Citi Investment Banking Pitch Book

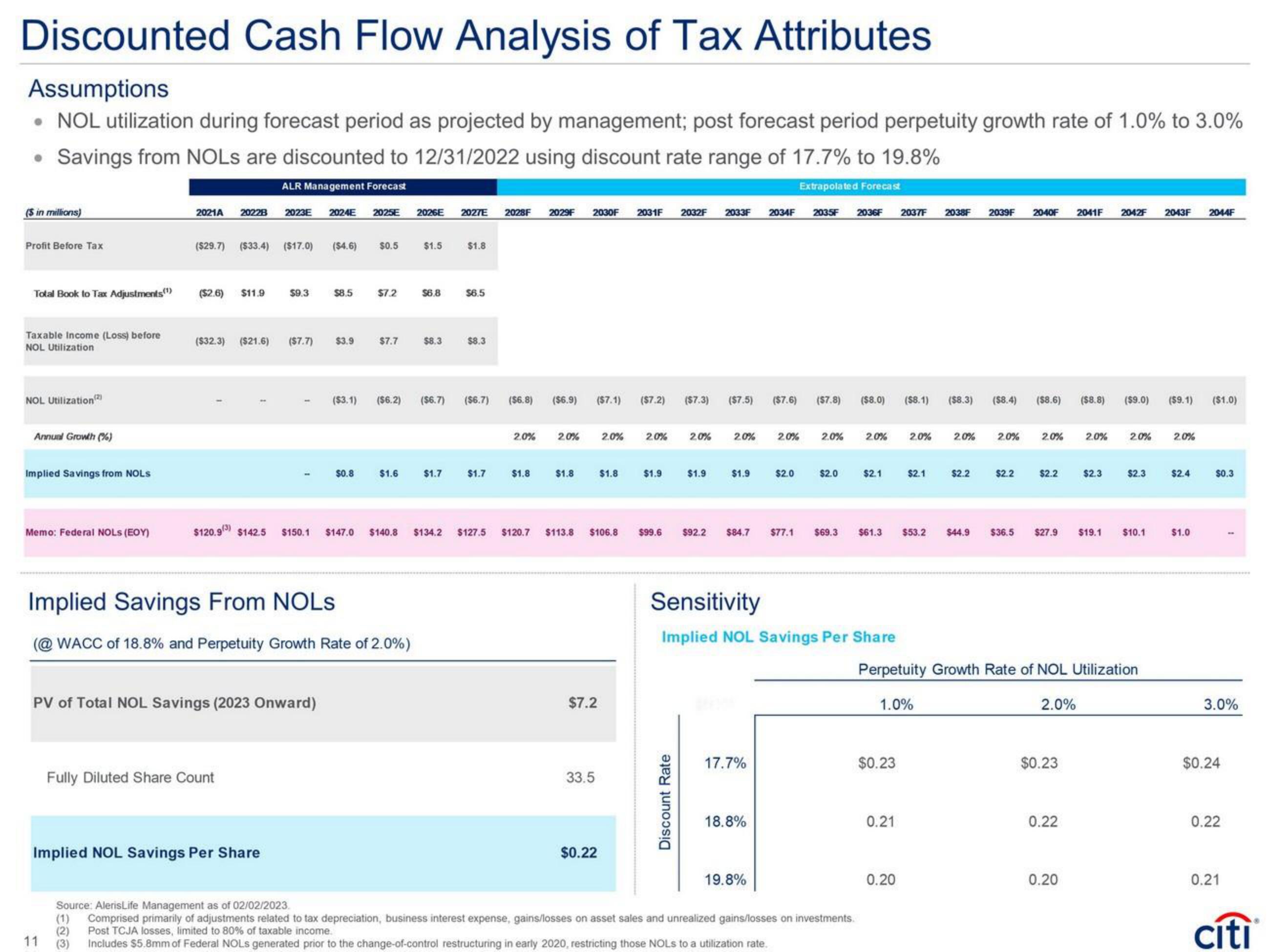

Discounted Cash Flow Analysis of Tax Attributes

Assumptions

• NOL utilization during forecast period as projected by management; post forecast period perpetuity growth rate of 1.0% to 3.0%

Savings from NOLS are discounted to 12/31/2022 using discount rate range of 17.7% to 19.8%

ALR Management Forecast

Extrapolated Forecast

2023E 2024E 2025E 2026E 2027E 2028F 2029F 2030F 2031F 2032F 2033 2034F

2035F 2036F 2037F 2038F 2039F 2040F 2041F 2042F 2043F 2044F

(S in millions)

Profit Before Tax

Total Book to Tax Adjustments(¹)

Taxable income (Loss) before

NOL Utilization

NOL Utilization¹2)

Annual Growth (%)

Implied Savings from NOLS

Memo: Federal NOLS (EOY)

2021A 20228

($29.7) ($33.4)

($2.6) $11.9

11

($17.0)

($32.3) ($21.6) ($7.7)

$9.3

PV of Total NOL Savings (2023 Onward)

Fully Diluted Share Count

Implied NOL Savings Per Share

($4.6)

$8.5

$3.9

($3.1)

$0.8

$0.5

$7.2

$7.7

Implied Savings From NOLS

(@WACC of 18.8% and Perpetuity Growth Rate of 2.0%)

$1.6

$1.5

$6,8

$8.3

$1.8

($6.2) ($6.7) ($6.7) ($6.8)

$1.7

$6.5

$8.3

$1.7

2.0%

$1.8

$120.93) $142.5 $150.1 $147.0 $140.8 $134.2 $127.5 $120.7 $113.8

($6.9) ($7.1) ($7.2) ($7.3) ($7.5) ($7.6)

2.0%

$1.8

$7.2

$106.8

33.5

2.0%

$0.22

$1.8

2.0%

$1.9

$99.6

2.0%

Discount Rate

$1.9

$92.2

2.0%

$1.9

$84.7

17.7%

18.8%

19.8%

2.0%

$2.0

(2)

(3) Includes $5.8mm of Federal NOLS generated prior to the change-of-control restructuring in early 2020, restricting those NOLS to a utilization rate.

($7.8) ($8.0) ($8.1)

2.0%

Sensitivity

Implied NOL Savings Per Share

$2.0

2.0%

Source: AlerisLife Management as of 02/02/2023.

Comprised primarily of adjustments related to tax depreciation, business interest expense, gains/losses on asset sales and unrealized gains/losses on investments.

Post TCJA losses, limited to 80% of taxable income.

$2.1

$77.1 $69.3 $61.3

$0.23

0.21

2.0%

0.20

$2.1

($8.3)

2.0%

$2.2

$53.2 $44.9

($8.4) ($8.6) ($8.8) ($9.0) ($9.1) ($1.0)

2.0%

$2.2

2.0%

$2.2

$36.5 $27.9 $19.1

$0.23

2.0%

Perpetuity Growth Rate of NOL Utilization

1.0%

2.0%

0.22

$2.3

0.20

2.0%

$2.3

$10.1

2.0%

$2.4

$1.0

$0.3

3.0%

$0.24

0.22

0.21

cítiView entire presentation