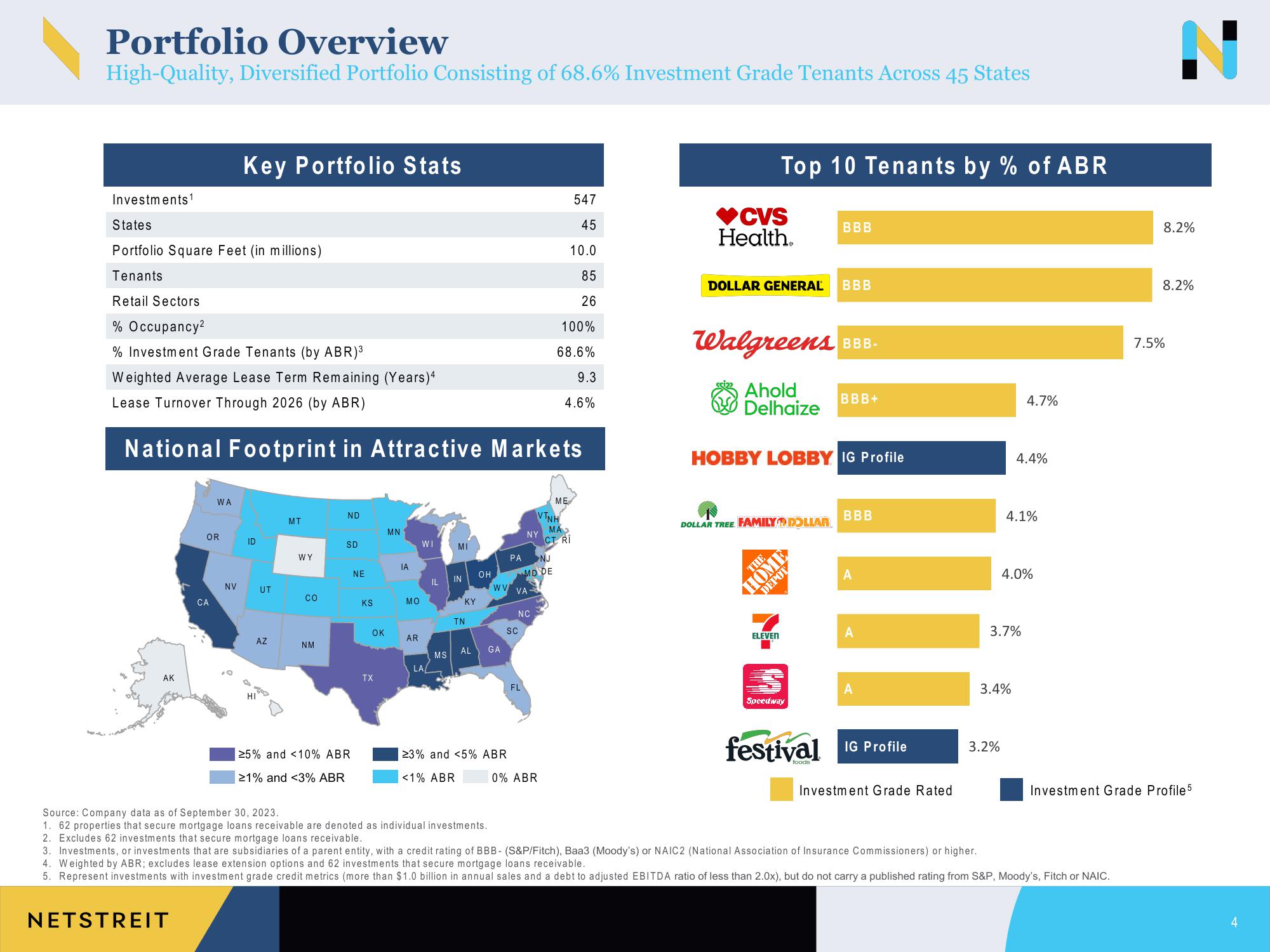

Portfolio Overview

High-Quality, Diversified Portfolio Consisting of 68.6% Investment Grade Tenants Across 45 States

Investments 1

AK

States

Portfolio Square Feet (in millions)

Tenants.

Retail Sectors

% Occupancy²

% Investment Grade Tenants (by ABR)³

Weighted Average Lease Term Remaining (Years)4

Lease Turnover Through 2026 (by ABR)

National Footprint in Attractive Markets

NETSTREIT

WA

OR

CA

Key Portfolio Stats

NV

ID

UT

AZ

HI

MT

WY

CO

NM

ND

SD

≥5% and <10% ABR

≥1% and <3% ABR

NE

KS

OK

TX

MN

IA

MO

AR

WI

LA/

IL

MS

IN

KY

TN

AL

OH

GA

PA

WV VA

23% and <5% ABR

<1% ABR

SC

NY

NC

FL

NJ

MD DE

VTNH

0% ABR

547

45

10.0

85

26

100%

68.6%

ME

9.3

4.6%

MA

CT RI

♥CVS

Health

Top 10 Tenants by % of ABR

DOLLAR GENERAL BBB

Walgreens BBB-

Ahold

Delhaize

DOLLAR TREE FAMILY DOLLAR

THE

HOBBY LOBBY IG Profile

BBB

HOME

DEPOT

ELEVEN

Speedway

BBB+

III

BBB

A

A

A

festival IG Profile

Investment Grade Rated

3.2%

4.7%

4.4%

4.1%

3.7%

3.4%

4.0%

Source: Company data as of September 30, 2023.

1. 62 properties that secure mortgage loans receivable are denoted as individual investments.

2. Excludes 62 investments that secure mortgage loans receivable.

3. Investments, or investments that are subsidiaries of a parent entity, with a credit rating of BBB- (S&P/Fitch), Baa3 (Moody's) or NAIC2 (National Association of Insurance Commissioners) or higher.

4. Weighted by ABR; excludes lease extension options and 62 investments that secure mortgage loans receivable.

5. Represent investments with investment grade credit metrics (more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x), but do not carry a published rating from S&P, Moody's, Fitch or NAIC.

8.2%

8.2%

7.5%

Investment Grade Profile 5View entire presentation