Vroom Results Presentation Deck

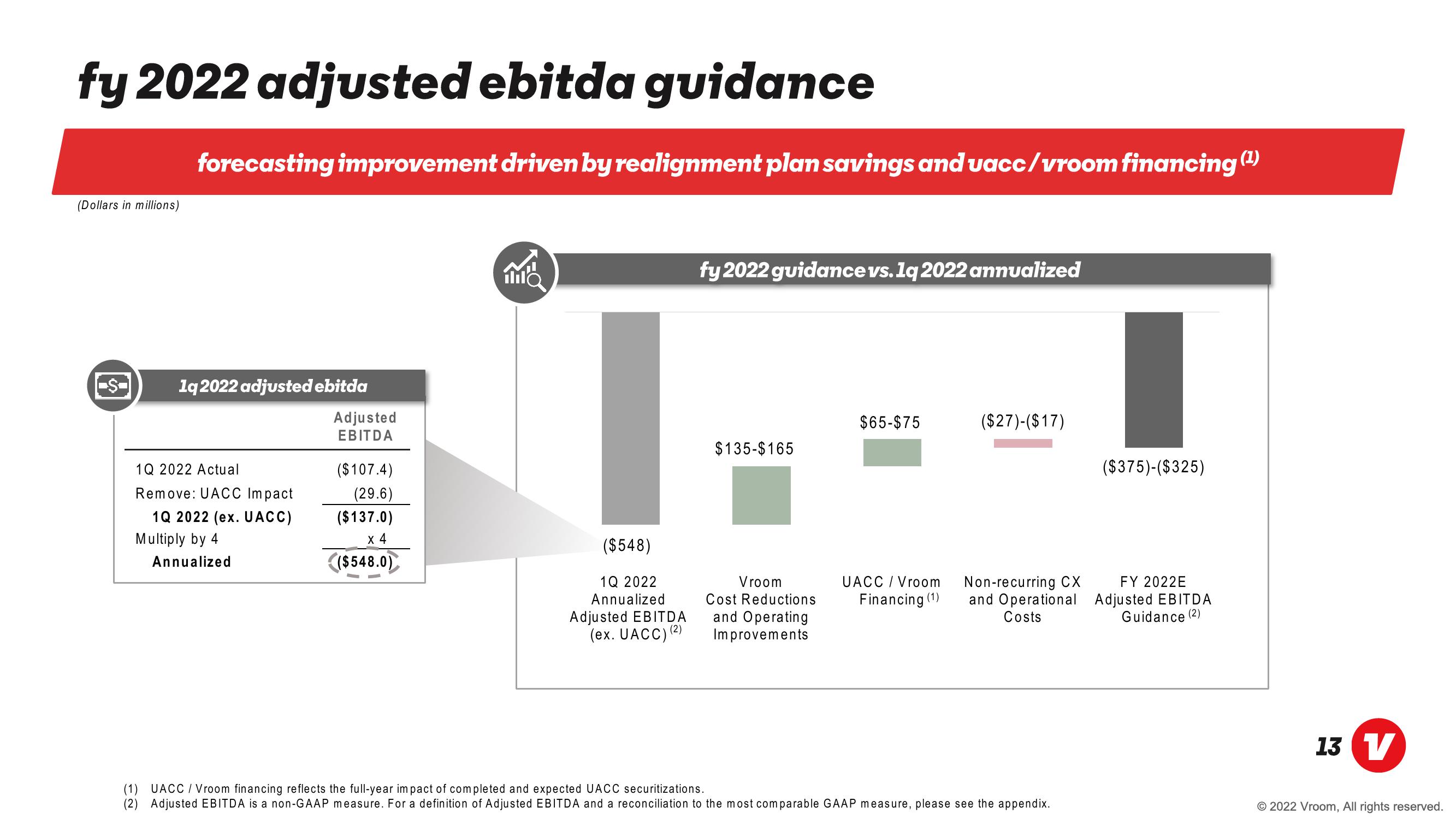

fy 2022 adjusted ebitda guidance

(Dollars in millions)

$

forecasting improvement driven by realignment plan savings and uacc/vroom financing (¹)

1q 2022 adjusted ebitda

1Q 2022 Actual

Remove: UACC Impact

1Q 2022 (ex. UACC)

Multiply by 4

Annualized

Adjusted

EBITDA

($107.4)

(29.6)

($137.0)

x 4

($548.0)

MO

($548)

1Q 2022

Annualized

Adjusted EBITDA

(ex. UACC)

(2)

fy 2022 guidance vs. 1q 2022 annualized

$135-$165

Vroom

Cost Reductions

and Operating

Improvements

$65-$75

UACC / Vroom

Financing (1)

($27)-($17)

($375)-($325)

FY 2022E

Non-recurring CX

and Operational Adjusted EBITDA

Costs

Guidance (2)

(1) UACC / Vroom financing reflects the full-year impact of completed and expected UACC securitizations.

(2) Adjusted EBITDA is a non-GAAP measure. For a definition of Adjusted EBITDA and a reconciliation to the most comparable GAAP measure, please see the appendix.

13 V

© 2022 Vroom, All rights reserved.View entire presentation