Kinnevik Results Presentation Deck

Intro

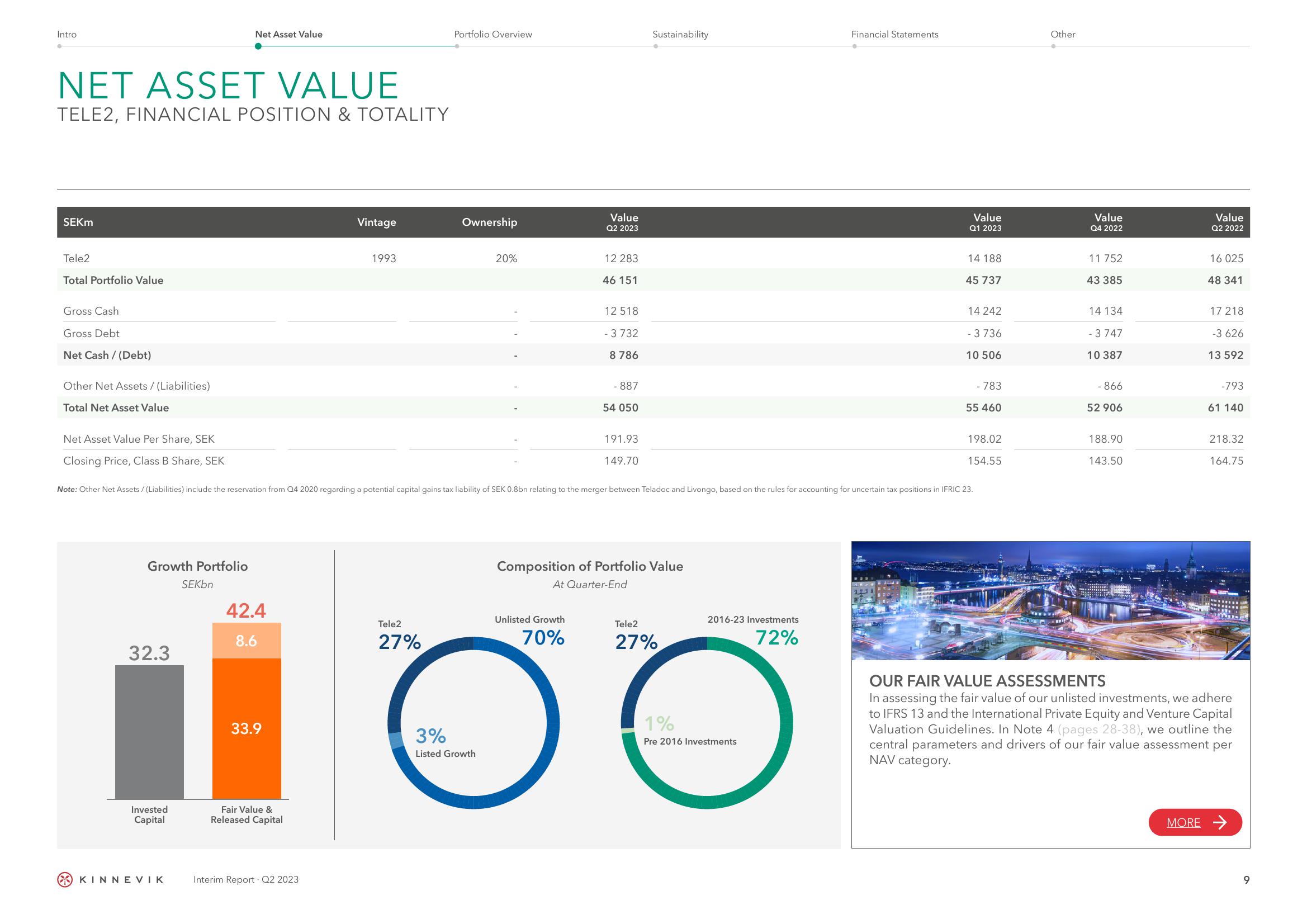

NET ASSET VALUE

TELE2, FINANCIAL POSITION & TOTALITY

SEKM

Tele2

Total Portfolio Value

Gross Cash

Gross Debt

Net Cash / (Debt)

Other Net Assets/(Liabilities)

Total Net Asset Value

Net Asset Value Per Share, SEK

Closing Price, Class B Share, SEK

Note:

Growth Portfolio

32.3

Invested

Capital

Net Asset Value

KINNEVIK

SEKbn

42.4

8.6

33.9

Fair Value &

Released Capital

Vintage

Interim Report - Q2 2023

1993

Portfolio Overview

Tele2

27%

Ownership

20%

3%

Listed Growth

Value

Q2 2023

12 283

Unlisted Growth

70%

46 151

tAssets/(Liabilities) include the reservation from Q4 2020 regarding a potential capital gains tax liability of SEK 0.8bn relating to the merger between Teladoc and Livongo, based on the rules for accounting for uncertain tax positions in IFRIC 23.

12 518

- 3 732

8 786

- 887

54 050

191.93

149.70

Sustainability

Composition of Portfolio Value

At Quarter-End

Tele2

27%

2016-23 Investments

72%

Financial Statements

1%

Pre 2016 Investments

Value

Q1 2023

14 188

45

737

14 242

- 3 736

10 506

- 783

55 460

198.02

154.55

Other

Value

Q4 2022

11 752

43 385

14 134

- 3 747

10 387

- 866

52 906

188.90

143.50

Value

Q2 2022

16 02

48 341

17 218

-3 626

13 592

-793

61 140

218.32

164.75

OUR FAIR VALUE ASSESSMENTS

In assessing the fair value of our unlisted investments, we adhere

to IFRS 13 and the International Private Equity and Venture Capital

Valuation Guidelines. In Note 4 (pages 28-38), we outline the

central parameters and drivers of our fair value assessment per

NAV category.

MORE →

9View entire presentation