Next.e.GO Investor Update

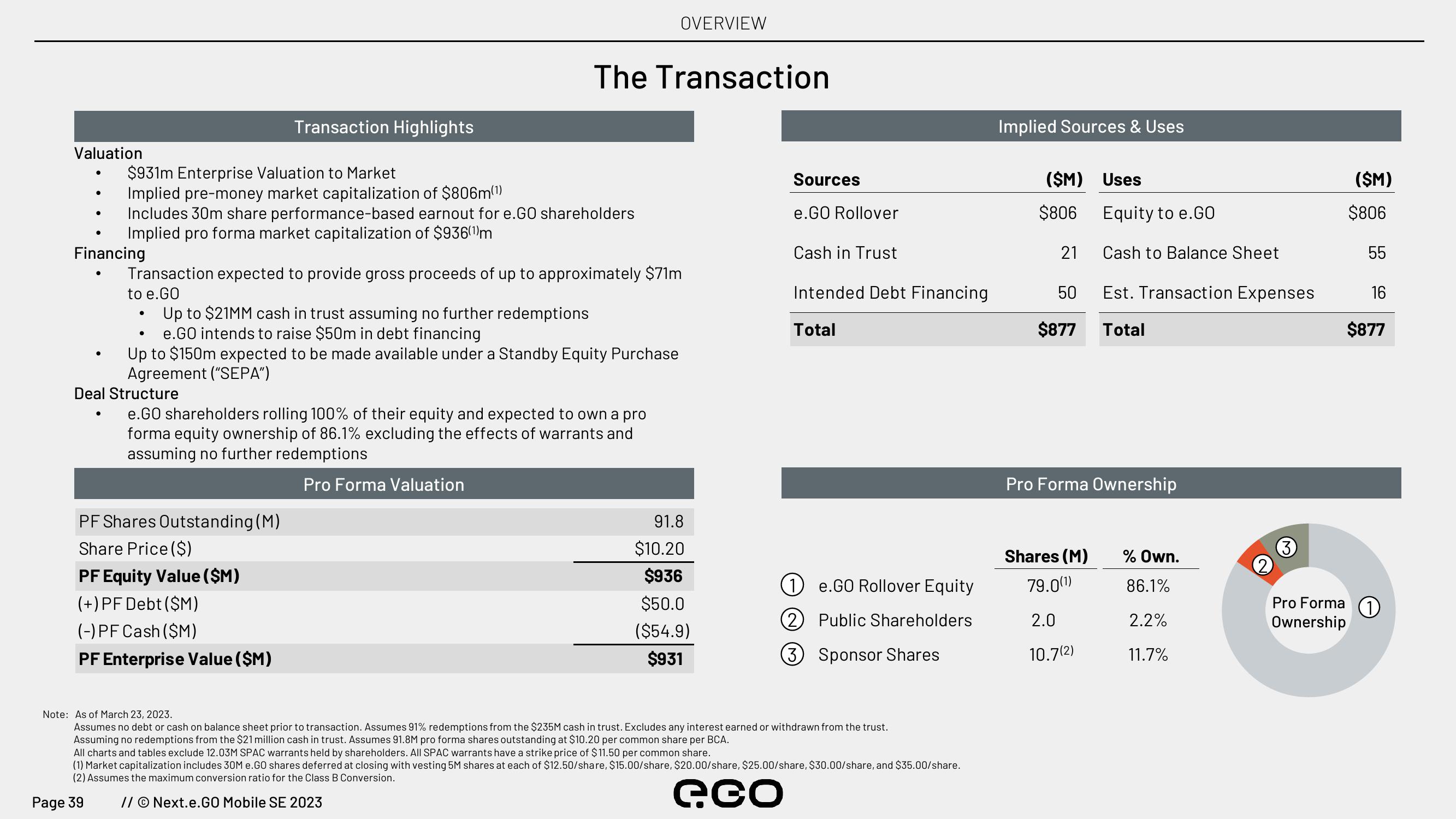

Valuation

Financing

$931m Enterprise Valuation to Market

Implied pre-money market capitalization of $806m(¹)

Includes 30m share performance-based earnout for e.GO shareholders

Implied pro forma market capitalization of $936(¹)m

●

Transaction Highlights

Transaction expected to provide gross proceeds of up to approximately $71m

to e.GO

Up to $21MM cash in trust assuming no further redemptions

e.GO intends to raise $50m in debt financing

Up to $150m expected to be made available under a Standby Equity Purchase

Agreement ("SEPA")

●

Deal Structure

The Transaction

PF Shares Outstanding (M)

Share Price ($)

PF Equity Value ($M)

(+) PF Debt ($M)

(-) PF Cash ($M)

PF Enterprise Value ($M)

OVERVIEW

e.GO shareholders rolling 100% of their equity and expected to own a pro

forma equity ownership of 86.1% excluding the effects of warrants and

assuming no further redemptions

Pro Forma Valuation

91.8

$10.20

$936

$50.0

($54.9)

$931

Sources

e.GO Rollover

Cash in Trust

Intended Debt Financing

Total

1e.GO Rollover Equity

(2) Public Shareholders

3 Sponsor Shares

Note: As of March 23, 2023.

Assumes no debt or cash on balance sheet prior to transaction. Assumes 91% redemptions from the $235M cash in trust. Excludes any interest earned or withdrawn from the trust.

Assuming no redemptions from the $21 million cash in trust. Assumes 91.8M pro forma shares outstanding at $10.20 per common share per BCA.

All charts and tables exclude 12.03M SPAC warrants held by shareholders. All SPAC warrants have a strike price of $11.50 per common share.

(1) Market capitalization includes 30M e.GO shares deferred at closing with vesting 5M shares at each of $12.50/share, $15.00/share, $20.00/share, $25.00/share, $30.00/share, and $35.00/share.

(2) Assumes the maximum conversion ratio for the Class B Conversion.

Page 39

// © Next.e.GO Mobile SE 2023

eco

Implied Sources & Uses

($M) Uses

$806

50

$877

Equity to e.GO

Cash to Balance Sheet

Shares (M)

79.0(1¹)

2.0

10.7(2)

Est. Transaction Expenses

Total

Pro Forma Ownership

% Own.

86.1%

2.2%

11.7%

Pro Forma

Ownership

($M)

$806

55

16

$877View entire presentation