First Merchants Investor Presentation Deck

Highlights

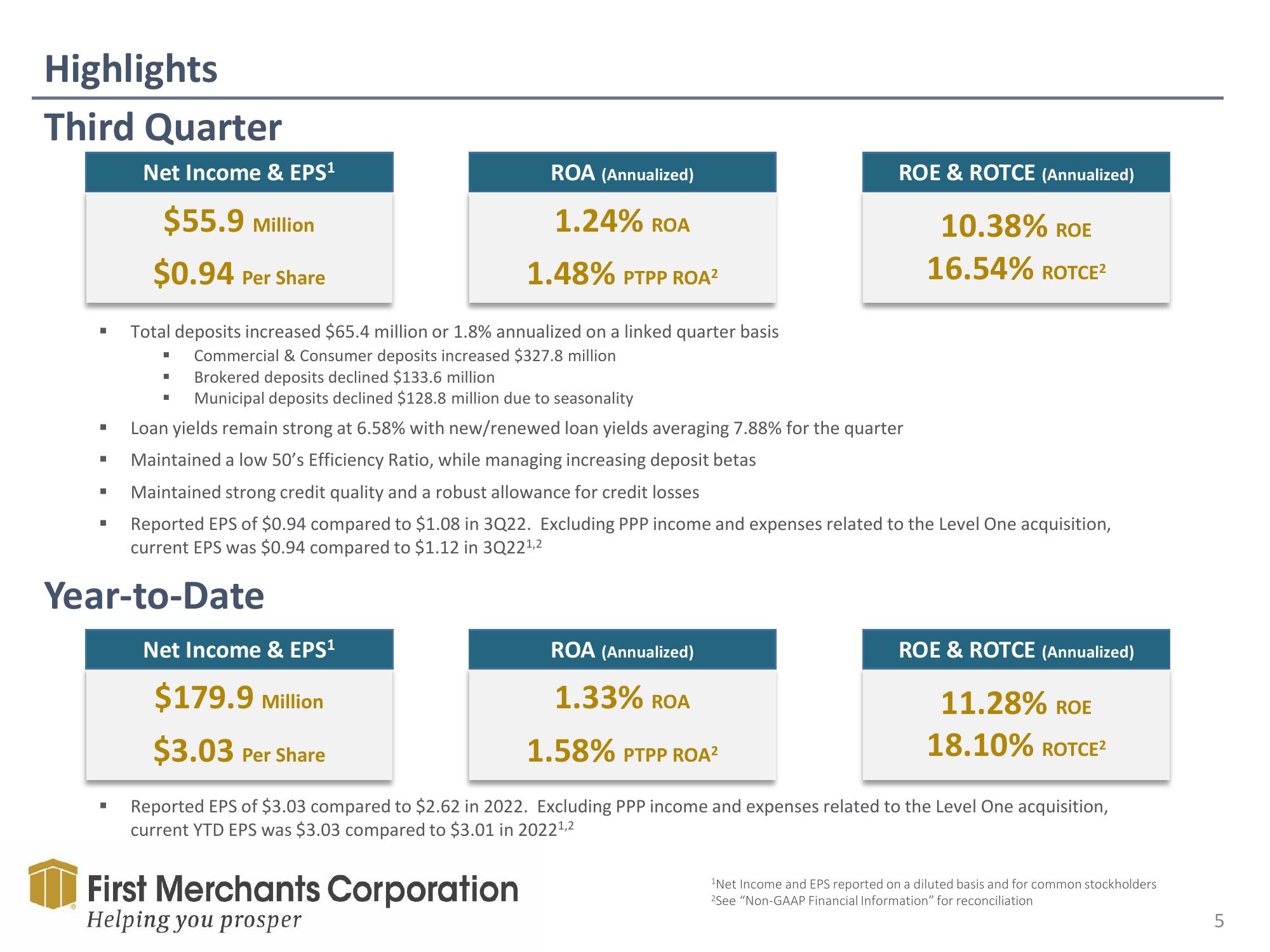

Third Quarter

■

■

■

Total deposits increased $65.4 million or 1.8% annualized on a linked quarter basis

Commercial & Consumer deposits increased $327.8 million

Brokered deposits declined $133.6 million

Municipal deposits declined $128.8 million due to seasonality

Loan yields remain strong at 6.58% with new/renewed loan yields averaging 7.88% for the quarter

Maintained a low 50's Efficiency Ratio, while managing increasing deposit betas

Maintained strong credit quality and a robust allowance for credit losses

Reported EPS of $0.94 compared to $1.08 in 3Q22. Excluding PPP income and expenses related to the Level One acquisition,

current EPS was $0.94 compared to $1.12 in 3Q221,2

Year-to-Date

■

Net Income & EPS¹

■

$55.9 Million

$0.94 Per Share

■

■

I

ROA (Annualized)

1.24% ROA

1.48% PTPP ROA²

Net Income & EPS¹

$179.9 Million

$3.03 Per Share

ROE & ROTCE (Annualized)

10.38% ROE

16.54% ROTCE²

ROA (Annualized)

1.33% ROA

1.58% PTPP ROA²

Reported EPS of $3.03 compared to $2.62 in 2022. Excluding PPP income and expenses related to the Level One acquisition,

current YTD EPS was $3.03 compared to $3.01 in 2022¹,2

First Merchants Corporation

Helping you prosper

ROE & ROTCE (Annualized)

11.28% ROE

18.10% ROTCE²

¹Net Income and EPS reported on a diluted basis and for common stockholders

2See "Non-GAAP Financial Information" for reconciliationView entire presentation