Snap Inc Results Presentation Deck

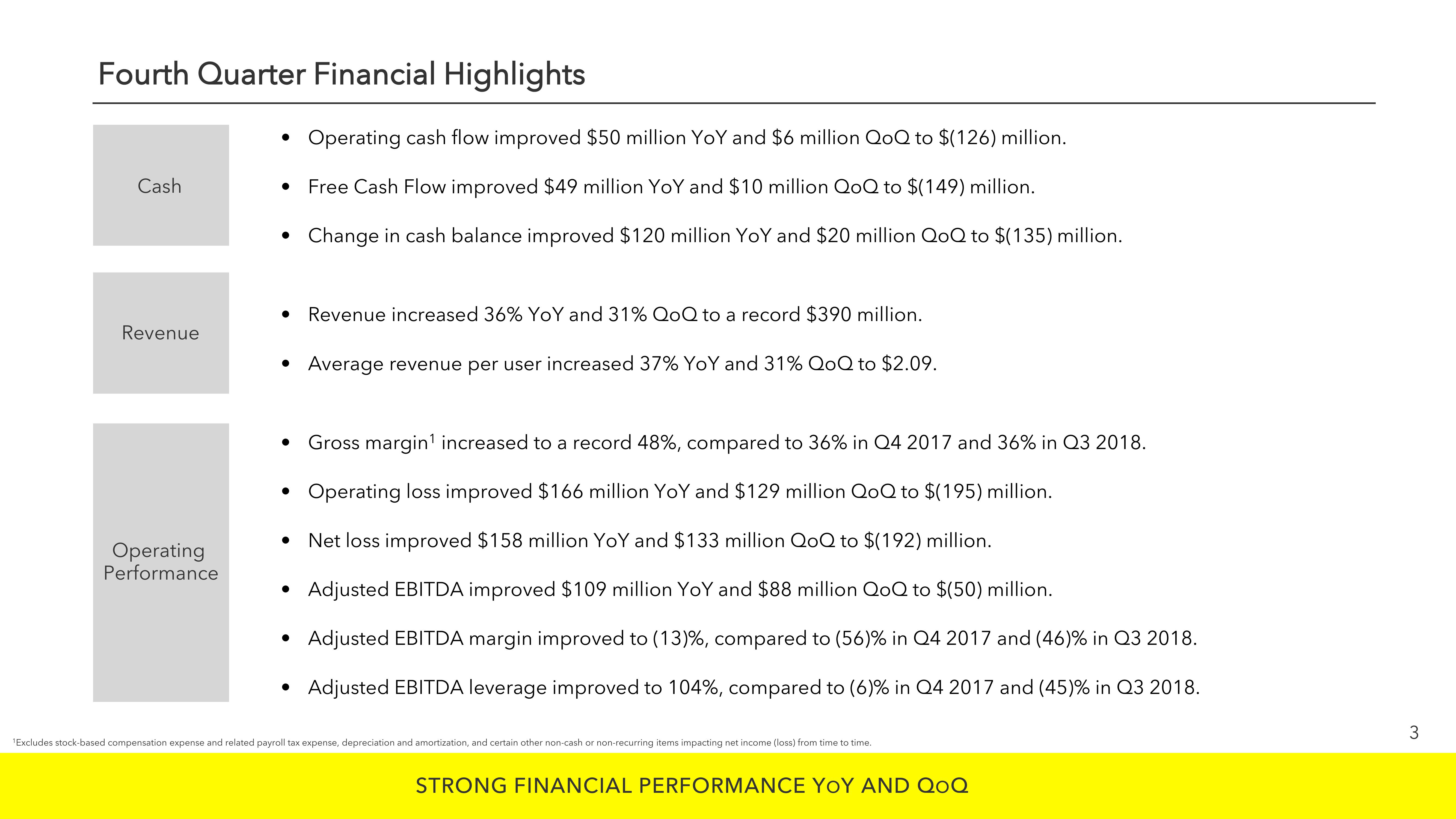

Fourth Quarter Financial Highlights

Cash

Revenue

Operating

Performance

●

●

●

● Revenue increased 36% YoY and 31% QoQ to a record $390 million.

Operating cash flow improved $50 million YoY and $6 million QoQ to $(126) million.

Free Cash Flow improved $49 million YoY and $10 million QoQ to $(149) million.

Change in cash balance improved $120 million YoY and $20 million QoQ to $(135) million.

• Average revenue per user increased 37% YoY and 31% QoQ to $2.09.

Gross margin¹ increased to a record 48%, compared to 36% in Q4 2017 and 36% in Q3 2018.

• Operating loss improved $166 million YoY and $129 million QoQ to $(195) million.

Net loss improved $158 million YoY and $133 million QoQ to $(192) million.

• Adjusted EBITDA improved $109 million YoY and $88 million QoQ to $(50) million.

Adjusted EBITDA margin improved to (13) %, compared to (56) % in Q4 2017 and (46)% in Q3 2018.

Adjusted EBITDA leverage improved to 104%, compared to (6) % in Q4 2017 and (45)% in Q3 2018.

●

●

¹Excludes stock-based compensation expense and related payroll tax expense, depreciation and amortization, and certain other non-cash or non-recurring items impacting net income (loss) from time to time.

STRONG FINANCIAL PERFORMANCE YOY AND QOQ

3View entire presentation