The Urgent Need for Change and The Superior Path Forward

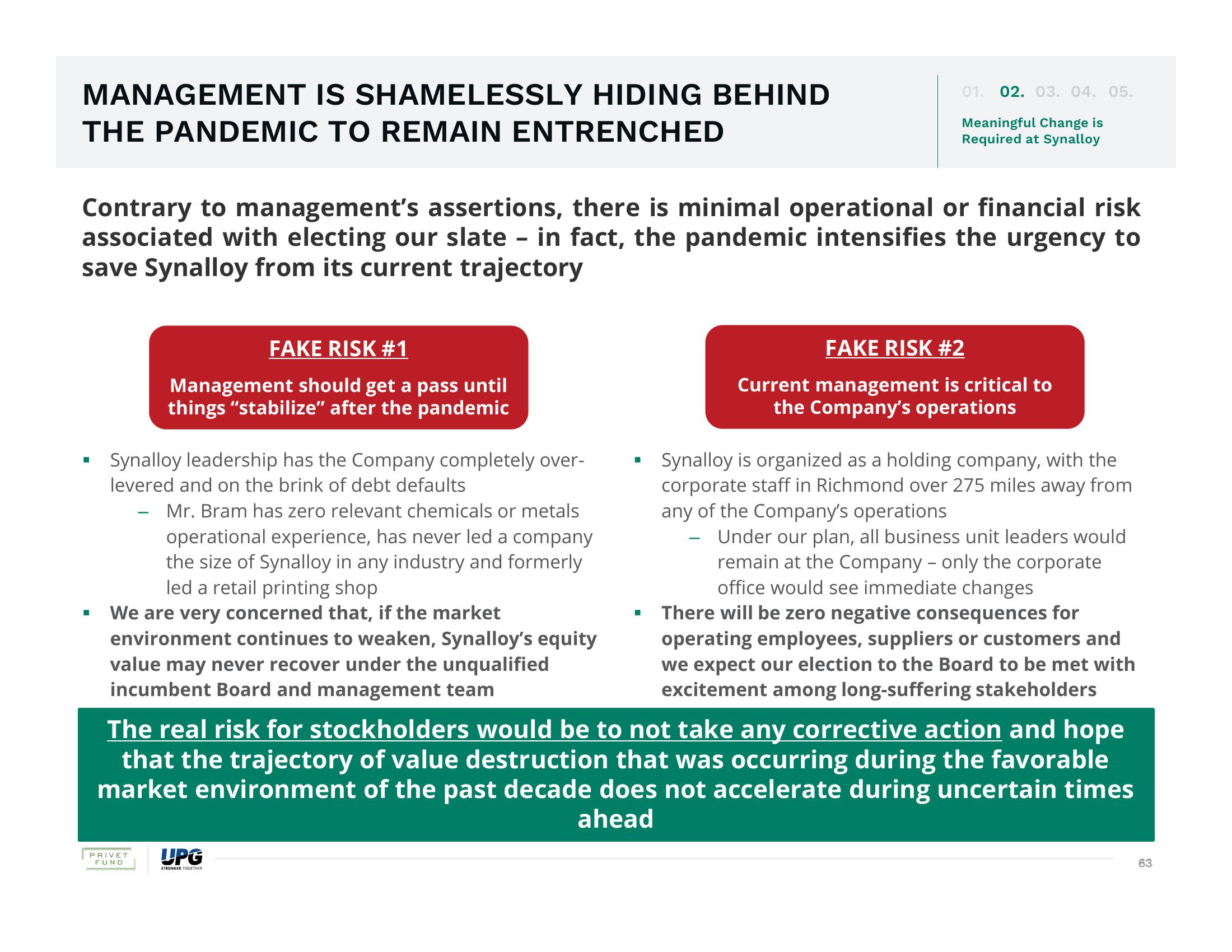

MANAGEMENT IS SHAMELESSLY HIDING BEHIND

THE PANDEMIC TO REMAIN ENTRENCHED

-

Contrary to management's assertions, there is minimal operational or financial risk

associated with electing our slate – in fact, the pandemic intensifies the urgency to

save Synalloy from its current trajectory

FAKE RISK #1

Management should get a pass until

things "stabilize” after the pandemic

Synalloy leadership has the Company completely over-

levered and on the brink of debt defaults

Mr. Bram has zero relevant chemicals or metals

operational experience, has never led a company

the size of Synalloy in any industry and formerly

led a retail printing shop

We are very concerned that, if the market

environment continues to weaken, Synalloy's equity

value may never recover under the unqualified

incumbent Board and management team

PRIVET

FUND

01. 02. 03. 04. 05.

■

UPG

STRONGER TOGETHER

Meaningful Change is

Required at Synalloy

FAKE RISK #2

Current management is critical to

the Company's operations

The real risk for stockholders would be to not take any corrective action and hope

that the trajectory of value destruction that was occurring during the favorable

market environment of the past decade does not accelerate during uncertain times

ahead

Synalloy is organized as a holding company, with the

corporate staff in Richmond over 275 miles away from

any of the Company's operations

- Under our plan, all business unit leaders would

remain at the Company - only the corporate

office would see immediate changes

There will be zero negative consequences for

operating employees, suppliers or customers and

we expect our election to the Board to be met with

excitement among long-suffering stakeholders

63View entire presentation