Silicon Valley Bank Results Presentation Deck

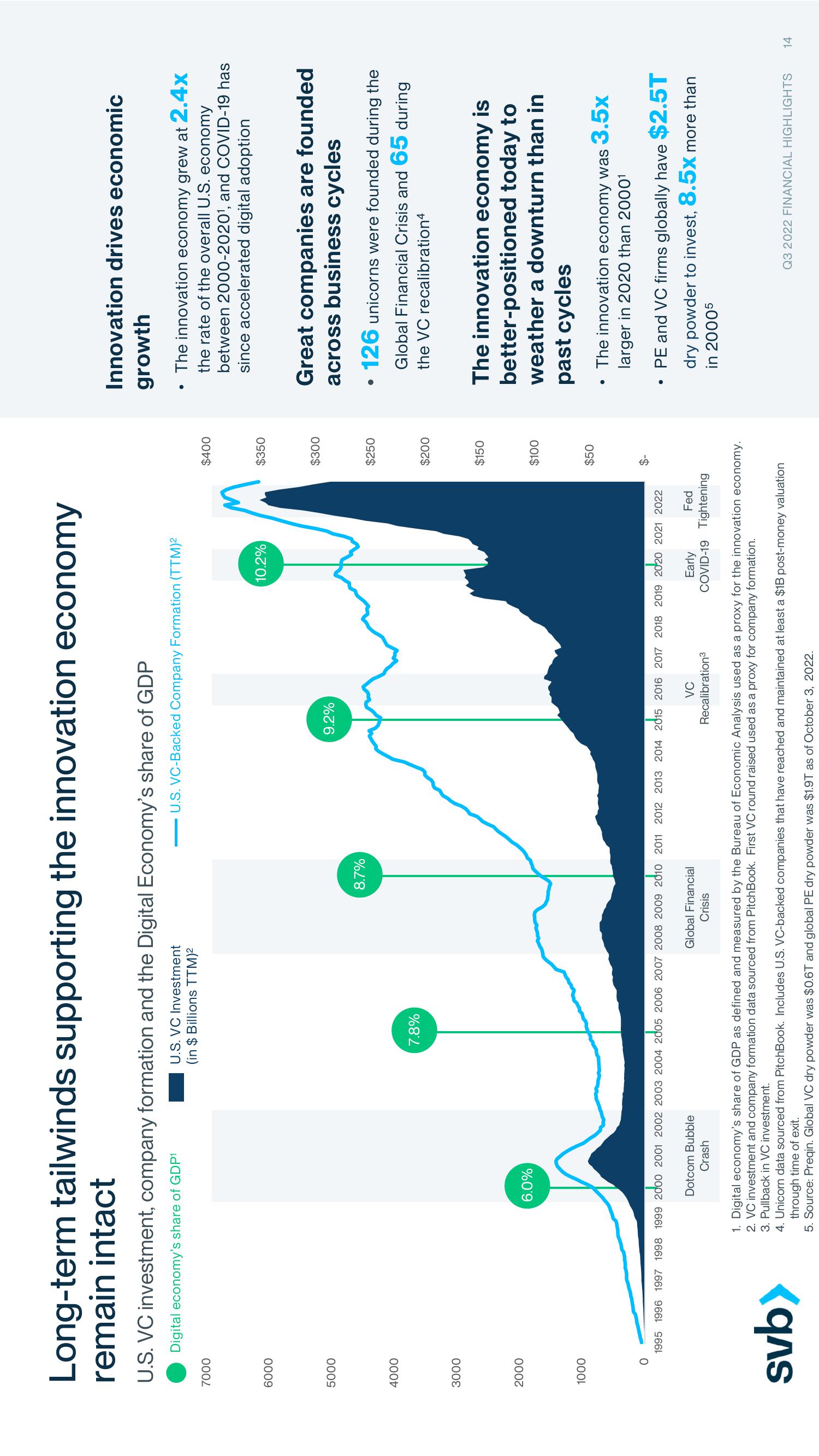

Long-term tailwinds supporting the innovation economy

remain intact

U.S. VC investment, company formation and the Digital Economy's share of GDP

Digital economy's share of GDP¹

7000

6000

5000

4000

3000

2000

1000

6.0%

svb>

U.S. VC Investment

(in $ Billions TTM)²

Dotcom Bubble

Crash

7.8%

8.7%

- U.S. VC-Backed Company Formation (TTM)²

0

2000

2005

2010

2015

2020

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Global Financial

Crisis

9.2%

10.2%

VC

Recalibration³

Early

Fed

COVID-19 Tightening

$400

$350

$300

$250

$200

$150

$100

$50

S

1. Digital economy's share of GDP as defined and measured by the Bureau of Economic Analysis used as a proxy for the innovation economy.

2. VC investment and company formation data sourced from PitchBook. First VC round raised used as a proxy for company formation.

3. Pullback in VC investment.

4. Unicorn data sourced from PitchBook. Includes U.S. VC-backed companies that have reached and maintained at least a $1B post-money valuation

through time of exit.

5. Source: Preqin. Global VC dry powder was $0.6T and global PE dry powder was $1.9T as of October 3, 2022.

Innovation drives economic

growth

Great companies are founded

across business cycles

The innovation economy grew at 2.4x

the rate of the overall U.S. economy

between 2000-2020¹, and COVID-19 has

since accelerated digital adoption

• 126 unicorns were founded during the

Global Financial Crisis and 65 during

the VC recalibration4

The innovation economy is

better-positioned today to

weather a downturn than in

past cycles

●

●

The innovation economy was 3.5x

larger in 2020 than 2000¹

PE and VC firms globally have $2.5T

dry powder to invest, 8.5x more than

in 20005

Q3 2022 FINANCIAL HIGHLIGHTS 14View entire presentation