Zegna Results Presentation Deck

FY 2021 RESULTS - ZEGNA SEGMENT mer ZEGNA SEGMEN Ermenegildo Zegna Group

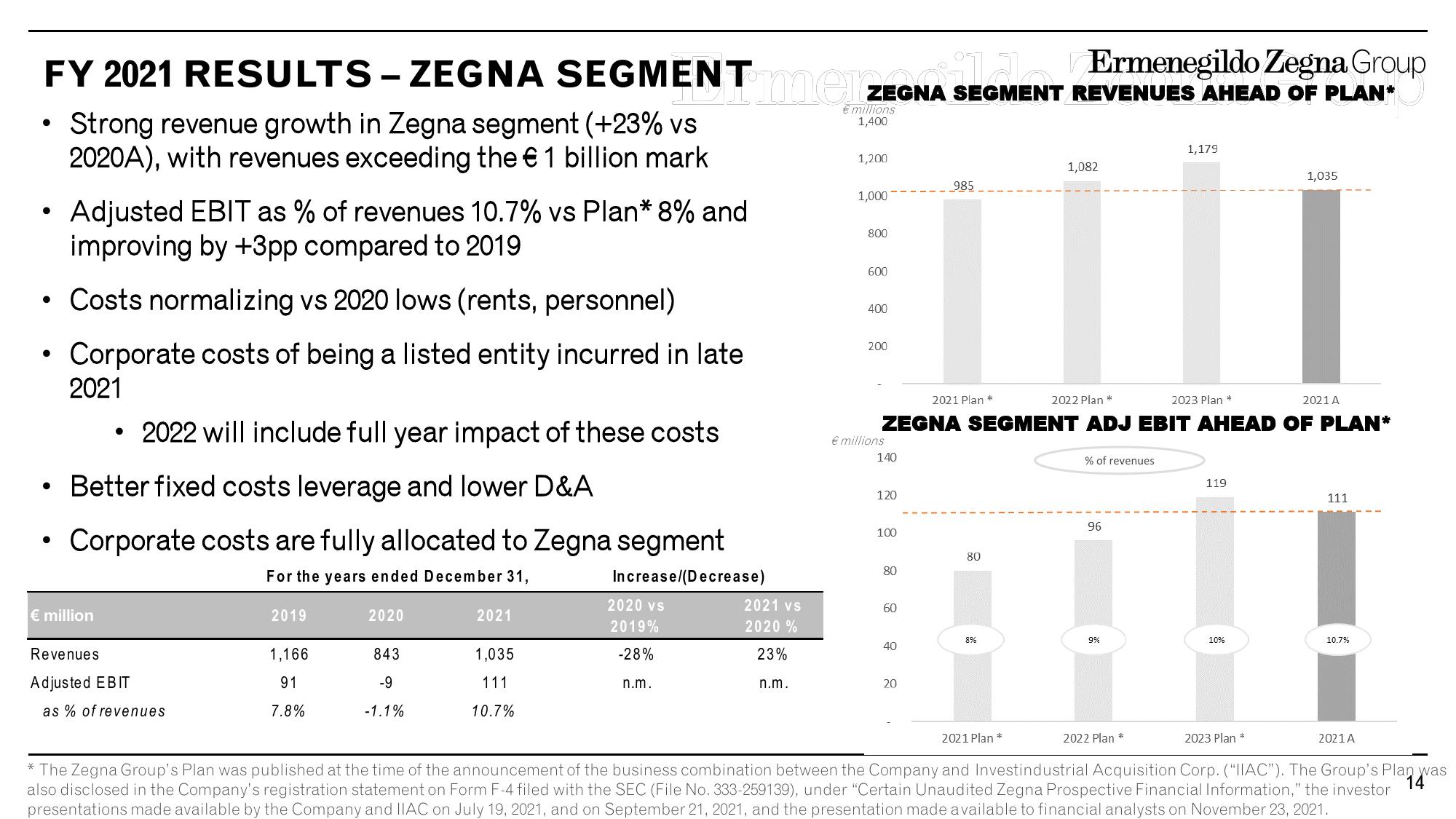

ZEGNA SEGMENT REVENUES AHEAD OF PLAN*

• Strong revenue growth in Zegna segment (+23% vs

2020A), with revenues exceeding the € 1 billion mark

Adjusted EBIT as % of revenues 10.7% vs Plan* 8% and

improving by +3pp compared to 2019

• Costs normalizing vs 2020 lows (rents, personnel)

• Corporate costs of being a listed entity incurred in late

2021

• 2022 will include full year impact of these costs

Better fixed costs leverage and lower D&A

• Corporate costs are fully allocated to Zegna segment

For the years ended December 31,

Increase/(Decrease)

●

€ million

Revenues

Adjusted EBIT

as % of revenues

2019

1,166

91

7.8%

2020

843

-9

-1.1%

2021

1,035

111

10.7%

2020 vs

2019%

-28%

n.m.

2021 vs

2020 %

23%

n.m.

€ millions

1,400

1,200

1,000

800

600

400

200

€ millions

140

120

2022 Plan *

2023 Plan *

2021 A

ZEGNA SEGMENT ADJ EBIT AHEAD OF PLAN*

100

80

60

40

985

20

2021 Plan *

80

1,082

8%

% of revenues

96

9%

1,179

2022 Plan *

119

10%

1,035

2023 Plan *

111

10.7%

2021 A

2021 Plan *

* The Zegna Group's Plan was published at the time of the announcement of the business combination between the Company and Investindustrial Acquisition Corp. ("IIAC"). The Group's Plan was

14

also disclosed in the Company's registration statement on Form F-4 filed with the SEC (File No. 333-259139), under "Certain Unaudited Zegna Prospective Financial Information," the investor

presentations made available by the Company and IIAC on July 19, 2021, and on September 21, 2021, and the presentation made available to financial analysts on November 23, 2021.View entire presentation