TPG Investor Presentation Deck

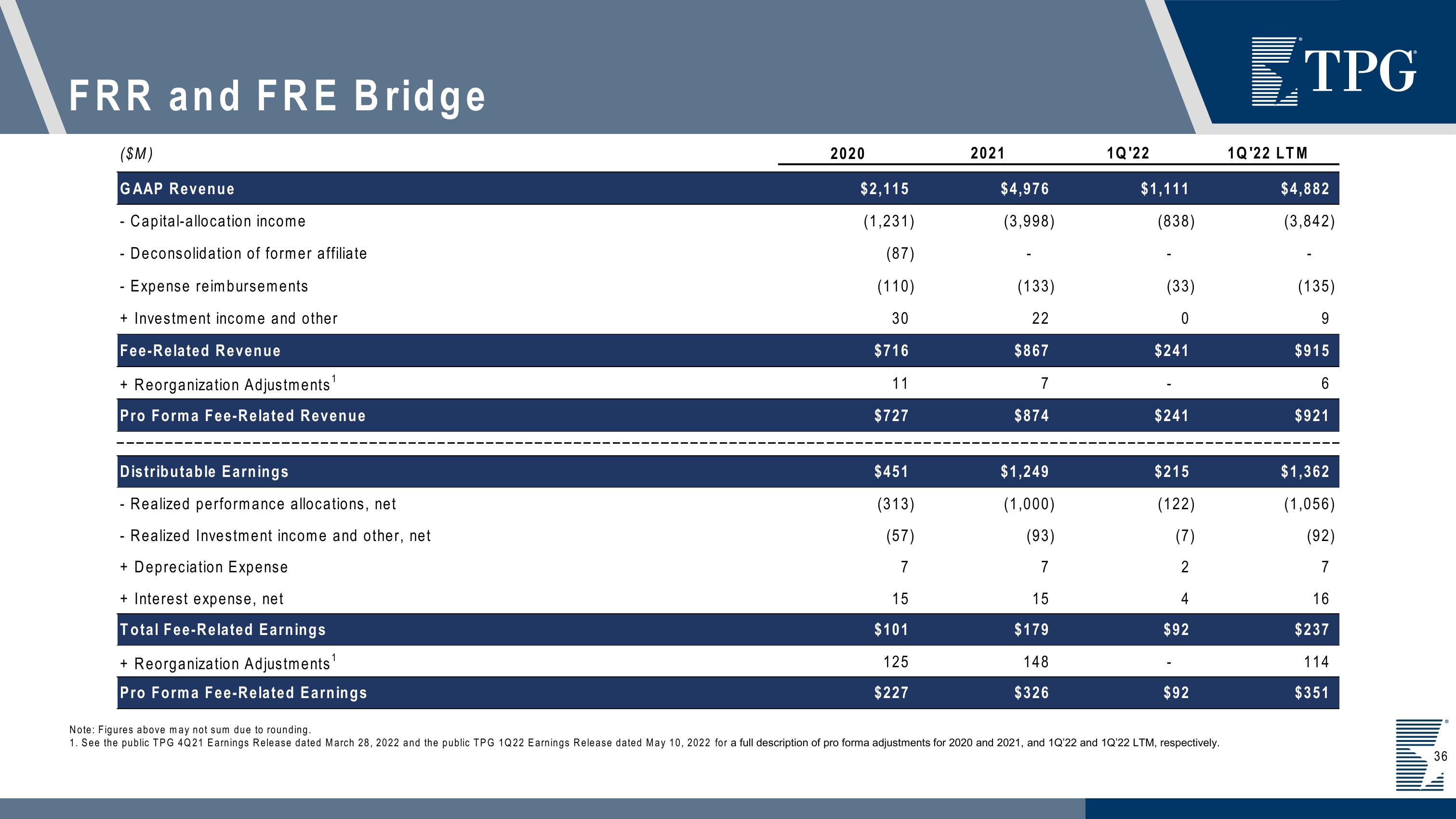

FRR and FRE Bridge

($M)

GAAP Revenue

- Capital-allocation income

- Deconsolidation of former affiliate

- Expense reimbursements

+ Investment income and other

Fee-Related Revenue

+ Reorganization Adjustments¹

Pro Forma Fee-Related Revenue

Distributable Earnings

- Realized performance allocations, net

- Realized Investment income and other, net

+ Depreciation Expense

+ Interest expense, net

Total Fee-Related Earnings

+ Reorganization Adjustments¹

Pro Forma Fee-Related Earnings

2020

$2,115

(1,231)

(87)

(110)

30

$716

11

$727

$451

(313)

(57)

7

15

$101

125

$227

2021

$4,976

(3,998)

(133)

22

$867

7

$874

$1,249

(1,000)

(93)

7

15

$179

148

$326

1Q'22

$1,111

(838)

(33)

0

$241

$241

$215

(122)

(7)

2

4

$92

$92

Note: Figures above may not sum due to rounding.

1. See the public TPG 4Q21 Earnings Release dated March 28, 2022 and the public TPG 1Q22 Earnings Release dated May 10, 2022 for a full description of pro forma adjustments for 2020 and 2021, and 1Q'22 and 1Q'22 LTM, respectively.

TPG

1Q'22 LTM

$4,882

(3,842)

(135)

9

$915

CO

6

$921

$1,362

(1,056)

(92)

7

16

$237

114

$351

36View entire presentation