WeWork Results Presentation Deck

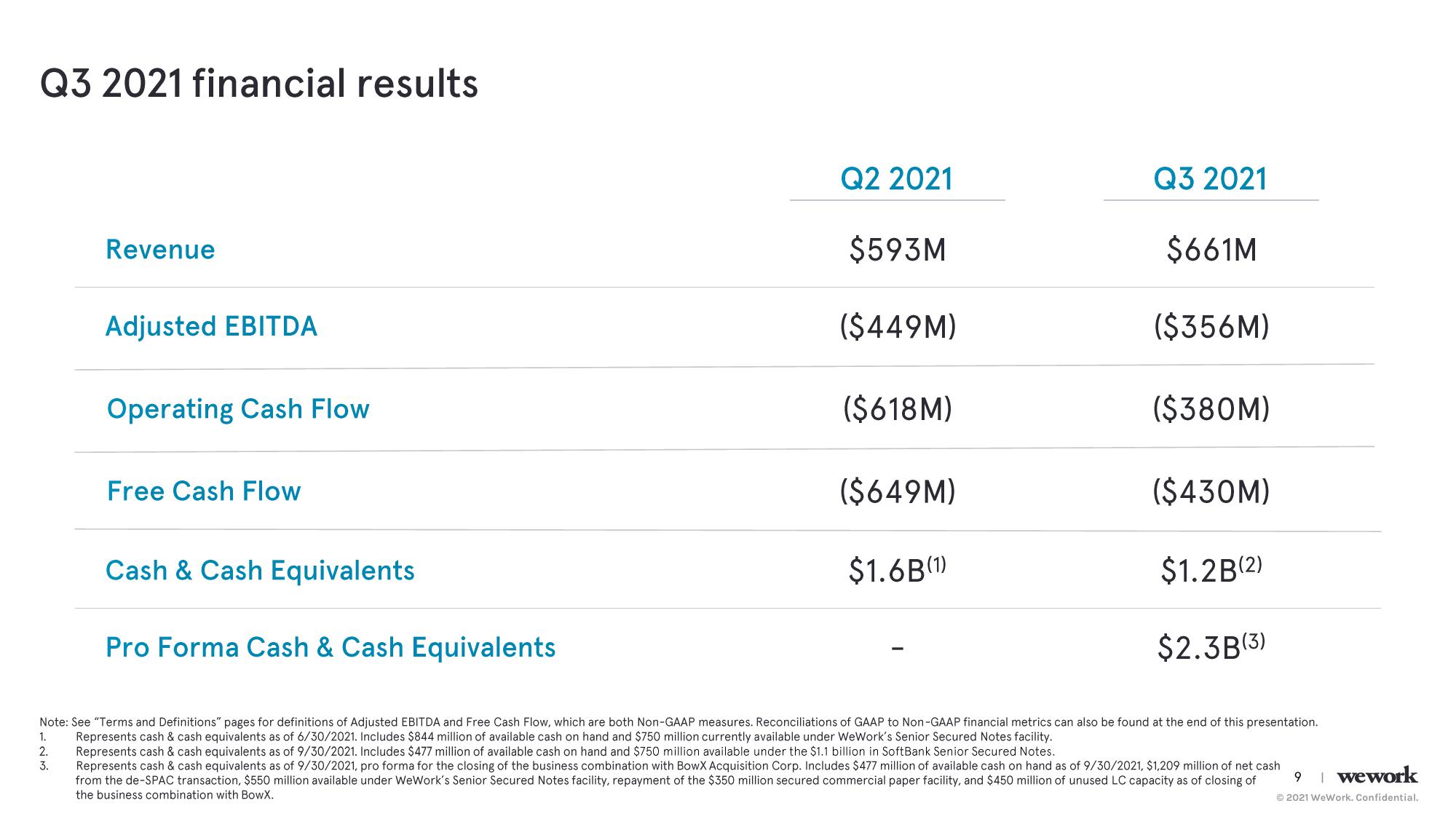

Q3 2021 financial results

Revenue

1.

2.

3.

Adjusted EBITDA

Operating Cash Flow

Free Cash Flow

Cash & Cash Equivalents

Pro Forma Cash & Cash Equivalents

Q2 2021

$593M

($449M)

($618M)

($649M)

$1.6B (1)

Q3 2021

$661M

($356M)

($380M)

($430M)

$1.2B(2)

$2.3B(3)

Note: See "Terms and Definitions" pages for definitions of Adjusted EBITDA and Free Cash Flow, which are both Non-GAAP measures. Reconciliations of GAAP to Non-GAAP financial metrics can also be found at the end of this presentation.

Represents cash & cash equivalents as of 6/30/2021. Includes $844 million of available cash on hand and $750 million currently available under WeWork's Senior Secured Notes facility.

Represents cash & cash equivalents as of 9/30/2021. Includes $477 million of available cash on hand and $750 million available under the $1.1 billion in SoftBank Senior Secured Notes.

Represents cash & cash equivalents as of 9/30/2021, pro forma for the closing of the business combination with BowX Acquisition Corp. Includes $477 million of available cash on hand as of 9/30/2021, $1,209 million of net cash

from the de-SPAC transaction, $550 million available under WeWork's Senior Secured Notes facility, repayment of the $350 million secured commercial paper facility, and $450 million of unused LC capacity as of closing of

the business combination with BowX.

9

wework

Ⓒ2021 WeWork. Confidential.View entire presentation