Hertz Investor Presentation Deck

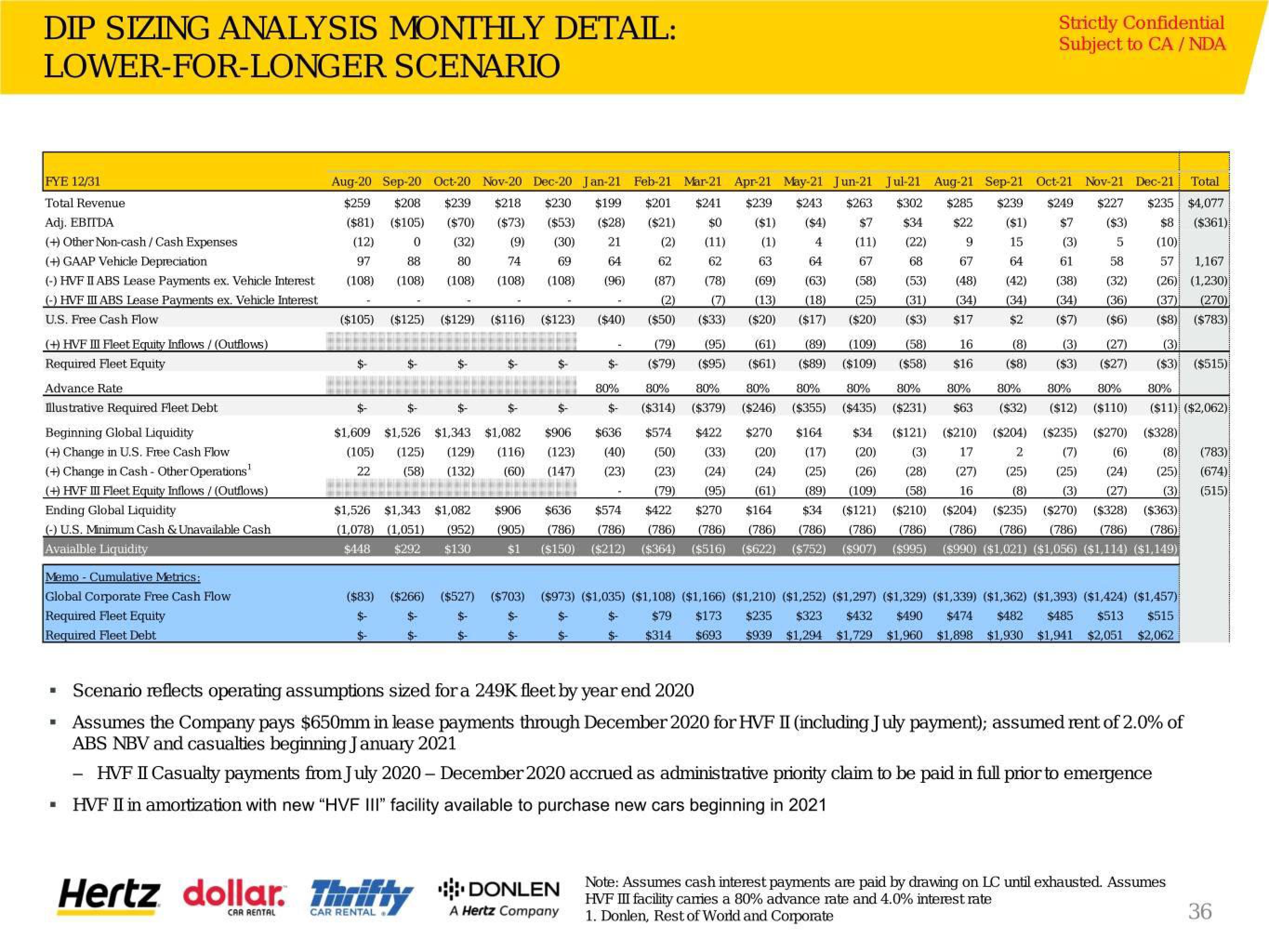

DIP SIZING ANALYSIS MONTHLY DETAIL:

LOWER-FOR-LONGER

SCENARIO

FYE 12/31

Total Revenue

Adj. EBITDA

(+) Other Non-cash / Cash Expenses

(+) GAAP Vehicle Depreciation

(-) HVF II ABS Lease Payments ex. Vehicle Interest

(-) HVF III ABS Lease Payments ex. Vehicle Interest

U.S. Free Cash Flow

(+) HVF III Fleet Equity Inflows / (Outflows)

Required Fleet Equity

Advance Rate

Illustrative Required Fleet Debt

Beginning Global Liquidity

(+) Change in U.S. Free Cash Flow

(+) Change in Cash - Other Operations¹

(+) HVF III Fleet Equity Inflows / (Outflows)

Ending Global Liquidity

(-) U.S. Minimum Cash & Unavailable Cash

Avaialble Liquidity

Memo - Cumulative Metrics:

Global Corporate Free Cash Flow

Required Fleet Equity

Required Fleet Debt

1

■

$8 ($361)

($21)

(2)

($1)

15

(12)

(10)

97

62

57 1,167

61

(38)

(108)

(96)

(53)

58

(32)

(36)

(26) (1,230)

(31)

(34)

(34)

(37) (270)

($3)

($6) ($8) ($783)

Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Total

$259 $208 $239 $218 $230 $199 $201 $241 $239 $243 $263 $302 $285 $239 $249 $227 $235 $4,077

($81) ($105) ($70) ($73) ($53) ($28)

$0 ($1) ($4) $7 $34 $22

$7 ($3)

0 (32) (9) (30) 21

(11) (1)

4 (11) (22)

9

(3) 5

88

80

74

69

64

62

63 64

67 68 67

64

(108)

(108) (108) (108)

(87) (78) (69) (63) (58)

(48) (42)

(2)

(7) (13) (18) (25)

(34)

($50) ($33) ($20) ($17) ($20)

$17 $2 ($7)

(79) (95) (61) (89) (109) (58) 16 (8) (3)

($79) ($95) ($61) ($89)

($109) ($58) $16 ($8) ($3)

80% 80% 80% 80%

80%

80% 80% 80% 80%

($314) ($379) ($246) ($355) ($435) ($231) $63 ($32) ($12)

$574 $422 $270 $164 $34 ($121) ($210) ($204) ($235)

(50) (33) (20) (17) (20) (3) 17

2

(7)

(23) (24) (24) (25) (26) (28) (27) (25) (25)

(79) (95) (61) (89) (109) (58) 16 (8) (3)

(27)

$1,526 $1,343 $1,082 $906 $636 $574 $422 $270 $164 $34 ($121) ($210) ($204) ($235) ($270) ($328) ($363)

(1,078) (1,051) (952) (905) (786) (786) (786) (786) (786) (786) (786) (786) (786) (786) (786) (786) (786)

$448 $292 $130 $1 ($150) ($212) ($364) ($516) ($622) ($752) ($907) ($995) ($990) ($1,021) ($1,056) ($1,114) ($1,149)

80%

(27)

($27)

80%

($110) ($11) ($2,062)

($270) ($328)

(6) (8) (783)

(24) (25) (674)

(3) (515)

($105)

$-

$-

($125) ($129)

$-

$-

$-

($116)

$-

($123)

$-

$-

$1,609 $1,526 $1,343 $1,082

(105)

22

$-

$-

$906

(125) (129) (116) (123)

(58) (132) (60) (147)

($40)

Strictly Confidential

Subject to CA / NDA

$-

80%

$-

$636

(40)

(23)

Hertz dollar. Thrifty DONLEN

CAR RENTAL

CAR RENTAL

A Hertz Company

Scenario reflects operating assumptions sized for a 249K fleet by year end 2020

▪ Assumes the Company pays $650mm in lease payments through December 2020 for HVF II (including July payment); assumed rent of 2.0% of

ABS NBV and casualties beginning January 2021

HVF II Casualty payments from July 2020 - December 2020 accrued as administrative priority claim to be paid in full prior to emergence

HVF II in amortization with new "HVF III" facility available to purchase new cars beginning in 2021

(3)

($3) ($515)

($83) ($266) ($527) ($703) ($973) ($1,035) ($1,108) ($1,166) ($1,210) ($1,252) ($1,297) ($1,329) ($1,339) ($1,362) ($1,393) ($1,424) ($1,457)

$-

$-

$-

$-

$79 $173 $235 $323 $432 $490 $474 $482 $485 $513 $515

$314 $693 $939 $1,294 $1,729 $1,960 $1,898 $1,930 $1,941 $2,051 $2,062

$-

$-

Note: Assumes cash interest payments are paid by drawing on LC until exhausted. Assumes

HVF III facility camies a 80% advance rate and 4.0% interest rate

1. Donlen, Rest of World and Corporate

36View entire presentation