BAT Results Presentation Deck

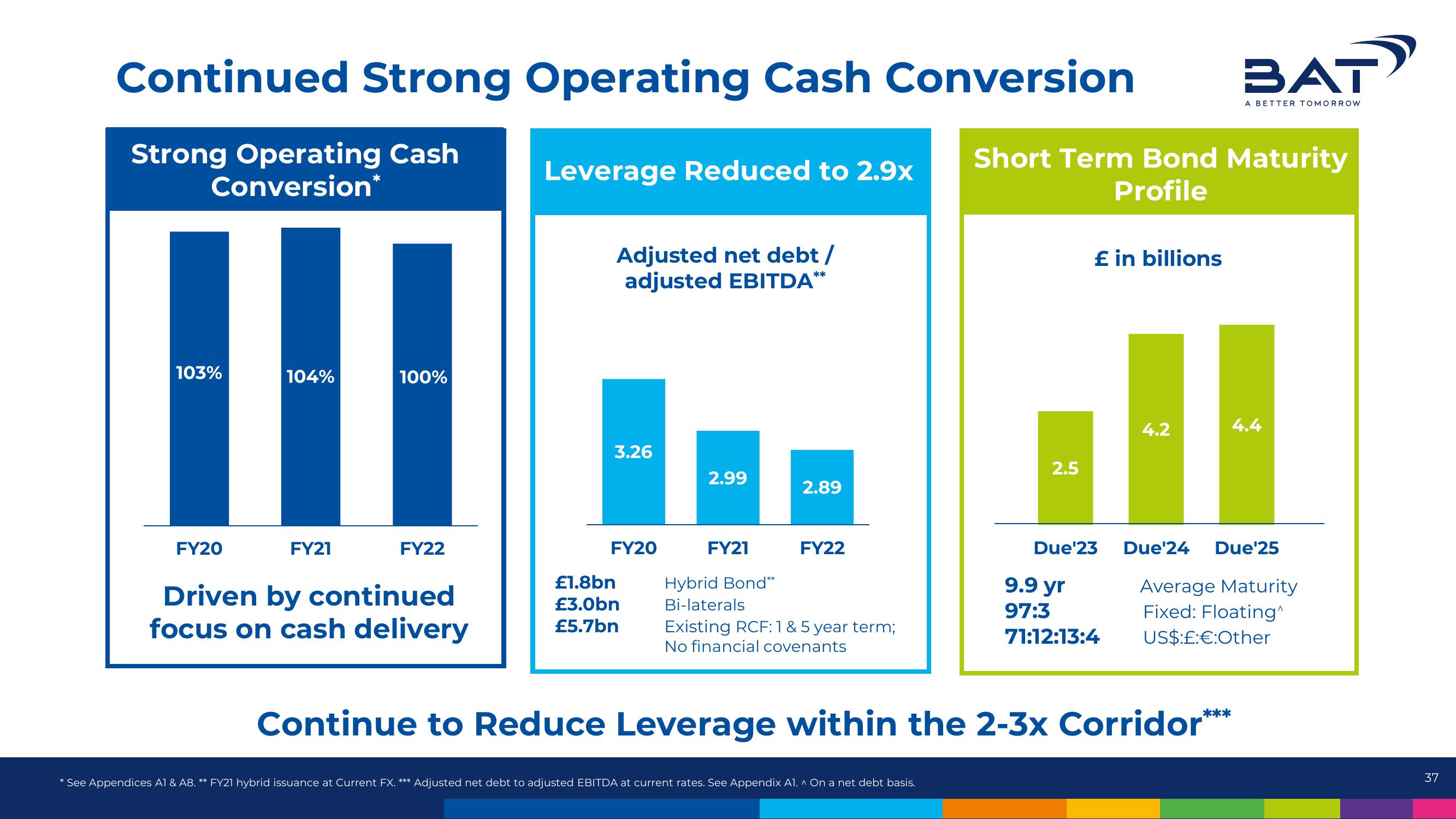

Continued Strong Operating Cash Conversion

Strong Operating Cash

Conversion*

III

103%

104%

100%

FY20

FY21

FY22

Driven by continued

focus on cash delivery

Leverage Reduced to 2.9x

Adjusted net debt /

adjusted EBITDA**

3.26

FY20

£1.8bn

£3.0bn

£5.7bn

2.99

FY21

2.89

FY22

Hybrid Bond**

Bi-laterals

Existing RCF:1 & 5 year term;

No financial covenants

* See Appendices A1 & A8. ** FY21 hybrid issuance at Current FX. *** Adjusted net debt to adjusted EBITDA at current rates. See Appendix A1. ^ On a net debt basis.

Short Term Bond Maturity

Profile

2.5

£ in billions

Due¹23

9.9 yr

97:3

71:12:13:4

4.2

BAT?

A BETTER TOMORROW

Continue to Reduce Leverage within the 2-3x Corridor***

4.4

Due'24 Due¹25

Average Maturity

Fixed: Floating^

US$:£:€:Other

37View entire presentation