Barclays Global Financial Services Conference

Progress to date

-

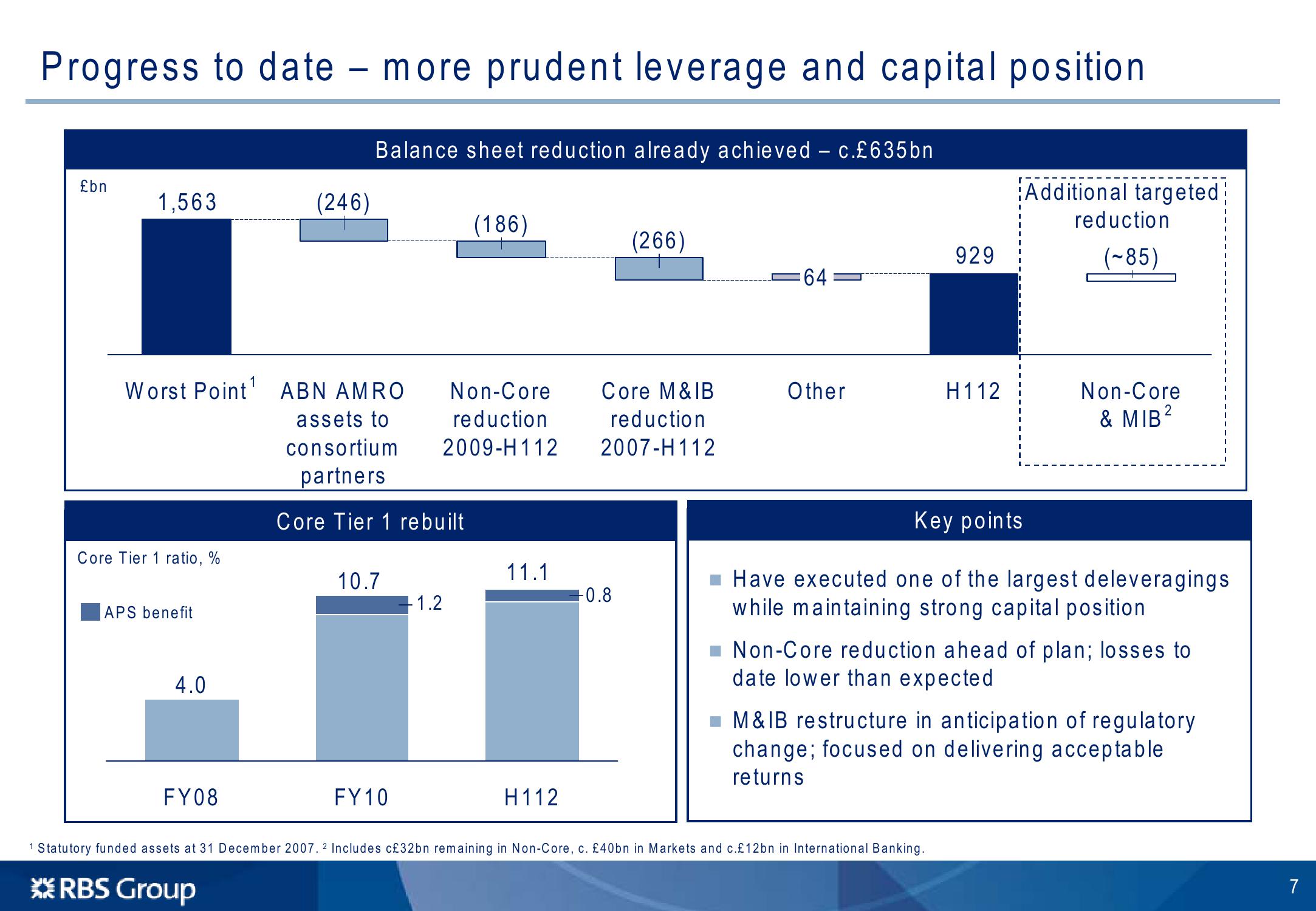

more prudent leverage and capital position.

£bn

1,563

(246)

Balance sheet reduction already achieved – c.£635bn

(186)

(266)

929

64

Additional targeted

reduction

(~85)

Worst Point ABN AMRO

Non-Core

assets to

reduction

2009-H112

Core M&IB

reduction

2007-H112

Other

H112

Non-Core

& MIB2

Core Tier 1 ratio, %

APS benefit

4.0

FY08

consortium

partners

Core Tier 1 rebuilt

11.1

10.7

-0.8

1.2

FY10

H112

Key points

■ Have executed one of the largest deleveragings

while maintaining strong capital position

■Non-Core reduction ahead of plan; losses to

date lower than expected

M&IB restructure in anticipation of regulatory

change; focused on delivering acceptable

returns

1 Statutory funded assets at 31 December 2007. 2 Includes c£32bn remaining in Non-Core, c. £40bn in Markets and c.£12bn in International Banking.

**RBS Group

7View entire presentation