Xometry Mergers and Acquisitions Presentation Deck

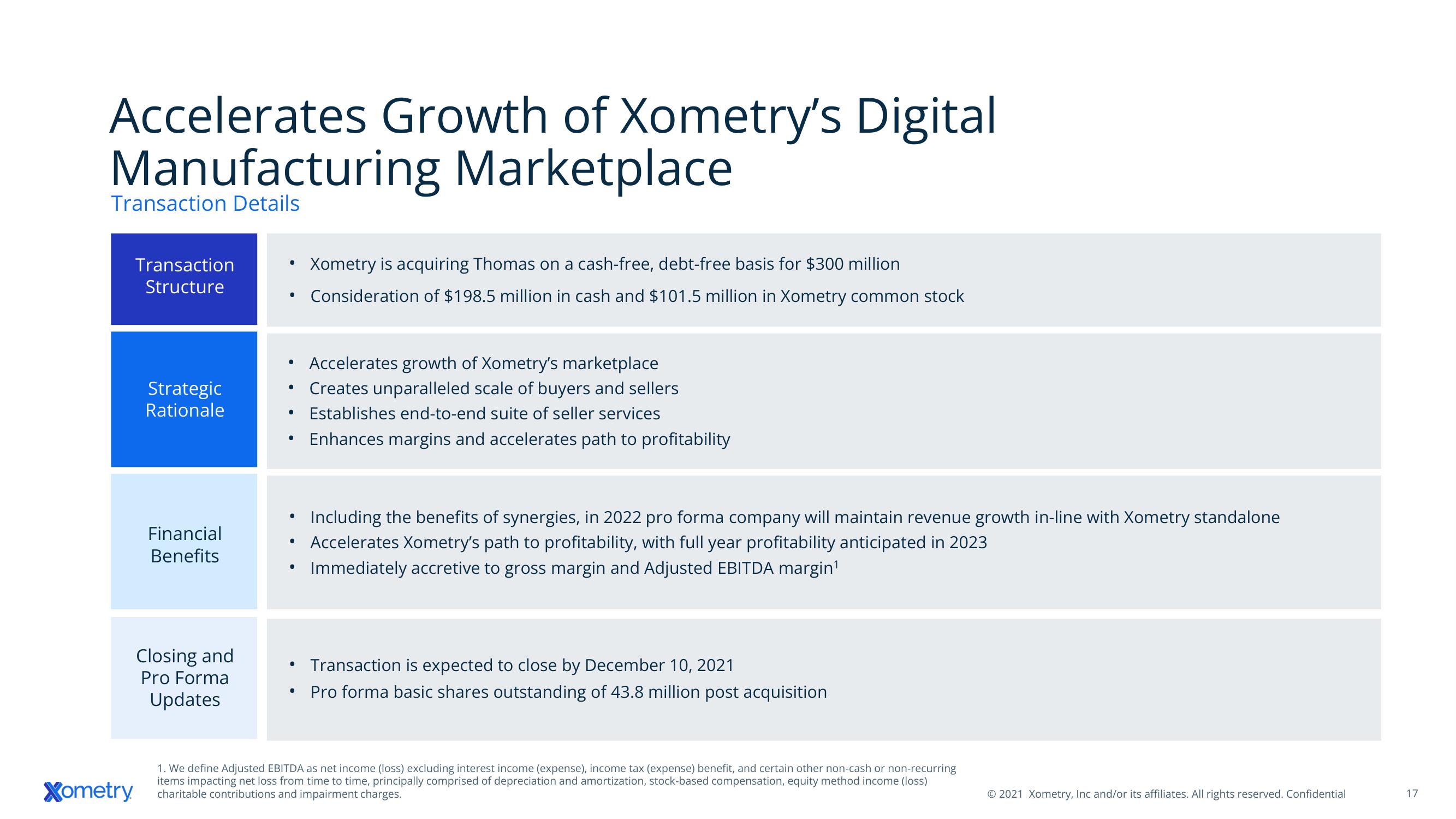

Accelerates Growth of Xometry's Digital

Manufacturing Marketplace

Transaction Details

Xometry

Transaction

Structure

Strategic

Rationale

Financial

Benefits

Closing and

Pro Forma

Updates

●

●

●

●

●

●

Xometry is acquiring Thomas on a cash-free, debt-free basis for $300 million

Consideration of $198.5 million in cash and $101.5 million in Xometry common stock

●

Accelerates growth of Xometry's marketplace

Creates unparalleled scale of buyers and sellers

Establishes end-to-end suite of seller services

Enhances margins and accelerates path to profitability

Including the benefits of synergies, in 2022 pro forma company will maintain revenue growth in-line with Xometry standalone

Accelerates Xometry's path to profitability, with full year profitability anticipated in 2023

Immediately accretive to gross margin and Adjusted EBITDA margin¹

Transaction is expected to close by December 10, 2021

• Pro forma basic shares outstanding of 43.8 million post acquisition

1. We define Adjusted EBITDA as net income (loss) excluding interest income (expense), income tax (expense) benefit, and certain other non-cash or non-recurring

items impacting net loss from time to time, principally comprised of depreciation and amortization, stock-based compensation, equity method income (loss)

charitable contributions and impairment charges.

© 2021 Xometry, Inc and/or its affiliates. All rights reserved. Confidential

17View entire presentation