Vista Equity Partners Fund VIII, L.P. Recommendation Report

Ⓡ

Hamilton Lane

●

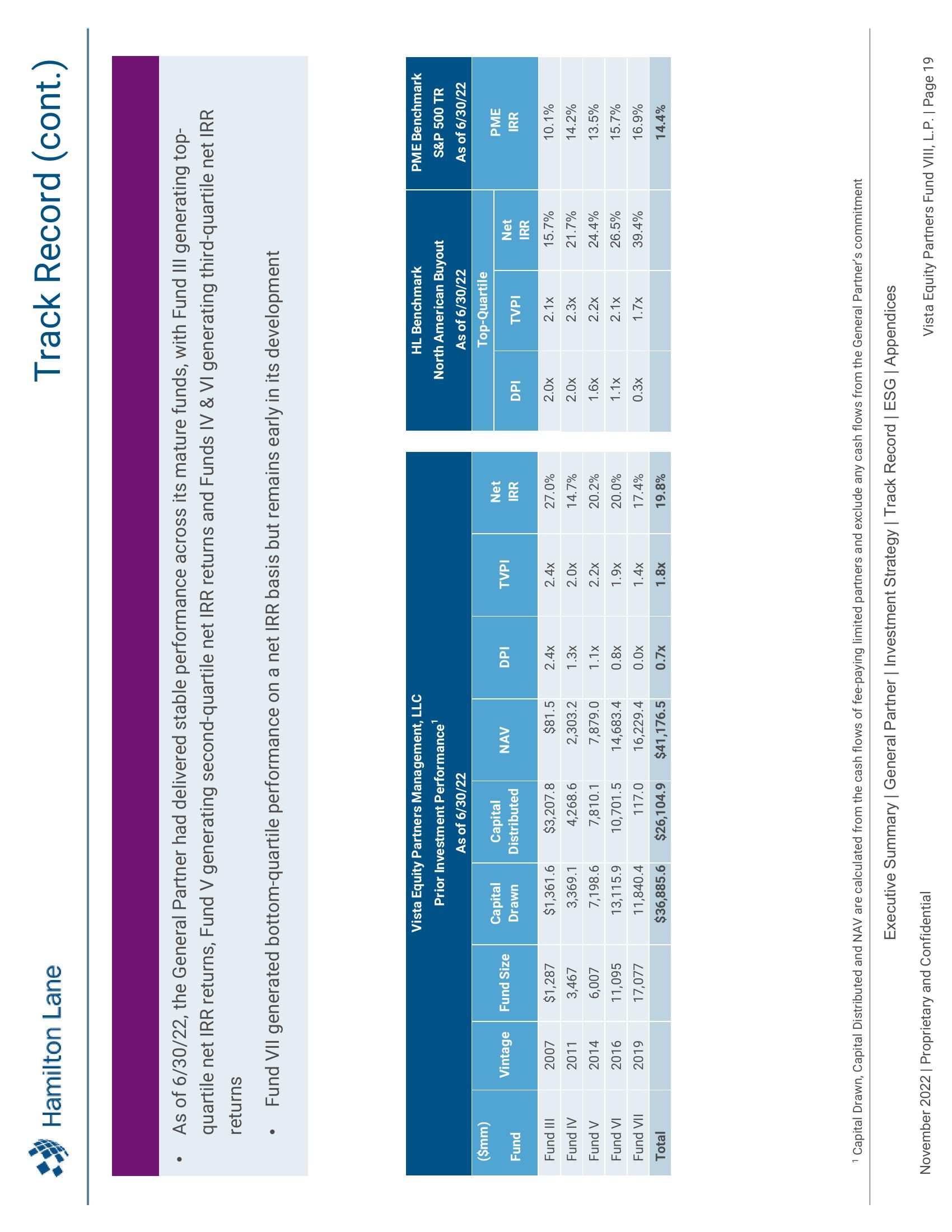

As of 6/30/22, the General Partner had delivered stable performance across its mature funds, with Fund III generating top-

quartile net IRR returns, Fund V generating second-quartile net IRR returns and Funds IV & VI generating third-quartile net IRR

returns

($mm)

Fund

Fund III

Fund IV

Fund V

Fund VI

Fund VII

Total

Fund VII generated bottom-quartile performance on a net IRR basis but remains early in its development

Vintage

2007

2011

2014

2016

2019

Fund Size

$1,287

3,467

6,007

11,095

17,077

Vista Equity Partners Management, LLC

Prior Investment Performance'

As of 6/30/22

Capital

Drawn

Capital

Distributed

$1,361.6

$3,207.8

3,369.1

4,268.6

7,198.6

7,810.1

13,115.9

10,701.5

11,840.4

117.0

$36,885.6 $26,104.9

NAV

$81.5

2,303.2

7,879.0

14,683.4

16,229.4

$41,176.5

DPI

2.4x

1.3x

1.1x

0.8x

0.0x

0.7x

TVPI

2.4x

2.0x

2.2x

1.9x

1.4x

1.8x

Track Record (cont.)

Net

IRR

27.0%

14.7%

20.2%

20.0%

17.4%

19.8%

DPI

HL Benchmark

North American Buyout

As of 6/30/22

Top-Quartile

2.0x

2.0x

1.6x

1.1x

0.3x

TVPI

2.1x

2.3x

2.2x

2.1x

1.7x

Net

IRR

15.7%

21.7%

24.4%

26.5%

39.4%

1 Capital Drawn, Capital Distributed and NAV are calculated from the cash flows of fee-paying limited partners and exclude any cash flows from the General Partner's commitment

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

November 2022 | Proprietary and Confidential

PME Benchmark

S&P 500 TR

As of 6/30/22

PME

IRR

10.1%

14.2%

13.5%

15.7%

16.9%

14.4%

Vista Equity Partners Fund VIII, L.P. | Page 19View entire presentation