Credit Suisse Investment Banking Pitch Book

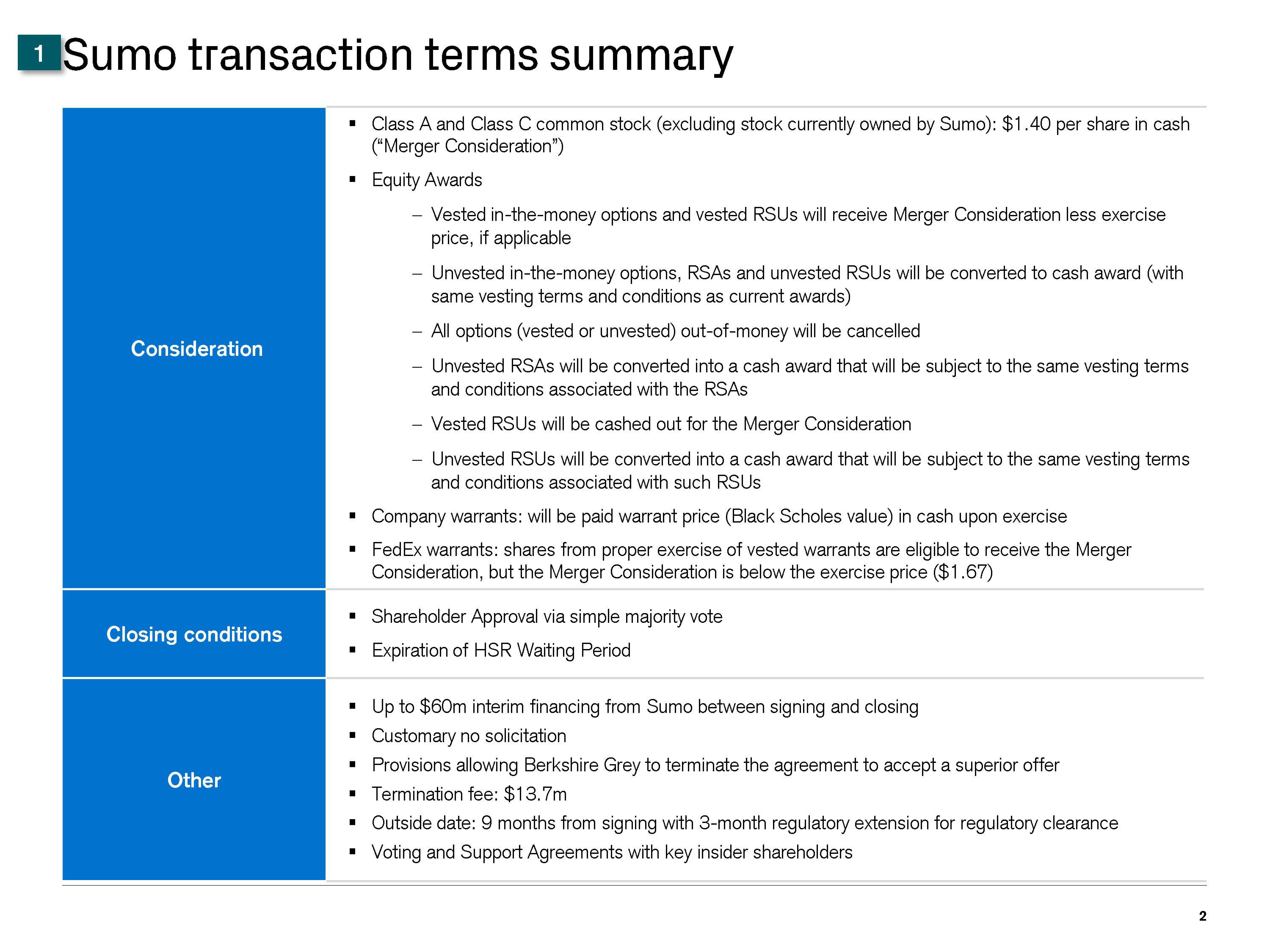

1 Sumo transaction terms summary

Consideration

Closing conditions

Other

▪ Class A and Class C common stock (excluding stock currently owned by Sumo): $1.40 per share in cash

("Merger Consideration")

Equity Awards

Vested in-the-money options and vested RSUS will receive Merger Consideration less exercise

price, if applicable

■

Company warrants: will be paid warrant price (Black Scholes value) in cash upon exercise

▪ FedEx warrants: shares from proper exercise of vested warrants are eligible to receive the Merger

Consideration, but the Merger Consideration is below the exercise price ($1.67)

Unvested in-the-money options, RSAs and unvested RSUS will be converted to cash award (with

same vesting terms and conditions as current awards)

- All options (vested or unvested) out-of-money will be cancelled

- Unvested RSAs will be converted into a cash award that will be subject to the same vesting terms

and conditions associated with the RSAS

■

- Vested RSUS will be cashed out for the Merger Consideration

- Unvested RSUS will be converted into a cash award that will be subject to the same vesting terms

and conditions associated with such RSUS

▪ Shareholder Approval via simple majority vote

Expiration of HSR Waiting Period

■

Up to $60m interim financing from Sumo between signing and closing

Customary no solicitation

▪ Provisions allowing Berkshire Grey to terminate the agreement to accept a superior offer

■ Termination fee: $13.7m

▪ Outside date: 9 months from signing with 3-month regulatory extension for regulatory clearance

▪ Voting and Support Agreements with key insider shareholders

2View entire presentation