AppHarvest SPAC Presentation Deck

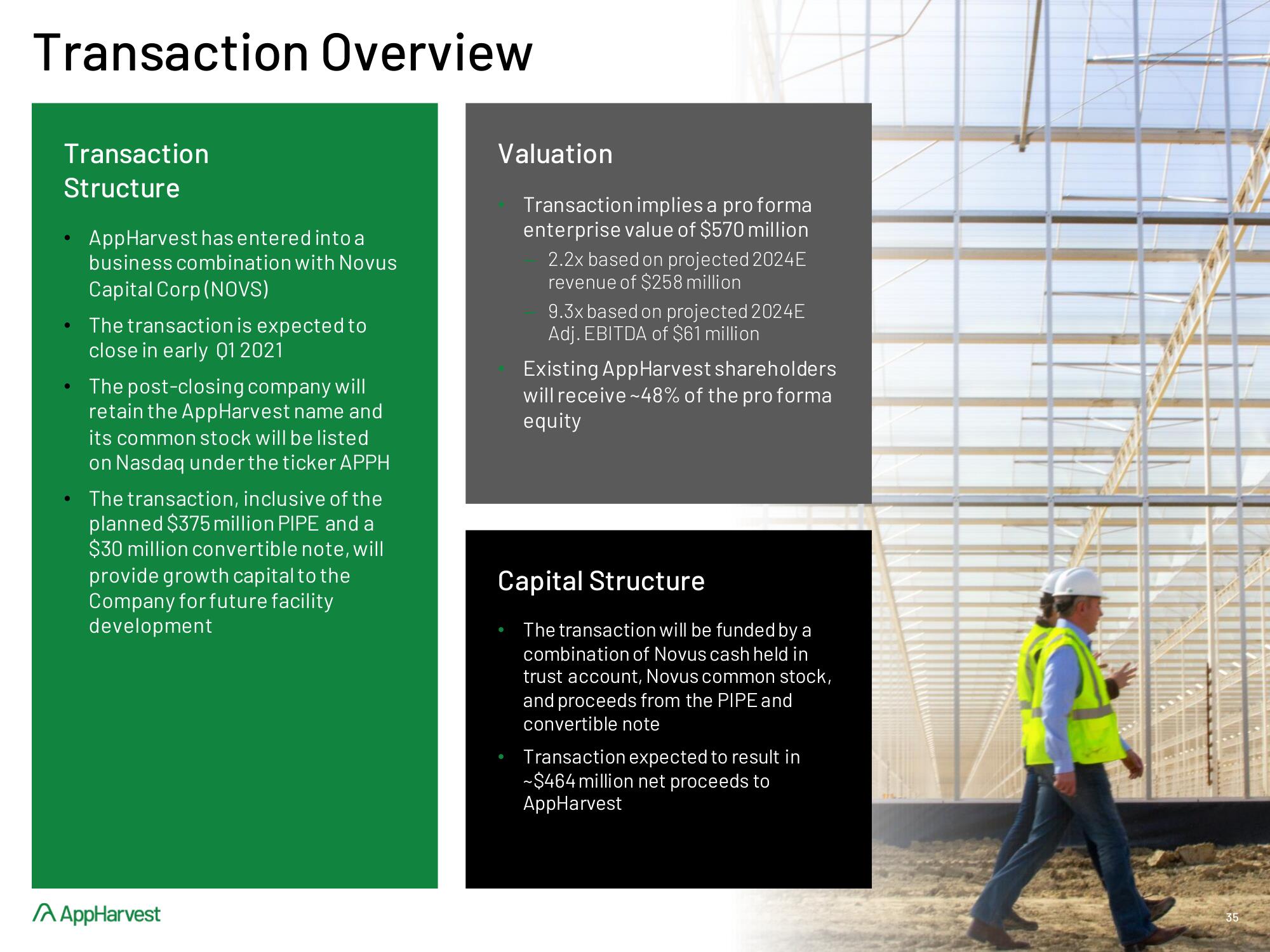

Transaction Overview

Transaction

Structure

●

●

AppHarvest has entered into a

business combination with Novus

Capital Corp (NOVS)

The transaction is expected to

close in early Q1 2021

The post-closing company will

retain the AppHarvest name and

its common stock will be listed

on Nasdaq under the ticker APPH

The transaction, inclusive of the

planned $375 million PIPE and a

$30 million convertible note, will

provide growth capital to the

Company for future facility

development

A AppHarvest

Valuation

Transaction implies a pro forma

enterprise value of $570 million

2.2x based on projected 2024E

revenue of $258 million

9.3x based on projected 2024E

Adj. EBITDA of $61 million

Existing AppHarvest shareholders

will receive ~48% of the pro forma

equity

Capital Structure

The transaction will be funded by a

combination of Novus cash held in

trust account, Novus common stock,

and proceeds from the PIPE and

convertible note

Transaction expected to result in

~$464 million net proceeds to

AppHarvest

2022 2023

35View entire presentation