FiscalNote Investor Presentation Deck

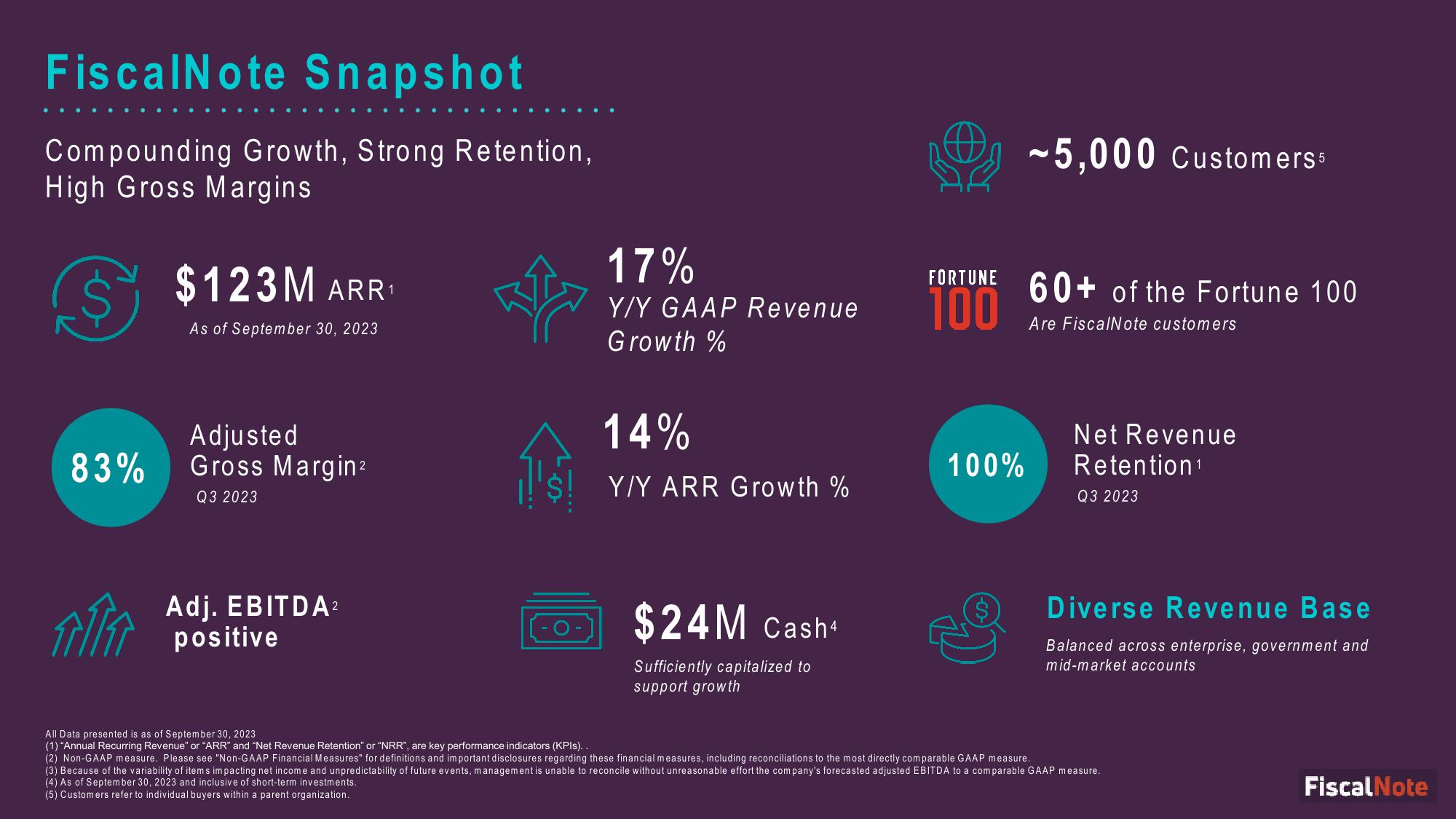

FiscalNote Snapshot

Compounding Growth, Strong Retention,

High Gross Margins

$

$123M ARR¹

As of September 30, 2023

Adjusted

83% Gross Margin²

Q3 2023

Adj. EBITDA²

positive

17%

Y/Y GAAP Revenue

Growth %

14%

Y/Y ARR Growth %

$24M Cash4

Sufficiently capitalized to

support growth

FORTUNE

100

100%

~5,000 Customers

60+ of the Fortune 100

Are FiscalNote customers

All Data presented is as of September 30, 2023

(1) "Annual Recurring Revenue" or "ARR" and "Net Revenue Retention" or "NRR", are key performance indicators (KPIs)..

(2) Non-GAAP measure. Please see "Non-GAAP Financial Measures" for definitions and important disclosures regarding these financial measures, including reconciliations to the most directly comparable GAAP measure.

Net Revenue

Retention ¹

Q3 2023

Diverse Revenue Base

Balanced across enterprise, government and

mid-market accounts

(3) Because of the variability of items impacting net income and unpredictability of future events, management is unable to reconcile without unreasonable effort the company's forecasted adjusted EBITDA to a comparable GAAP measure.

(4) As of September 30, 2023 and inclusive of short-term investments.

(5) Customers refer to individual buyers within a parent organization.

Fiscal NoteView entire presentation