Deutsche Bank Results Presentation Deck

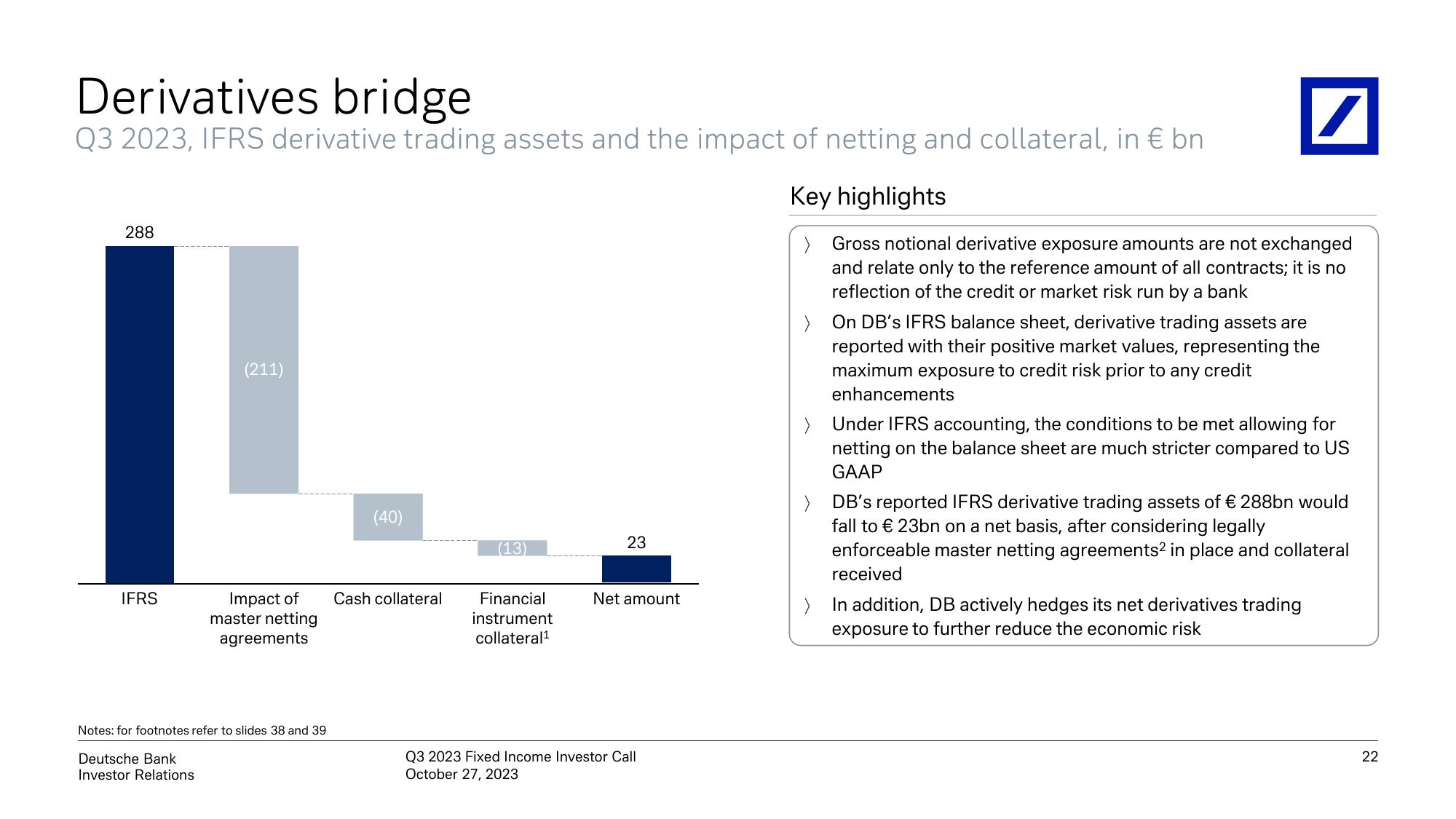

Derivatives bridge

Q3 2023, IFRS derivative trading assets and the impact of netting and collateral, in € bn

288

IFRS

(211)

Impact of

master netting

agreements

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

(40)

Cash collateral

(13)

Financial

instrument

collateral¹

23

Net amount

Q3 2023 Fixed Income Investor Call

October 27, 2023

/

Key highlights

> Gross notional derivative exposure amounts are not exchanged

and relate only to the reference amount of all contracts; it is no

reflection of the credit or market risk run by a bank

> On DB's IFRS balance sheet, derivative trading assets are

reported with their positive market values, representing the

maximum exposure to credit risk prior to any credit

enhancements

> Under IFRS accounting, the conditions to be met allowing for

netting on the balance sheet are much stricter compared to US

GAAP

> DB's reported IFRS derivative trading assets of € 288bn would

fall to € 23bn on a net basis, after considering legally

enforceable master netting agreements2 in place and collateral

received

>

In addition, DB actively hedges its net derivatives trading

exposure to further reduce the economic risk

22View entire presentation