Rally SPAC Presentation Deck

Transaction Overview

TRANSACTION SUMMARY

Rally and America's Technology Acquisition Corp (ATA) have

entered into a Merger Agreement, expected to close in Q4 2022

The transaction is expected to provide Rally with a minimum of

I ~$30M proceeds (subject to shareholder redemptions) to fund

Rally's growth strategy

Non-redeeming ATA shareholders and certain support investors will

receive Contingent Value Rights ("CVR") offering holders a preferred

return and protection up to a share per CVR. The mechanics of the

CVR are explained on the next page

VALUATION

Transaction implies a pro-forma enterprise value of ~$207M

exclusive of earnout shares

3.5x 2023E revenue of $60M

EARNOUT INCENTIVE STRUCTURE

H Seller earnout of 4.5M shares

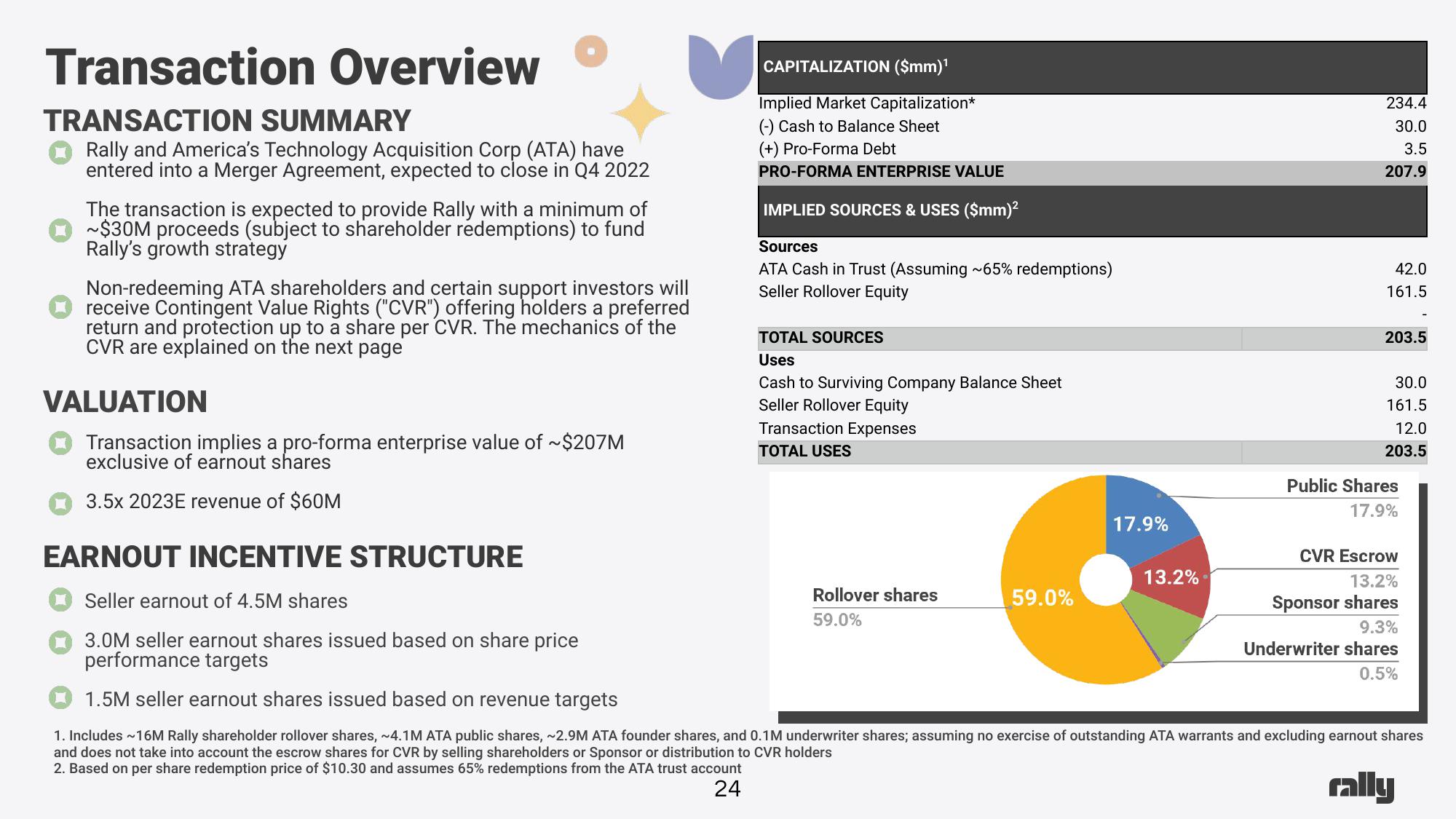

CAPITALIZATION ($mm)¹

Implied Market Capitalization*

(-) Cash to Balance Sheet

(+) Pro-Forma Debt

PRO-FORMA ENTERPRISE VALUE

IMPLIED SOURCES & USES ($mm)²

Sources

ATA Cash in Trust (Assuming ~65% redemptions)

Seller Rollover Equity

TOTAL SOURCES

Uses

Cash to Surviving Company Balance Sheet

Seller Rollover Equity

Transaction Expenses

TOTAL USES

Rollover shares

59.0%

59.0%

17.9%

13.2%

234.4

30.0

3.5

207.9

42.0

161.5

203.

30.0

161.5

12.0

203.5

Public Shares

17.9%

CVR Escrow

13.2%

Sponsor shares

9.3%

Underwriter shares

0.5%

M 3.0M seller earnout shares issued based on share price

performance targets

1.5M seller earnout shares issued based on revenue targets

1. Includes ~16M Rally shareholder rollover shares, ~4.1M ATA public shares, ~2.9M ATA founder shares, and 0.1M underwriter shares; assuming no exercise of outstanding ATA warrants and excluding earnout shares

and does not take into account the escrow shares for CVR by selling shareholders or Sponsor or distribution to CVR holders

2. Based on per share redemption price of $10.30 and assumes 65% redemptions from the ATA trust account

24

rallyView entire presentation