Allego Results Presentation Deck

r

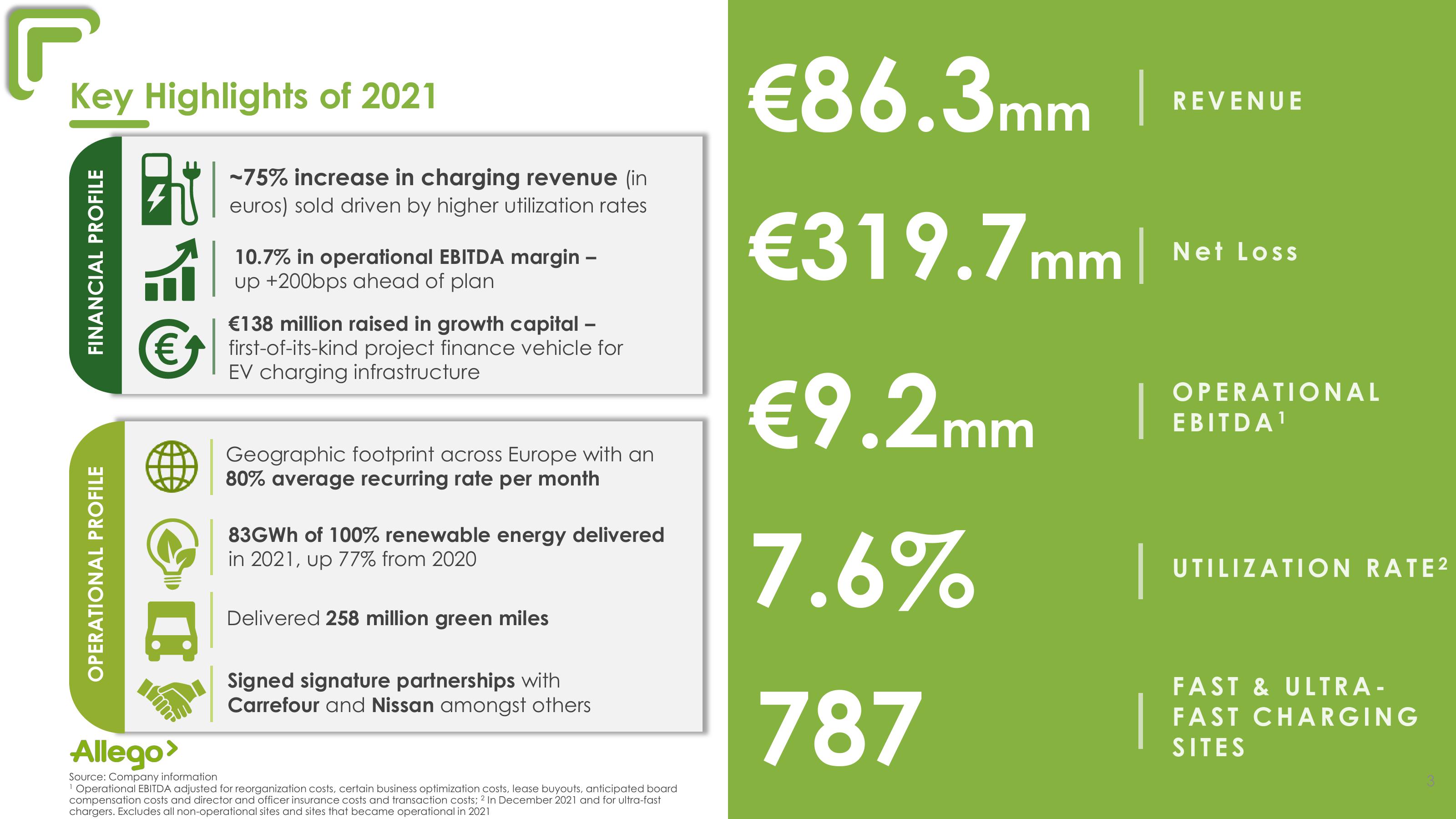

Key Highlights of 2021

FINANCIAL PROFILE

OPERATIONAL PROFILE

ZU

H

C

-75% increase in charging revenue (in

euros) sold driven by higher utilization rates

€138 million raised in growth capital -

€ first-of-its-kind project finance vehicle for

EV charging infrastructure

Im

10.7% in operational EBITDA margin-

up +200bps ahead of plan

Geographic footprint across Europe with an

80% average recurring rate per month

83GWh of 100% renewable energy delivered

in 2021, up 77% from 2020

Delivered 258 million green miles

Signed signature partnerships with

Carrefour and Nissan amongst others

Allego

Source: Company information

¹ Operational EBITDA adjusted for reorganization costs, certain business optimization costs, lease buyouts, anticipated board

compensation costs and director and officer insurance costs and transaction costs; 2 In December 2021 and for ultra-fast

chargers. Excludes all non-operational sites and sites that became operational in 2021

€86.3mm | REVENUE

€319.7mm |

€9.2mm

7.6%

787

Net Loss

OPERATIONAL

EBITDA ¹

UTILIZATION RATE²

FAST & ULTRA-

FAST CHARGING

SITESView entire presentation