SmileDirectClub Investor Presentation Deck

Cost Levers.

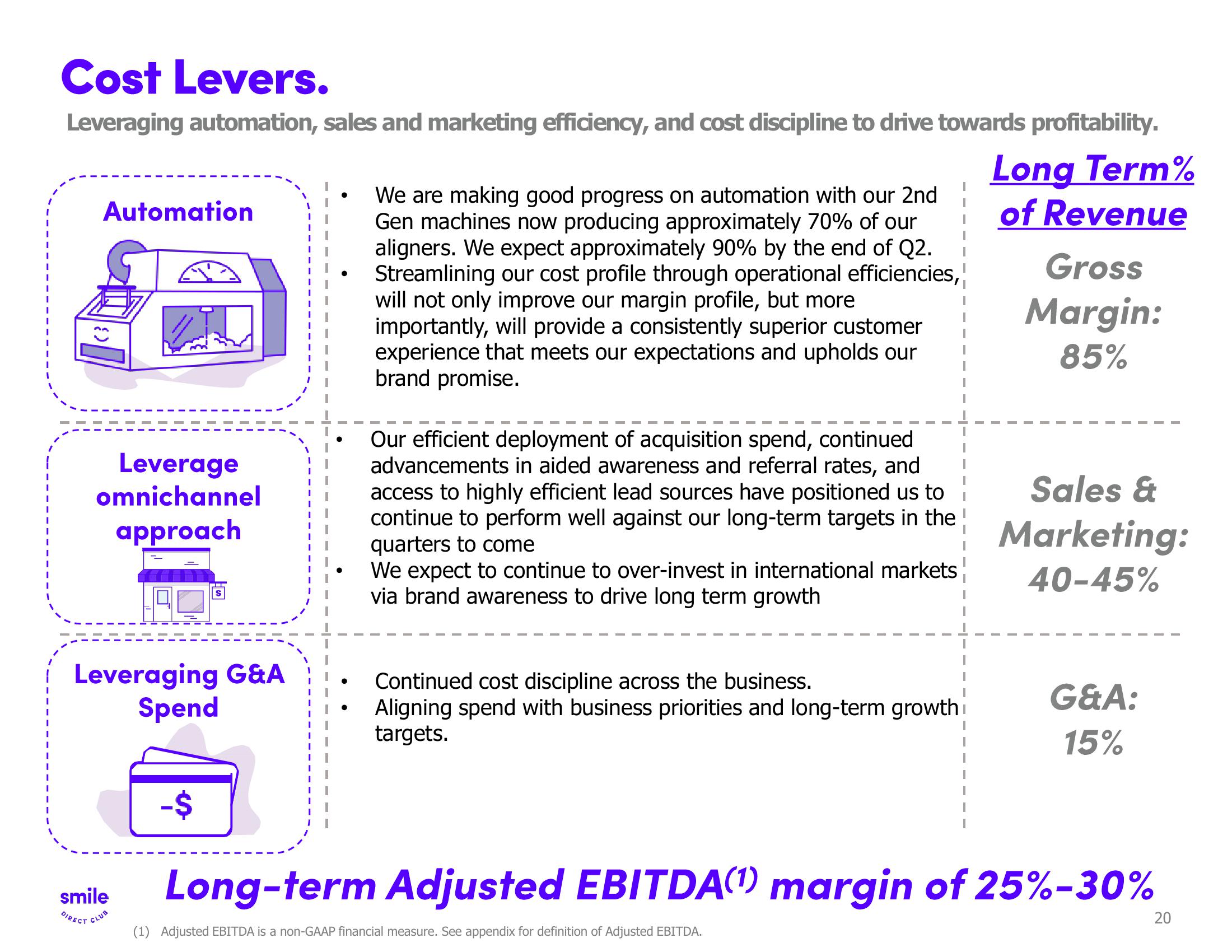

Leveraging automation, sales and marketing efficiency, and cost discipline to drive towards profitability.

Automation

Leverage

omnichannel

approach

Leveraging G&A

Spend

smile

DIRECT CLUB

-$

We are making good progress on automation with our 2nd

Gen machines now producing approximately 70% of our

aligners. We expect approximately 90% by the end of Q2.

Streamlining our cost profile through operational efficiencies,

will not only improve our margin profile, but more

importantly, will provide a consistently superior customer

experience that meets our expectations and upholds our

brand promise.

Our efficient deployment of acquisition spend, continued

advancements in aided awareness and referral rates, and

access to highly efficient lead sources have positioned us to

continue to perform well against our long-term targets in the

quarters to come

We expect to continue to over-invest in international markets

via brand awareness to drive long term growth

Continued cost discipline across the business.

Aligning spend with business priorities and long-term growth

targets.

Long Term%

of Revenue

Gross

Margin:

85%

Sales &

Marketing:

40-45%

G&A:

15%

Long-term Adjusted EBITDA(1) margin of 25%-30%

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

20View entire presentation