Citi Investment Banking Pitch Book

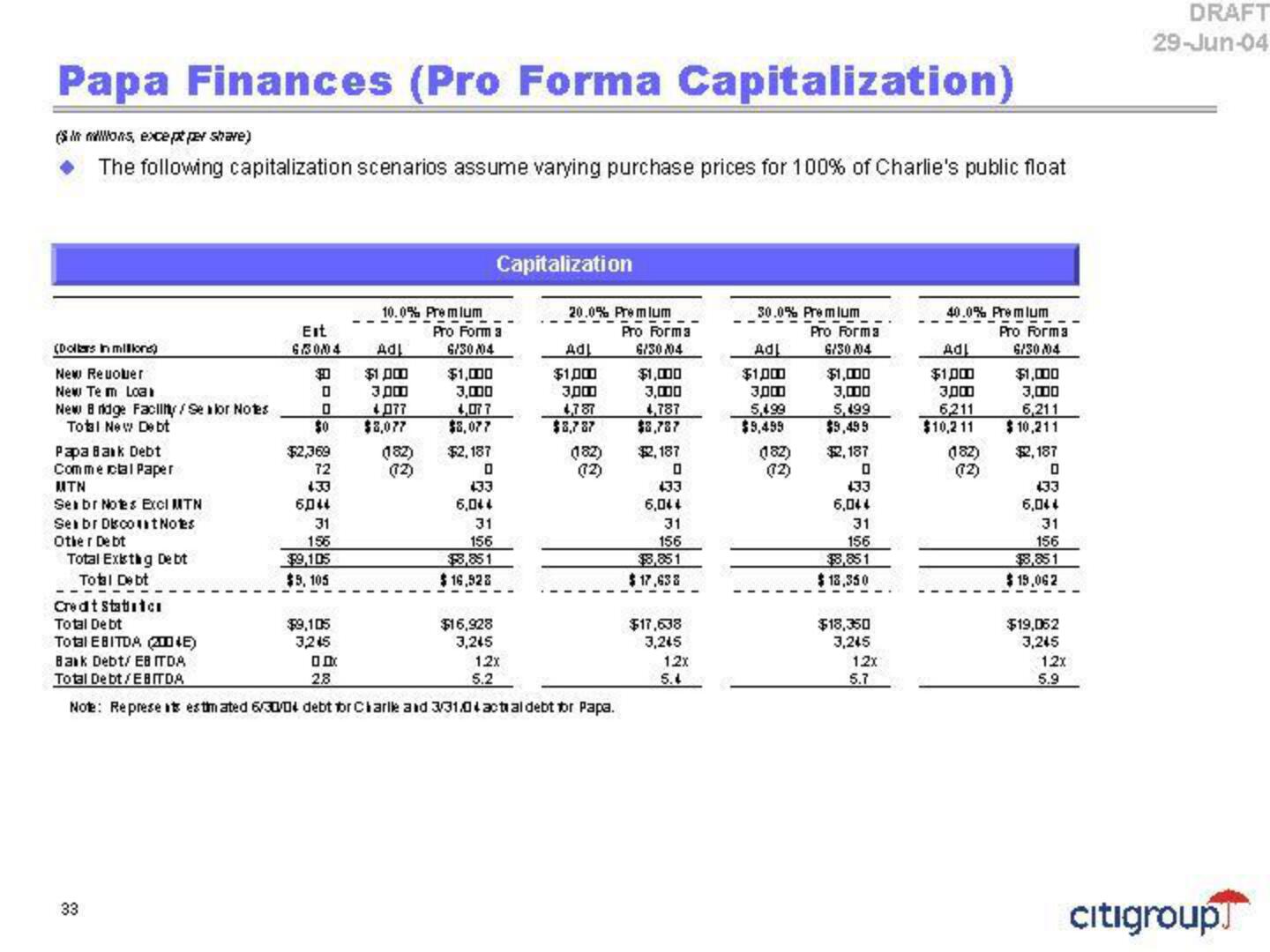

Papa Finances (Pro Forma Capitalization)

(in lons, excepper share)

The following capitalization scenarios assume varying purchase prices for 100% of Charlie's public float

(Dolls in milions)

New Reuouer

New Te m Loa

New Bridge Facility / Sealor Notes

Total New Debt

Papa Bank Debt

Commercial Paper

MTN

Seabr Notes Excl MTN

Sen br Discount Notes

Other Debt

Total Existing Debt

Total Debt

Credt Statister

Total Debt

Total EBITDA (2004E)

Bank Debt/ EBITDA

Total Debt/EBITDA

Eit

6/30004

33

$30

0

0

$0

$2,369

72

433

6044

31

156

$9,105

$9, 105

$9,105

3,245

10.0% Premium

Adl

$1,000

3,000

4077

$3,077

(182)

(12)

Pro Form a

6/30/04

$1,000

3,000

4,077

$8,077

$2,187

0

433

6,044

31

156

$8,851

$16,928

Capitalization

$16,928

3,245

20.0% Premium

12x

00x

2.8

5.2

Note: Represents estimated 6/30/04 debt for Charlle and 3/31/04actial debt for Papa.

Adl

$1,000

3,00

4,787

$8,787

(182)

(12)

Pro Form3

6/30/04

$1,000

3,000

4,787

$8,787

$2,187

0

433

6,044

31

156

$8,851

$17.638

$17,638

3,245

12x

5.4

30.0% Premium

Adl

$1,000

3,00

5,499

$9,499

(182)

(12)

Pro Forma

6/30/04

$1,000

3,000

5,199

$9,499

$2,187

0

433

6,044

31

156

$8,851

$13,350

$18,350

3,245

12x

5.7

40.0% Premlum

---------

Pro Form 3

6/30/04

Adl

$1,000

3,000

6,211

$10,211

(182)

(72)

$1,000

3,000

6,211

$10,211

$2,187

0

433

6,044

31

156

$8,851

$19,062

$19,052

3,245

12x

5.9

DRAFT

29-Jun-04

Citigroup]View entire presentation