Eutelsat Investor Presentation Deck

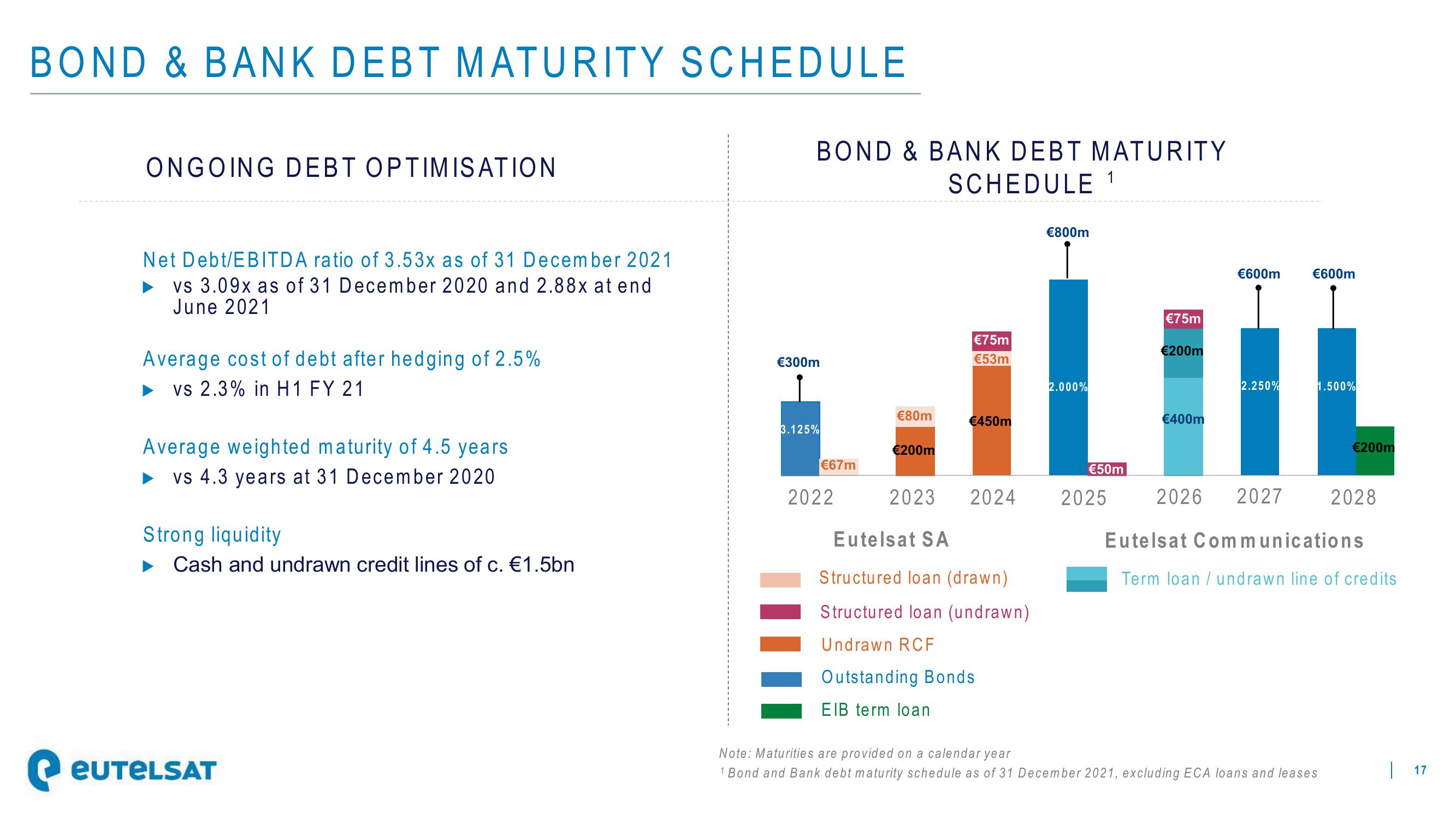

BOND & BANK DEBT MATURITY SCHEDULE

ONGOING DEBT OPTIMISATION

Net Debt/EBITDA ratio of 3.53x as of 31 December 2021

► vs 3.09x as of 31 December 2020 and 2.88x at end

June 2021

Average cost of debt after hedging of 2.5%

▶ vs 2.3% in H1 FY 21

Average weighted maturity of 4.5 years

► vs 4.3 years at 31 December 2020

Strong liquidity

► Cash and undrawn credit lines of c. €1.5bn

EUTELSAT

BOND & BANK DEBT MATURITY

SCHEDULE 1

€300m

3.125%

€67m

2022

€80m

€200m

€75m

€53m

€450m

2023 2024

Eutelsat SA

Structured loan (drawn)

Structured loan (undrawn)

Undrawn RCF

Outstanding Bonds

EIB term loan

€800m

2.000%

€50m

€75m

2025

€200m

€400m

€600m

2.250%

€600m

1.500%

2026 2027

Eutelsat Communications

Term loan/ undrawn line of credits

€200m

Note: Maturities are provided on a calendar year

1 Bond and Bank debt maturity schedule as of 31 December 2021, excluding ECA loans and leases

2028

17View entire presentation