OppFi Investor Presentation Deck

20

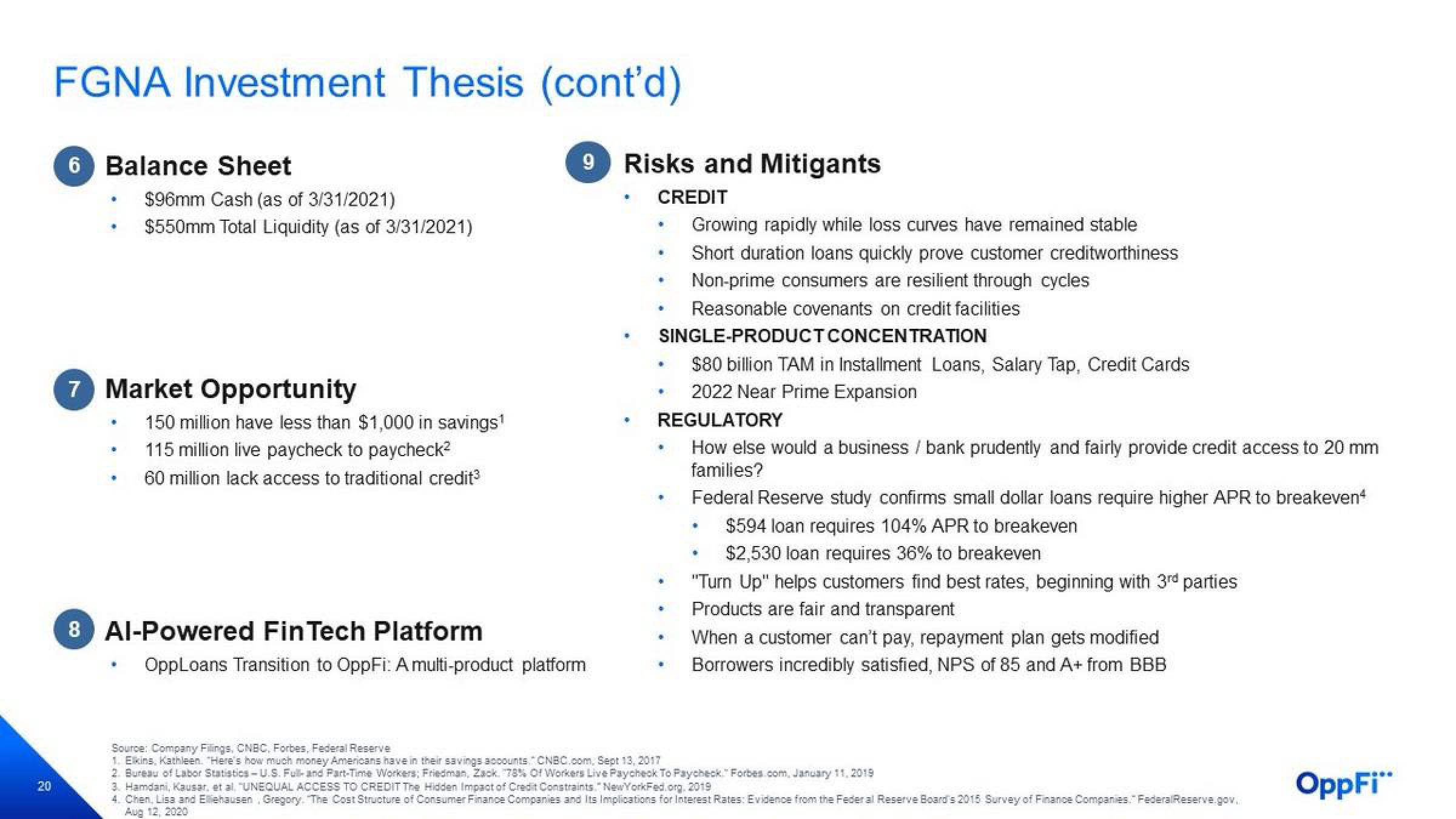

FGNA Investment Thesis (cont'd)

6 Balance Sheet

@

•

$96mm Cash (as of 3/31/2021)

$550mm Total Liquidity (as of 3/31/2021)

7 Market Opportunity

150 million have less than $1,000 in savings¹

115 million live paycheck to paycheck²

60 million lack access to traditional credit³

8 Al-Powered FinTech Platform

9 Risks and Mitigants

OppLoans Transition to OppFi: A multi-product platform

CREDIT

Growing rapidly while loss curves have remained stable

Short duration loans quickly prove customer creditworthiness

Non-prime consumers are resilient through cycles

Reasonable covenants on credit facilities

•

SINGLE-PRODUCT CONCENTRATION

$80 billion TAM in Installment Loans, Salary Tap, Credit Cards

2022 Near Prime Expansion

REGULATORY

+

How else would a business / bank prudently and fairly provide credit access to 20 mm

families?

Federal Reserve study confirms small dollar loans require higher APR to breakeven4

$594 loan requires 104% APR to breakeven

$2,530 loan requires 36% to breakeven

"Turn Up" helps customers find best rates, beginning with 3rd parties

Products are fair and transparent

#

.

When a customer can't pay, repayment plan gets modified

Borrowers incredibly satisfied, NPS of 85 and A+ from BBB

Source: Company Filings, CNBC, Forbes, Federal Reserve

1. Elkins, Kathleen. "Here's how much money Americans have in their savings accounts."CNBC.com, Sept 13, 2017

2. Bureau of Labor Statistics-U.S. Full-and Part-Time Workers; Friedman, Zack. 78% Of Workers Live Paycheck To Paycheck"Forbes.com, January 11, 2019

3. Hamdani, Kausar, et al. "UNEQUAL ACCESS TO CREDIT The Hidden Impact of Credit Constraints." NewYorkFed.org, 2019

4. Chen, Lisa and Elliehausen, Gregory. The Cost Structure of Consumer Finance Companies and Its Implications for Interest Rates: Evidence from the Federal Reserve Board's 2015 Survey of Finance Companies." Federal Reserve.gov.

Aug 12, 2020

OppFi"View entire presentation