Intertek Results Presentation Deck

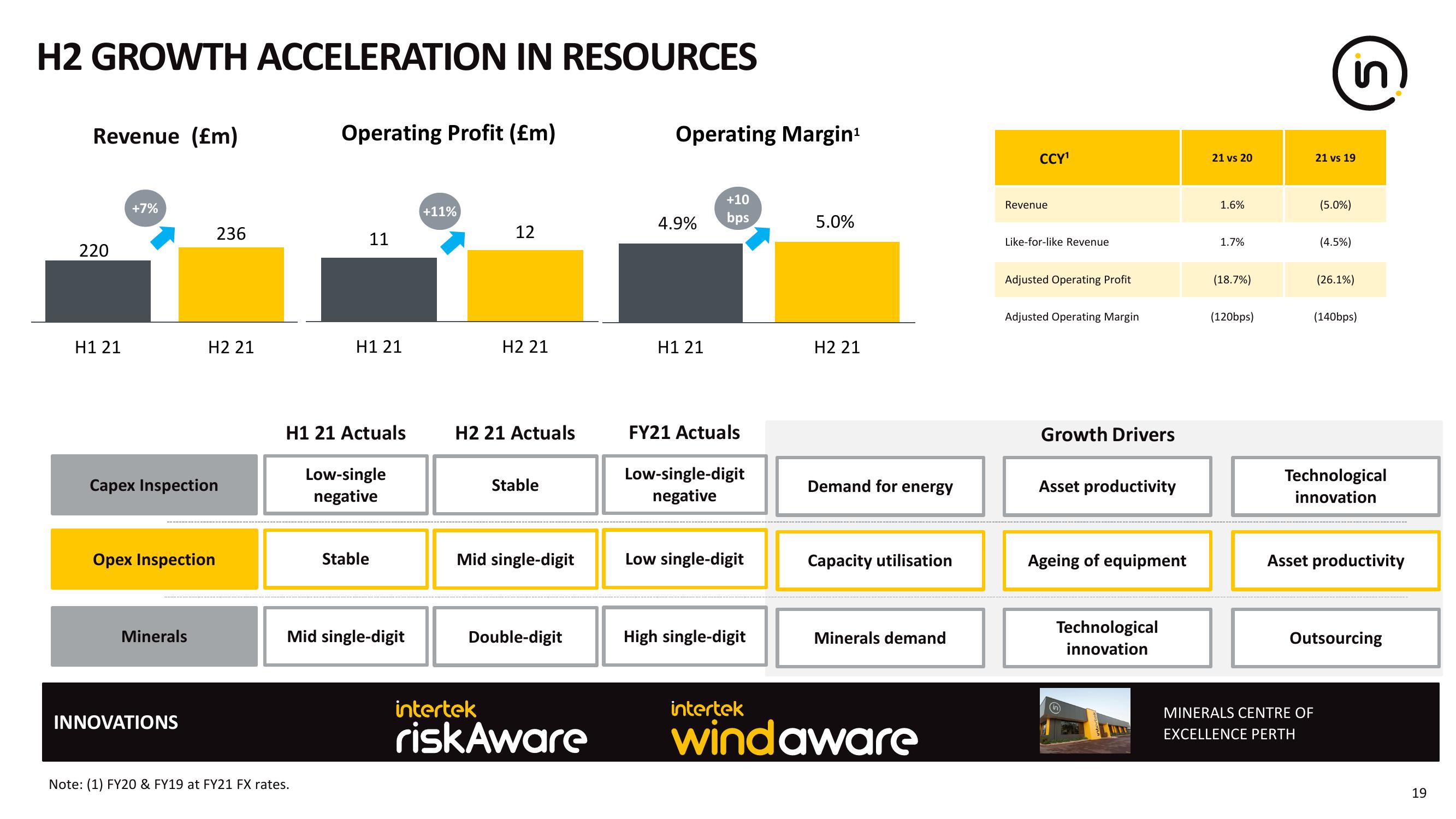

H2 GROWTH ACCELERATION IN RESOURCES

Revenue (Em)

220

H1 21

+7%

Capex Inspection

Opex Inspection

Minerals

236

H2 21

INNOVATIONS

Operating Profit (£m)

Note: (1) FY20 & FY19 at FY21 FX rates.

11

H1 21

H1 21 Actuals

Low-single

negative

Stable

Mid single-digit

+11%

12

H2 21

H2 21 Actuals

Stable

Mid single-digit

Double-digit

intertek

risk Aware

Operating Margin¹

4.9%

H1 21

+10

bps

FY21 Actuals

Low-single-digit

negative

Low single-digit

High single-digit

5.0%

H2 21

Demand for energy

Capacity utilisation

Minerals demand

intertek

wind aware

CCY¹

Revenue

Like-for-like Revenue

Adjusted Operating Profit

Adjusted Operating Margin

Growth Drivers

Asset productivity

Ageing of equipment

Technological

innovation

21 vs 20

1.6%

1.7%

(18.7%)

(120bps)

in

21 vs 19

(5.0%)

MINERALS CENTRE OF

EXCELLENCE PERTH

S

(4.5%)

(26.1%)

(140bps)

Technological

innovation

Asset productivity

Outsourcing

19View entire presentation