Apollo Global Management Mergers and Acquisitions Presentation Deck

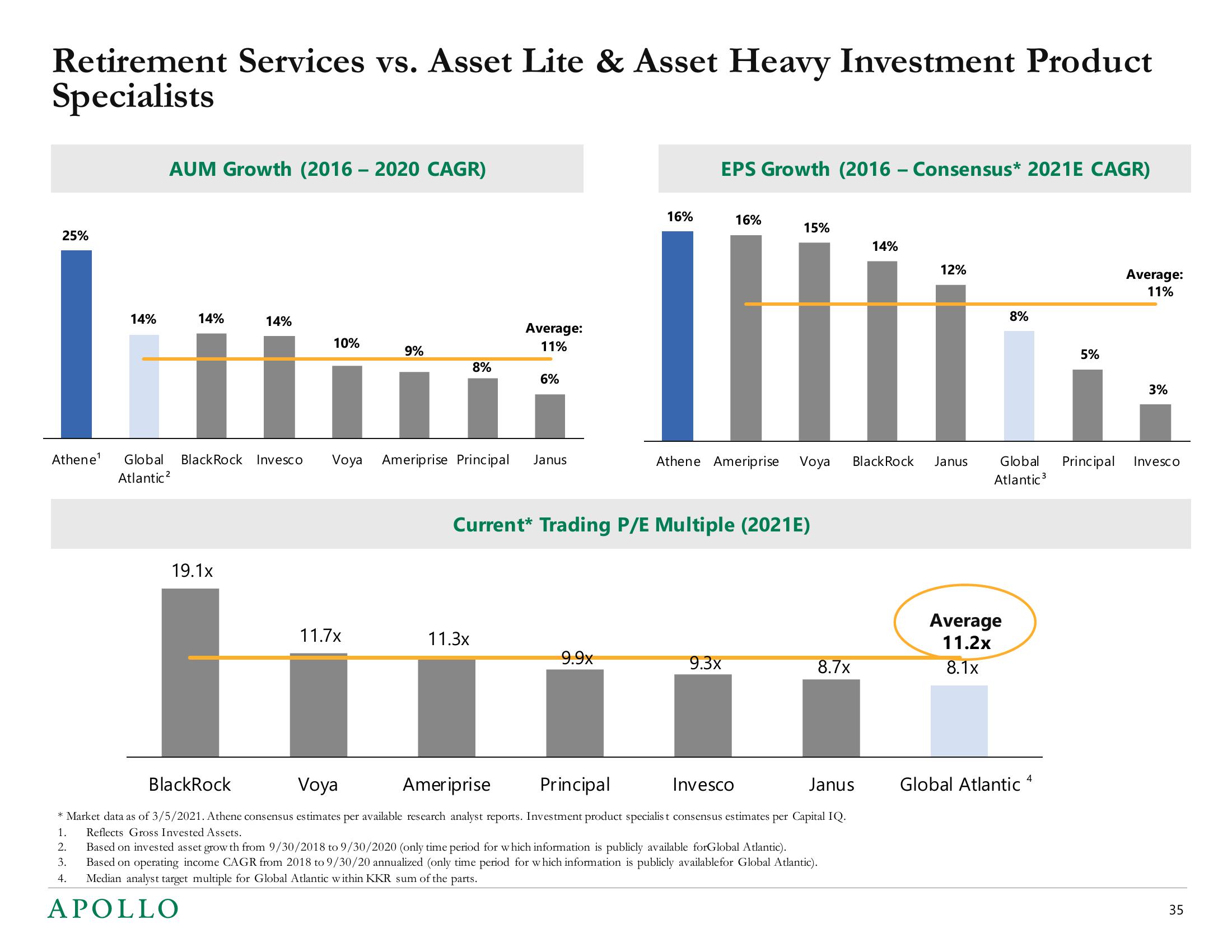

Retirement Services vs. Asset Lite & Asset Heavy Investment Product

Specialists

25%

AUM Growth (2016-2020 CAGR)

14%

||||| سننا

14%

Atlantic²

14%

19.1x

10%

9%

11.7x

Athene¹ Global BlackRock Invesco Voya Ameriprise Principal Janus

8%

Average:

11%

11.3x

6%

EPS Growth (2016 – Consensus* 2021E CAGR)

16%

9.9x

16%

Current* Trading P/E Multiple (2021E)

15%

9.3x

Athene Ameriprise Voya Black Rock Janus

8.7x

BlackRock

Voya

Ameriprise

Principal

Invesco

Janus

* Market data as of 3/5/2021. Athene consensus estimates per available research analyst reports. Investment product specialist consensus estimates per Capital IQ.

Reflects Gross Invested Assets.

1.

2.

3.

4.

14%

Based on invested asset grow th from 9/30/2018 to 9/30/2020 (only time period for which information is publicly available forGlobal Atlantic).

Based on operating income CAGR from 2018 to 9/30/20 annualized (only time period for which information is publicly availablefor Global Atlantic).

Median analyst target multiple for Global Atlantic within KKR sum of the parts.

APOLLO

12%

8%

Average

11.2x

8.1x

Global Principal

Atlantic ³

5%

Global Atlantic 4

Average:

11%

3%

Invesco

35View entire presentation