LionTree Investment Banking Pitch Book

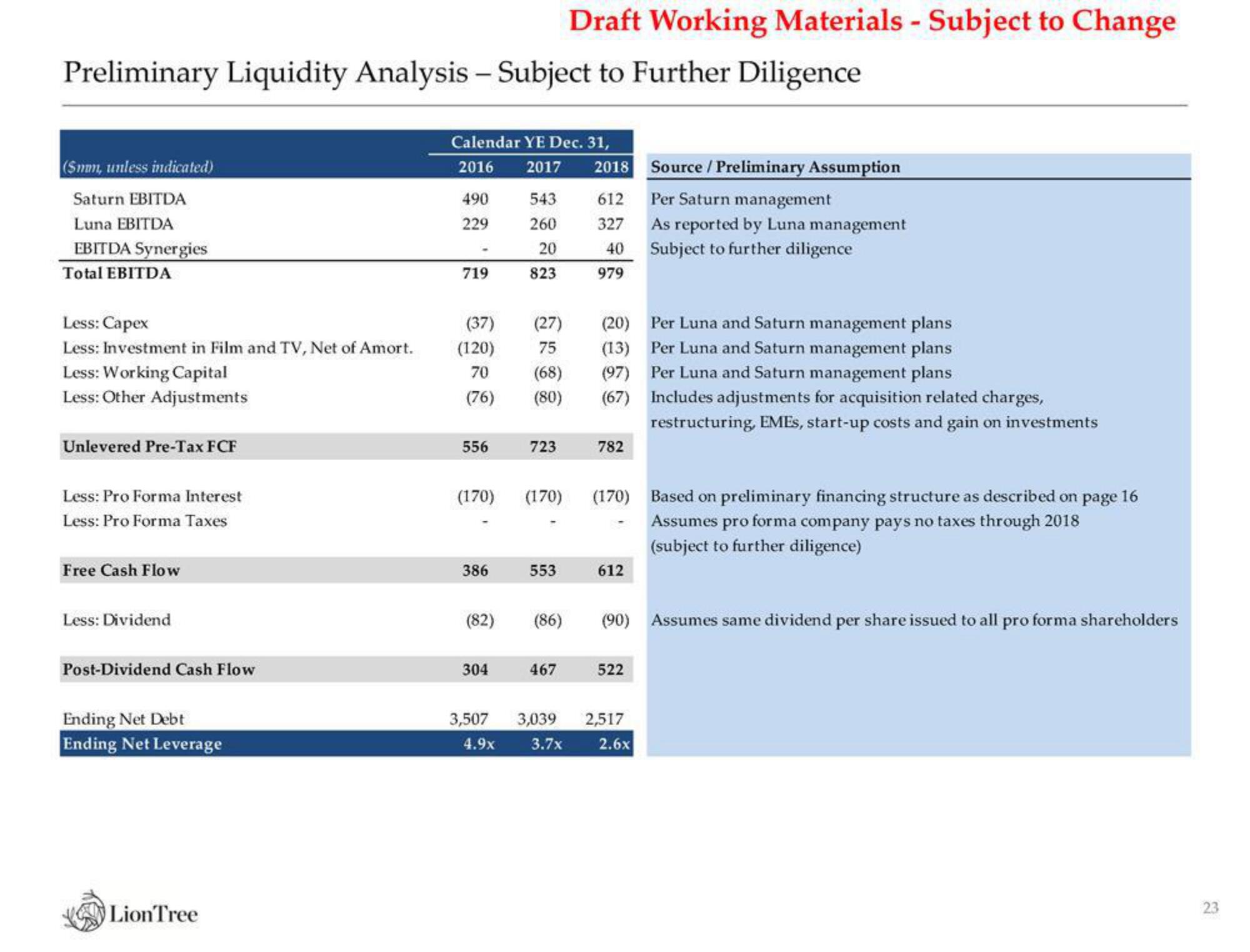

Preliminary Liquidity Analysis - Subject to Further Diligence

(Smm, unless indicated)

Saturn EBITDA

Luna EBITDA

EBITDA Synergies

Total EBITDA

Less: Capex

Less: Investment in Film and TV, Net of Amort.

Less: Working Capital

Less: Other Adjustments

Unlevered Pre-Tax FCF

Less: Pro Forma Interest

Less: Pro Forma Taxes

Free Cash Flow

Less: Dividend

Post-Dividend Cash Flow

Ending Net Debt

Ending Net Leverage

Lion Tree

Calendar YE Dec. 31,

2016

2017

490

229

-

719

(37)

(120)

70

(76)

556

(170)

386

(82)

304

3,507

4.9x

543

260

20

823

(27)

75

(68)

(80)

723

(170)

553

(86)

467

Draft Working Materials - Subject to Change

3,039

3.7x

Source / Preliminary Assumption

612

Per Saturn management

327 As reported by Luna management

40 Subject to further diligence

979

2018

(20) Per Luna and Saturn management plans

(13) Per Luna and Saturn management plans

(97)

Per Luna and Saturn management plans

(67)

782

(170)

612

522

(90) Assumes same dividend per share issued to all pro forma shareholders

2,517

Includes adjustments for acquisition related charges,

restructuring, EMEs, start-up costs and gain on investments

2.6x

Based on preliminary financing structure as described on page 16

Assumes pro forma company pays no taxes through 2018

(subject to further diligence)

23View entire presentation