2nd Quarter 2021 Investor Presentation

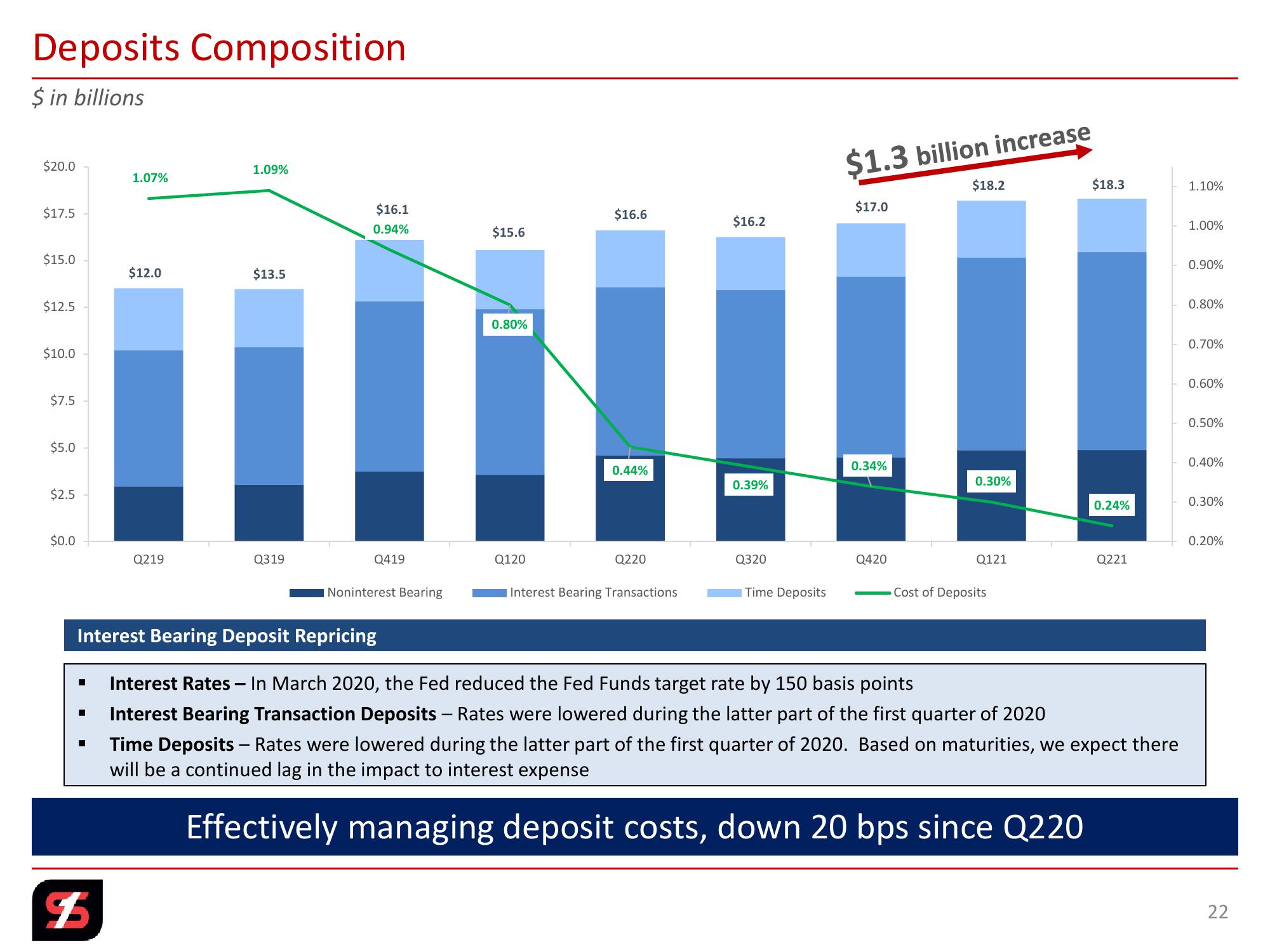

Deposits Composition

$ in billions

$20.0

1.09%

1.07%

$17.5

$15.0

$12.0

$13.5

$12.5

$10.0

$7.5

$5.0

$2.5

$1.3 billion increase

$16.1

$17.0

$16.6

$16.2

0.94%

$15.6

0.80%

$18.2

$18.3

1.10%

1.00%

0.90%

0.80%

0.70%

0.60%

0.50%

0.44%

0.34%

0.40%

0.39%

0.30%

0.24%

0.30%

0.20%

$0.0

Q219

Q319

Q419

Q120

Q220

Q320

Q420

Q121

Q221

Noninterest Bearing

Interest Bearing Transactions

Time Deposits

Cost of Deposits

Interest Bearing Deposit Repricing

"

Interest Rates - In March 2020, the Fed reduced the Fed Funds target rate by 150 basis points

Interest Bearing Transaction Deposits - Rates were lowered during the latter part of the first quarter of 2020

Time Deposits - Rates were lowered during the latter part of the first quarter of 2020. Based on maturities, we expect there

will be a continued lag in the impact to interest expense

Effectively managing deposit costs, down 20 bps since Q220

$

22View entire presentation