Maersk Investor Presentation Deck

•

●

●

●

●

●

Key statements

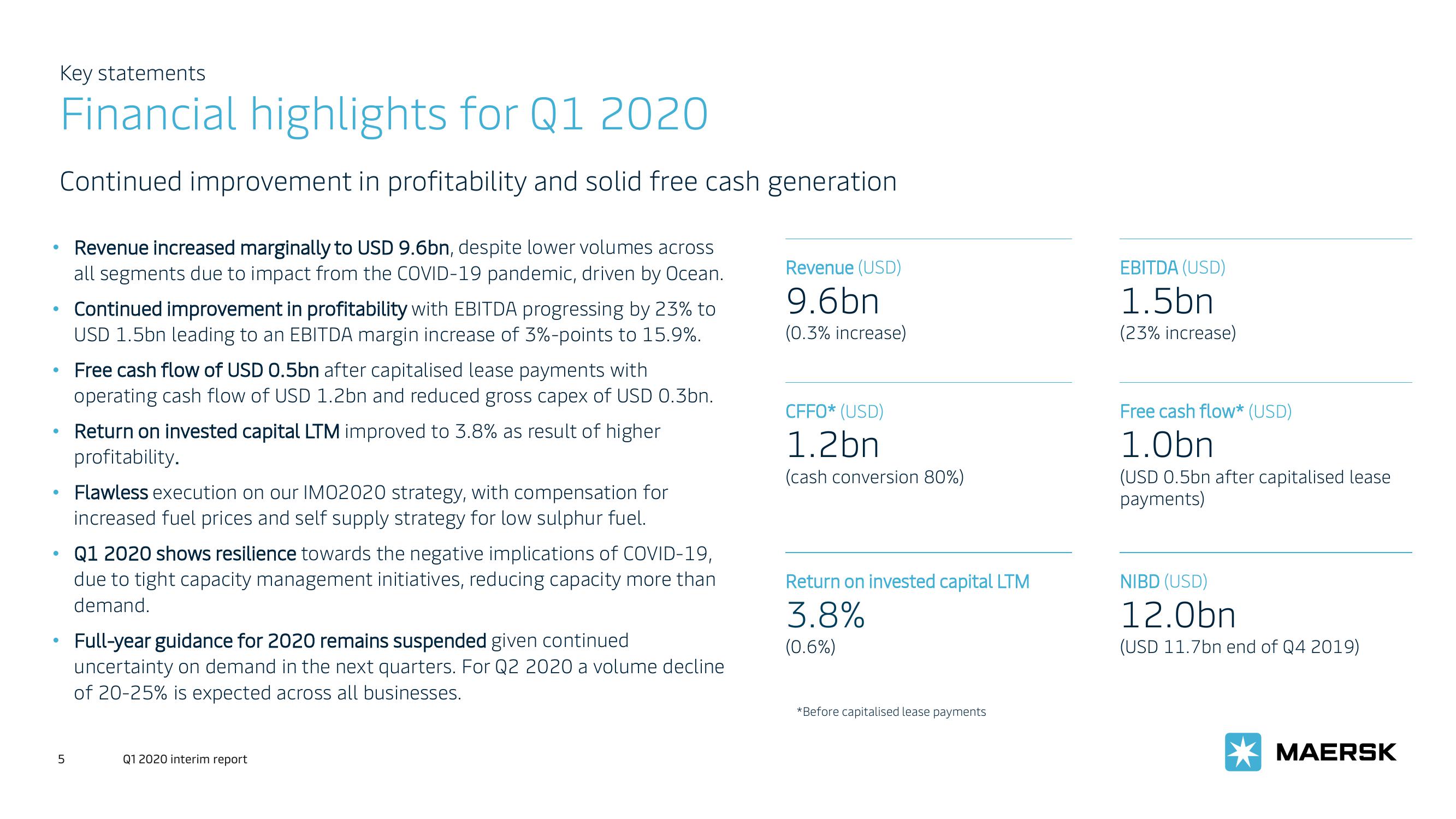

Financial highlights for Q1 2020

Continued improvement in profitability and solid free cash generation

5

Revenue increased marginally to USD 9.6bn, despite lower volumes across

all segments due to impact from the COVID-19 pandemic, driven by Ocean.

Continued improvement in profitability with EBITDA progressing by 23% to

USD 1.5bn leading to an EBITDA margin increase of 3%-points to 15.9%.

Free cash flow of USD 0.5bn after capitalised lease payments with

operating cash flow of USD 1.2bn and reduced gross capex of USD 0.3bn.

Return on invested capital LTM improved to 3.8% as result of higher

profitability.

Flawless execution on our IM02020 strategy, with compensation for

increased fuel prices and self supply strategy for low sulphur fuel.

Q1 2020 shows resilience towards the negative implications of COVID-19,

due to tight capacity management initiatives, reducing capacity more than

demand.

Full-year guidance for 2020 remains suspended given continued

uncertainty on demand in the next quarters. For Q2 2020 a volume decline

of 20-25% is expected across all businesses.

Q1 2020 interim report

Revenue (USD)

9.6bn

(0.3% increase)

CFFO* (USD)

1.2bn

(cash conversion 80%)

Return on invested capital LTM

3.8%

(0.6%)

*Before capitalised lease payments

EBITDA (USD)

1.5bn

(23% increase)

Free cash flow* (USD)

1.0bn

(USD 0.5bn after capitalised lease

payments)

NIBD (USD)

12.0bn

(USD 11.7bn end of Q4 2019)

MAERSKView entire presentation