Q2 2018 Fixed Income Investor Conference Call

Level 3 assets

€ bn, as of 30 June 2018

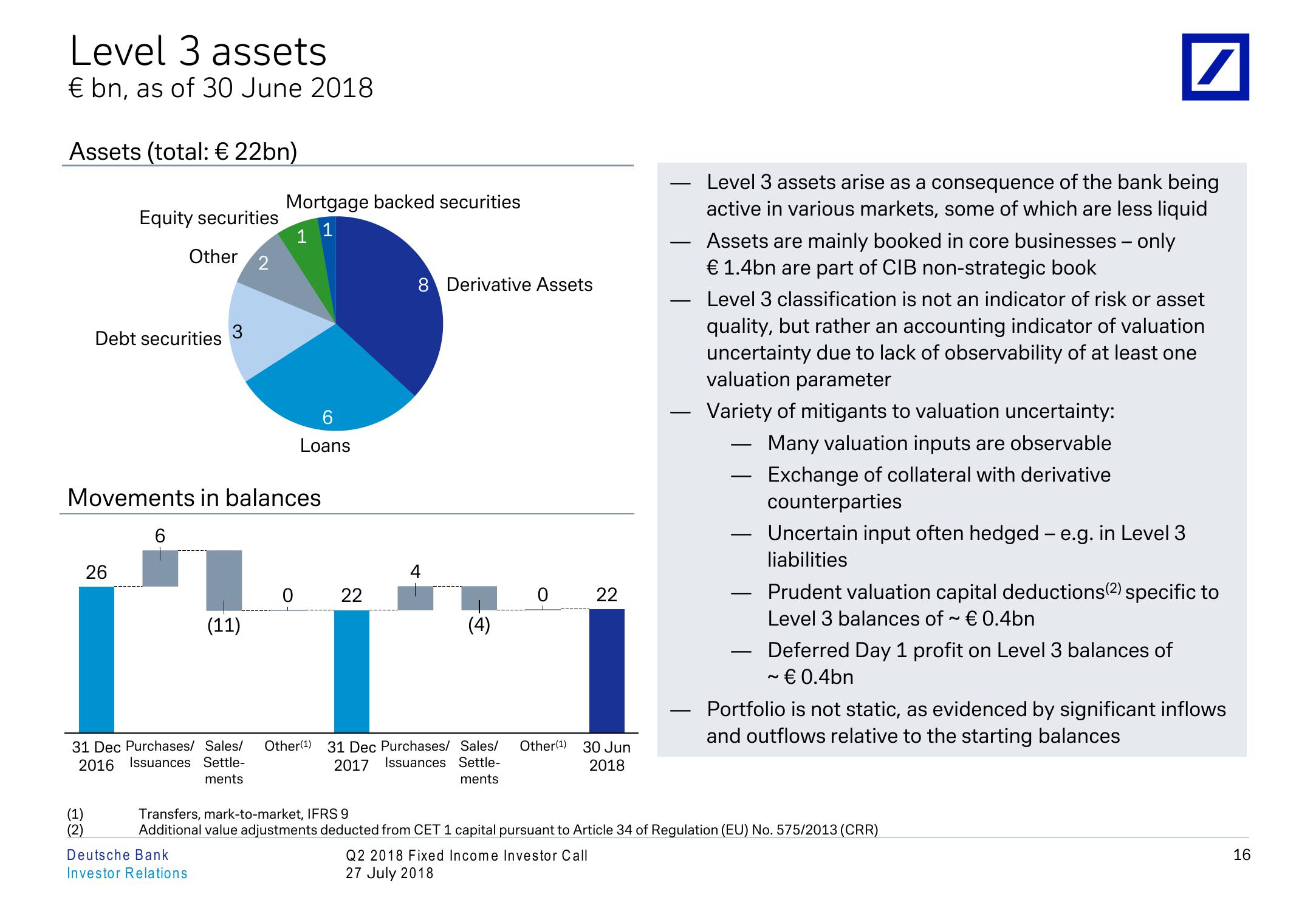

Assets (total: € 22bn)

Mortgage backed securities

Equity securities

1

1

Other 2

Debt securities

3

6

Loans

Movements in balances

6

26

4

0

22

(11)

8 Derivative Assets

0 22

(4)

31 Dec Purchases/ Sales/

2016 Issuances Settle-

Other(1) 31 Dec Purchases/ Sales/

2017 Issuances Settle-

Other(1)

30 Jun

2018

ments

ments

—

—

Level 3 assets arise as a consequence of the bank being

active in various markets, some of which are less liquid

Assets are mainly booked in core businesses – only

€ 1.4bn are part of CIB non-strategic book

Level 3 classification is not an indicator of risk or asset

quality, but rather an accounting indicator of valuation

uncertainty due to lack of observability of at least one

valuation parameter

Variety of mitigants to valuation uncertainty:

—

Many valuation inputs are observable

Exchange of collateral with derivative

counterparties

Uncertain input often hedged – e.g. in Level 3

liabilities

Prudent valuation capital deductions (2) specific to

Level 3 balances of ~ € 0.4bn

Deferred Day 1 profit on Level 3 balances of

~ € 0.4bn

Portfolio is not static, as evidenced by significant inflows

and outflows relative to the starting balances

(1)

(2)

Transfers, mark-to-market, IFRS 9

Additional value adjustments deducted from CET 1 capital pursuant to Article 34 of Regulation (EU) No. 575/2013 (CRR)

Deutsche Bank

Q2 2018 Fixed Income Investor Call

Investor Relations

27 July 2018

16View entire presentation