Getty SPAC Presentation Deck

Investment Highlights

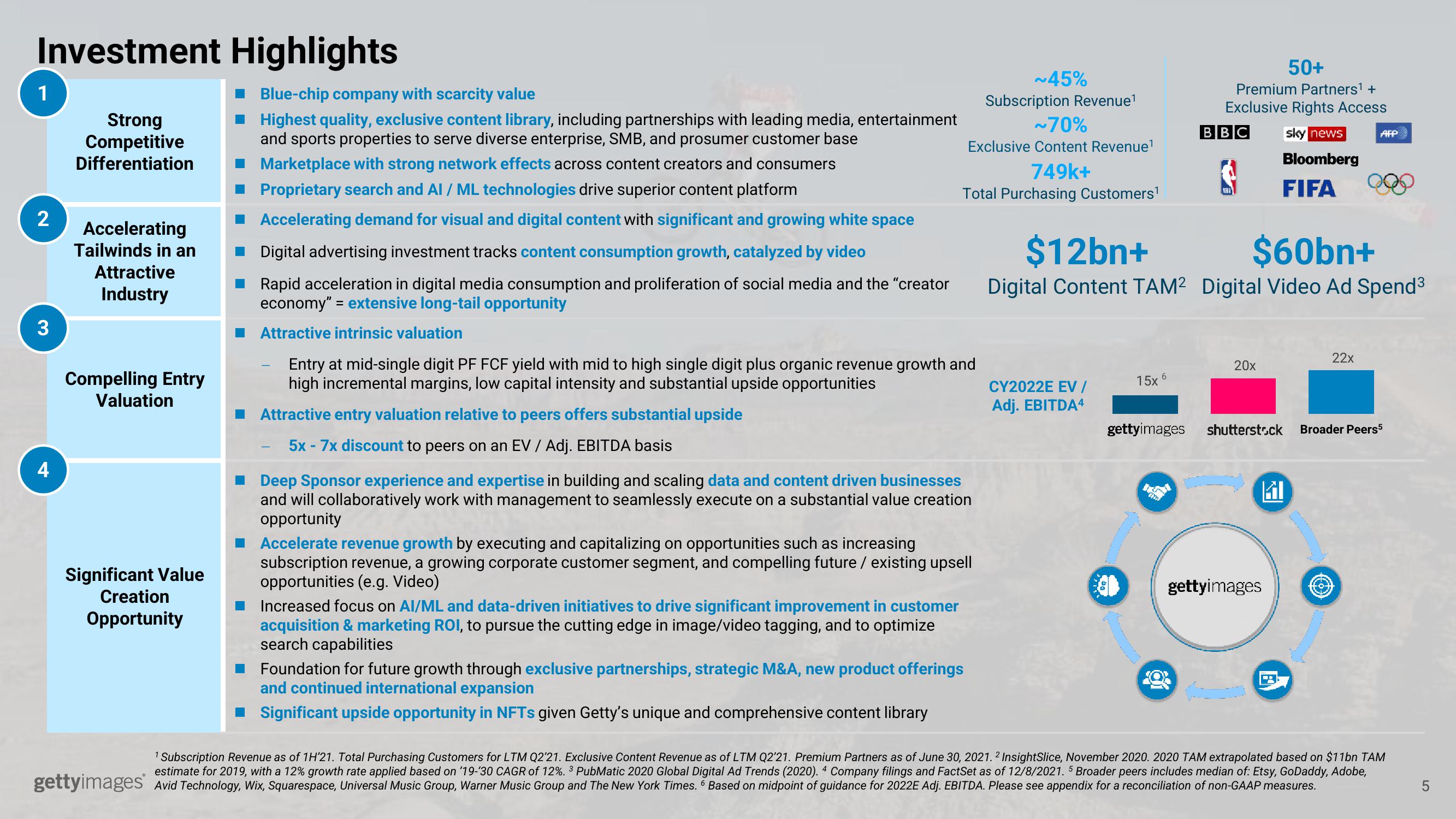

1

2

3

4

Strong

Competitive

Differentiation

Accelerating

Tailwinds in an

Attractive

Industry

Compelling Entry

Valuation

Significant Value

Creation

Opportunity

Blue-chip company with scarcity value

Highest quality, exclusive content library, including partnerships with leading media, entertainment

and sports properties to serve diverse enterprise, SMB, and prosumer customer base

Marketplace with strong network effects across content creators and consumers

Proprietary search and AI / ML technologies drive superior content platform

Accelerating demand for visual and digital content with significant and growing white space

Digital advertising investment tracks content consumption growth, yzed by video

Rapid acceleration in digital media consumption and proliferation of social media and the "creator

economy" = extensive long-tail opportunity

■ Attractive intrinsic valuation

~45%

Subscription Revenue¹

~70%

Exclusive Content Revenue¹

749k+

Total Purchasing Customers¹

Entry at mid-single digit PF FCF yield with mid to high single digit plus organic revenue growth and

high incremental margins, low capital intensity and substantial upside opportunities

Attractive entry valuation relative to peers offers substantial upside

5x - 7x discount to peers on an EV / Adj. EBITDA basis

Deep Sponsor experience and expertise in building and scaling data and content driven businesses

and will collaboratively work with management to seamlessly execute on a substantial value creation

opportunity

Accelerate revenue growth by executing and capitalizing on opportunities such as increasing

subscription revenue, a growing corporate customer segment, and compelling future / existing upsell

opportunities (e.g. Video)

Increased focus on AI/ML and data-driven initiatives to drive significant improvement in customer

acquisition & marketing ROI, to pursue the cutting edge in image/video tagging, and to optimize

search capabilities

Foundation for future growth through exclusive partnerships, strategic M&A, new product offerings

and continued international expansion

Significant upside opportunity in NFTs given Getty's unique and comprehensive content library

CY2022E EV /

Adj. EBITDA4

15x

6

gettyimages

50+

Premium Partners¹ +

Exclusive Rights Access

sky news

Bloomberg

FIFA

$12bn+

$60bn+

Digital Content TAM² Digital Video Ad Spend³

BBC

ģ

MWA

20x

gettyimages

3

22x

À

AFP

QQ

shutterstock Broader Peers5

M

1 Subscription Revenue as of 1H'21. Total Purchasing Customers for LTM Q2'21. Exclusive Content Revenue as of LTM Q2'21. Premium Partners as of June 30, 2021.2 InsightSlice, November 2020. 2020 TAM extrapolated based on $11bn TAM

estimate for 2019, with a 12% growth rate applied based on '19-'30 CAGR of 12%. ³ PubMatic 2020 Global Digital Ad Trends (2020). 4 Company filings and FactSet as of 12/8/2021. 5 Broader peers includes median of: Etsy, GoDaddy, Adobe,

gettyimages Avid Technology, Wix, Squarespace, Universal Music Group, Warner Music Group and The New York Times. Based on midpoint of guidance for 2022E Adj. EBITDA. Please see appendix for a reconciliation of non-GAAP measures.

ST

5View entire presentation