J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

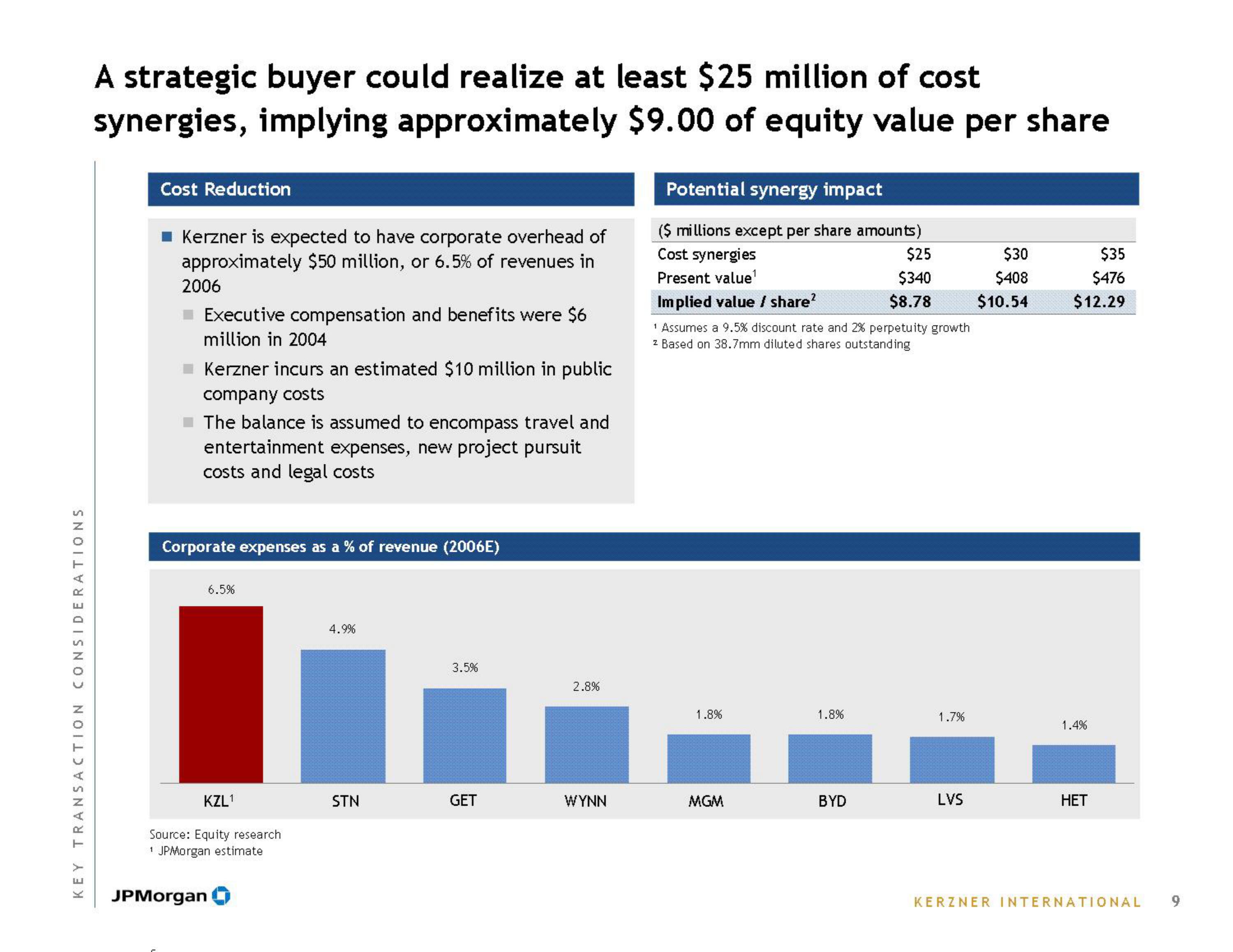

A strategic buyer could realize at least $25 million of cost

synergies, implying approximately $9.00 of equity value per share

Cost Reduction

Kerzner is expected to have corporate overhead of

approximately $50 million, or 6.5% of revenues in

2006

Executive compensation and benefits were $6

million in 2004

Kerzner incurs an estimated $10 million in public

company costs

The balance is assumed to encompass travel and

entertainment expenses, new project pursuit

costs and legal costs

Corporate expenses as a % of revenue (2006E)

6.5%

KZL¹

Source: Equity research

1 JPMorgan estimate

JPMorgan

4.9%

STN

3.5%

GET

2.8%

WYNN

Potential synergy impact

($ millions except per share amounts)

Cost synergies

Present value¹

Implied value / share²

1 Assumes a 9.5% discount rate and 2% perpetuity growth

z Based on 38.7mm diluted shares outstanding

1.8%

MGM

1.8%

$25

$340

$8.78

BYD

1.7%

LVS

$30

$408

$10.54

$35

$476

$12.29

1.4%

HET

KERZNER INTERNATIONAL

9View entire presentation